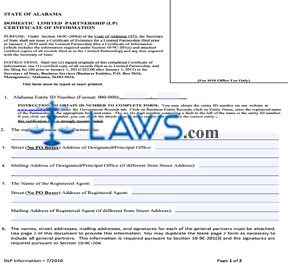

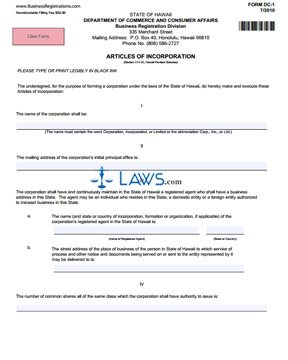

Form HI Articles of Incorporation

INSTRUCTIONS: HI ARTICLES OF INCORPORATION

Use this form if you’re attempting to form a corporation in the state of Hawaii. You can find requirements for the Articles of Incorporation in §414-32 of the Revised Statutes.

“HI Articles of Incorporation Step 1”

Write the name for the corporation exactly as it appears in section I. If you’ve filed a name reservation form in the state of Hawaii, attach the certificate from the Department of Commerce to this form. The name of the corporation needs to contain the word Corporation, Incorporation, Limited, Corp., Inc., or Ltd.

“HI Articles of Incorporation Step 2”

Indicate the mailing address for the corporation’s initial principal office in section II including city, state, and zip code.

“HI Articles of Incorporation Step 3”

In section III(a), provide the name of the corporation’s registered agent. A qualified registered agent is an individual, domestic business entity, or a foreign business entity allowed to conduct business in Hawaii. If the registered agent is an entity, provide its state or country.

Provide the street address for the registered agent in section III(b). Any future service of process and other documents will be forwarded to this address.

“HI Articles of Incorporation Step 4”

Highlight the number of common shares the corporation can legally issue in section IV.

“HI Articles of Incorporation Step 5”

Provide the name and full address of each incorporator in section V. If more room is needed, attach a separate sheet.

“HI Articles of Incorporation Step 6”

At least one incorporator needs to date and sign the bottom of this form. Additional incorporators can choose to sign the form as well.

“HI Articles of Incorporation Step 7”

The filing fee for this form is $25.00, and the fee is non-refundable. If you request certified copies, each copy will cost $10.00. Make all checks payable to Department of Commerce and Consumer Affairs.

“HI Articles of Incorporation Step 8”

Make a copy of the original and the documents and filing fee to the following address:

State of Hawaii

Department of Commerce and Consumer Affairs

Business Registration Division

P.O. Box 40

Honolulu, Hawaii 96810

Form NJ Complete Business Registration Packet

INSTRUCTIONS: NJ COMPLETE BUSINESS REGISTRATION PACKET

You should never complete any form in this packet without consulting with an attorney. This packet provides all required form for registering any type of business in the State of New Jersey. Businesses need to file the Division of Revenue Business Registration Form (in most cases), and the Public Records Filing for New Business Entity form as well.

“NJ Complete Business Registration Packet Step 1”

A sole proprietorship or partnership needs to file pages 17-19 of this packet (NJ-REG). IF a corporation, limited liability company, limited partnership, or limited liability partnership has already filed a new business certificate with the Commercial Recording/Corporate Filing Unit, the business only needs to complete pages 17-19.

“NJ Complete Business Registration Packet Step 2”

Only complete pages 23 and 24 of this packet if the business has not filed a Commercial Recording. If a new business entity is filing the Public Records Filing for New Business Entity on pages 23 and 24, this form needs completed before filing NJ-REG. Not that NJ-REG needs submitted within 60 days of filing the Public Records Filing.

“NJ Complete Business Registration Packet Step 3”

If the business collects sales tax, the NJ-REG needs submitted at least 15 days before the date of first sale, the use of tax, or the use of NJ exemption certificates.

“NJ Complete Business Registration Packet Step 4”

After forming a new business entity, you need to apply for a federal employer identification number (FEIN). You can contact the IRS at 1-800-829-1040 for more information on obtain the FEIN. If you have other questions about this packet, you can contact the Client Registration Bureau at the following number (609) 292-9292.

“NJ Complete Business Registration Packet Step 5”

Look under pages 25 and 26 if you need to file a Registration of Alternate Name Form (C-150G). You can find instructions and forms for new hiring reporting on pages 27-36. Request for Change of Registration Information is located on page 37, and Business Entity Amendment Filing is located on page 39. Additional forms are located in this form as well.

