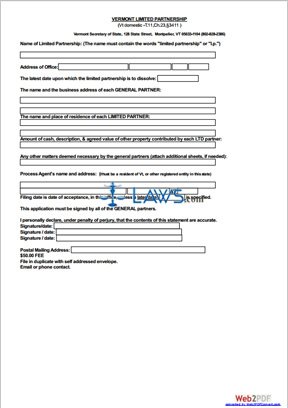

Form Limited Partnership Application

INSTRUCTIONS: VERMONT LIMITED PARTNERSHIP APPLICATION

To form a limited partnership in Vermont, an application must be submitted to the office of the secretary of state. This application is maintained on the official website of the Vermont Secretary of State. This article discusses the unnumbered questions in the order they are presented.

Vermont Limited Partnership Application Step 1: Give the name of the business, which must include the words "limited partnership" or the abbreviation "l.p."

Vermont Limited Partnership Application Step 2: Give the address of your office, including the city, state and zip code.

Vermont Limited Partnership Application Step 3: Give the latest possible date on which the limited partnership will be dissolved.

Vermont Limited Partnership Application Step 4: Give each general partner's name and business address.

Vermont Limited Partnership Application Step 5: Give the name and personal address of every limited partner.

Vermont Limited Partnership Application Step 6: Give the amount of cash and descriptions of other property contributed by every LTD partner, along with its agreed value.

Vermont Limited Partnership Application Step 7: Note any other matters you deem to be relevant where indicated.

Vermont Limited Partnership Application Step 8: Give the name and address of your process agent.

Vermont Limited Partnership Application Step 9: If you do not wish for the filing date to be the date on which your application takes effect, give the date on which you wish for this to occur.

Vermont Limited Partnership Application Step 10: All general partners must sign and date the form.

Vermont Limited Partnership Application Step 11: Enter your postal mailing address where indicated.

Vermont Limited Partnership Application Step 12: File two copies of this form with the Vermont Secretary of State, whose address is given at the top of the page. One copy should be the original, while the other should be an exact copy. You should include a $50 check to cover the filing fee, as well as a self-addressed envelope. This will be used to send back a certified copy of your application once it has been approved.

Vermont Limited Partnership Application Step 13: If you have any questions which are not answered by these instructions, the website of the Vermont Secretary of State includes both an email address and phone number that can provide further assistance.