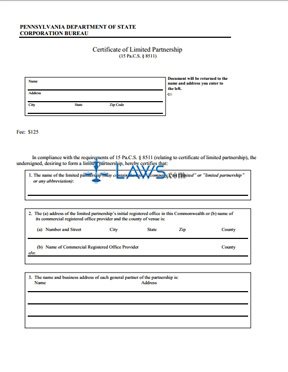

Certificate of Limited Partnerships

INSTRUCTIONS: CERTIFICATE OF LIMITED PARTNERSHIPS

You can use this form in Pennsylvania to form a limited partnership. Make sure you type the entries or use black ink, and consider speaking with an attorney before completing this form and any other required forms.

“Certificate of Limited Partnerships Step 1”

Provide a name and address for correspondence at the top of this form. The Department of State will send the verified Certificate to this address.

“Certificate of Limited Partnerships Step 2”

Enter the proposed name for the limited partnership in section 1. Make sure the name contains the words “company,” “limited,” “limited partnership,” or a stand abbreviation of the form.

“Certificate of Limited Partnerships Step 3”

Provide the street address of the limited partnership’s registered office in the Commonwealth in section 2a. Provide the name of the commercial registered office provider in section 2b if applicable.

“Certificate of Limited Partnerships Step 4”

You need to list the name and business address of all general partners in section 3. If additional space is needed, attach a separate sheet.

“Certificate of Limited Partnerships Step 5”

Check the appropriate line in section 4. Check the first line if the limited partnership becomes effective upon the filing by the Department of State. Check the second line if the limited partnership becomes effective on a specific date and provide the date and hour. Provide the effective date in section 5 again, as well as the hour.

“Certificate of Limited Partnerships Step 6”

All of the general partners need to sign the bottom of this form.

“Certificate of Limited Partnerships Step 7”

The filing fee for this form is $125.00. You should make the check payable to Department of State. You need to attach the following forms to this document as well:

· necessary governmental approvals

· necessary copies of DSCB:17.2.3 (Consent of Appropriation of Name)

After you’ve completed any necessary additional form, send the completed documents and payment to the following address:

Department of State

Corporation Bureau

P.O. Box 8722

Harrisburg, PA 17105-8722