“NJ Complete Business Registration Packet Step 6”

You can mail the forms to the following address:

Client Registration

PO Box 252

Trenton, NJ 08646-0252

For overnight delivery, use this address:

Client Registration

33 West State St 3rd FL

Trenton, NJ 08608

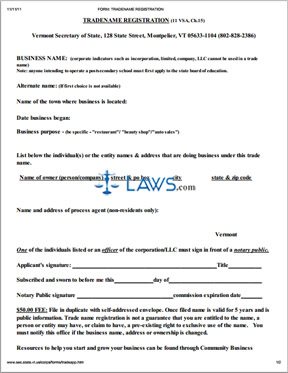

Form VT DBA Tradename Registration

INSTRUCTIONS: VERMONT DBA TRADENAME REGISTRATION

If you wish to register a name for your company in Vermont, this is done through the offices of the secretary of state. This form serves as form of public notification regarding your business and is also intended to help afford your business some protection from others making use of the same name. Their website has the application necessary to complete this registration. This article discusses the unnumbered questions in the order in which they appear. This form can be used by a sole proprietorship, association of multiple people or any other entity which wishes to operate under a newly registered name. Your application will not be approved if another Vermont business already has claimed the name.

Vermont DBA Tradename Registration Step 1: Enter the name you wish to be granted. Note that you cannot include indications of your corporate status in this name, such as "LLC" or "company."

Vermont DBA Tradename Registration Step 2: Enter an alternate name in case your first choice is not available.

Vermont DBA Tradename Registration Step 3: Enter the name of the city in which your business is located.

Vermont DBA Tradename Registration Step 4: Enter the date on which your business began operating.

Vermont DBA Tradename Registration Step 5: Enter the purpose of your business.

Vermont DBA Tradename Registration Step 6: Give the names and addresses of all individuals or companies who own the business.

Vermont DBA Tradename Registration Step 7: If you are a non-resident, you must include the name and address of your process agent.

Vermont DBA Tradename Registration Step 8: One of the individuals listed above or an officer must sign and date the form in the presence of a notary public.

Vermont DBA Tradename Registration Step 9: On the second page, include a telephone number and email address where the business can be contacted.

Vermont DBA Tradename Registration Step 10: File this form in duplicate with the Vermont Secretary of State. Include a self-addressed envelope.

Vermont DBA Tradename Registration Step 11: A $50 filing fee must be paid in order for your registration to be processed.

Vermont DBA Tradename Registration Step 12: Once this form has been approved, it will remain in effect for five years. If your name, address or ownership change during this period, you must inform the Secretary of State.

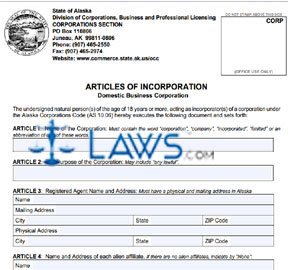

Form 08-400 Articles of Incorporation (online filing)

INSTRUCTIONS: ARTICLES OF INCORPORATION (Online Filing) 08-400

If the incorporators need help with this form, the state of Alaska encourages the help of legal counsel.

“Articles of Incorporation (Online Filing) 08-400 Step 1”

Provide the name of the corporation in Article 1. The name needs to contain the word “corporation,” “incorporation,” “limited” or an abbreviation of these terms. In order to search the availability of a name for the corporation, visit the following link: https://www.commerce.state.ak.us/occ.

“Articles of Incorporation (Online Filing) 08-400 Step 2”

Provide the overall purpose of the corporation in Article 2.

“Articles of Incorporation (Online Filing) 08-400 Step 3”

The Registered Agent of the corporation must have an address in the state of Alaska. If the Registered Agent does not have a PO Box as a mailing address, the physical address of the registered office is required.

“Articles of Incorporation (Online Filing) 08-400 Step 4”

Article 4 is required if there is an alien affiliate that maintains some degree of control within the corporation. If applicable, provide their full name, mailing address, city, state or province, and country. If there is no alien affiliate, write “None” in this section.

“Articles of Incorporation (Online Filing) 08-400 Step 5”

A for-profit corporation needs to list their common or preferred shares in Article 5 along with their par value. A value is zero is not valid.

“Articles of Incorporation (Online Filing) 08-400 Step 6”

Number 6 in this form requires additional pages for continuation of a previous article or additional articles. Refer to the second page of this document for specific instructions on additional articles.

“Articles of Incorporation (Online Filing) 08-400 Step 7”

Number 7 of this form requires the signature, printed name, and date of signature for all incorporators. Additionally, the name and phone number of an incorporator needed to resolve issues with this form is needed below the signatures.

“Articles of Incorporation (Online Filing) 08-400 Step 8”

On the last page of the form, provide NAICS number for the corporation which describes the activities of the business.

“Articles of Incorporation (Online Filing) 08-400 Step 9”

Pages 1-3 need sent to the following address:

State of Alaska

Corporations Section

PO Box 110806

Juneau AK 99811-0806

A filing fee of $250.00 is required as well. The check or money order is made payable to the State of Alaska. This form can also be submitted online at the following link: https://www.commerce.state.ak.us/occ/