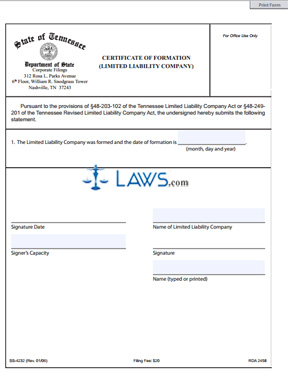

Form 4162 Articles of Incorporation

INSTRUCTIONS: ARTICLES OF INCORPORATION 4162

Use this form to establish a nonprofit corporation in the state of Indiana. Because you have to qualify under the Internal Revenue Service and Indiana Department of Revenue, you’re encouraged to contact these agencies before completing this form.

“Articles of Incorporation 4162 Step 1”

State the name of the corporation in Article I of this form. The name must include one of the following words: Corporation, Incorporated, Limited, Company, or an appropriate abbreviation. Provide a principal office address in the line below, and provide the post office address including the number and street of the building.

“Articles of Incorporation 4162 Step 2”

Article II is optional, but you should still fill out the section. Indicate the main purposes why the corporation is formed.

“Articles of Incorporation 4162 Step 3”

Check the appropriate box in Article III. Check the first box if the corporation is a public benefit corporation for public or charitable causes. Check the second box if it’s a religious corporation. Check the last box if the company is a mutual benefit corporation.

“Articles of Incorporation 4162 Step 4”

Enter the name of the corporation’s registered agent in Article IV. In the lines below, provide the office address of the individual or business entity acting as the registered agent.

“Articles of Incorporation 4162 Step 5”

If the corporation will have members, check the first box in Article V. Continue on to the next page and list the names and addresses of the incorporators. Make sure to include the city, state, and zip code.

“Articles of Incorporation 4162 Step 6”

You should refer to §23-17-22-5 of the Indiana Code for Article VII. Lay out a plan for the distributions of assets in the event of dissolution or a final liquidation. If more space is needed, attach a separate sheet.

“Articles of Incorporation 4162 Step 7”

All of the incorporators need to sign the bottom of this form. Make sure to provide a printed name beside the signature. The person who prepared this form needs to provide their name and address below the signatures as well.

“Articles of Incorporation 4162 Step 8”

The filing fee for this form is $30.00. Make a copy of this form and send both forms and the filing fee to the following address:

Charles P. White

Secretary of State

Corporations Division

302 W. Washington St., Rm. E018

Indianapolis, IN 46204

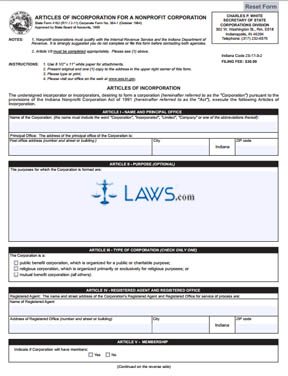

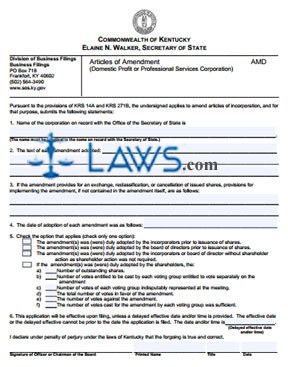

Form AMD Articles of Amendment for a Profit Corporation

INSTRUCTIONS: ARTICLES OF AMENDMENT FOR A PROFIT CORPORATION AMD

A domestic profit corporation or a professional services corporation can use this form to make amendments to the original Articles of Incorporation in Kentucky.

“Articles of Amendment for a Profit Corporation AMD Step 1”

Provide the name of the corporation as it currently appears under the Office of the Secretary of State in part 1.

“Articles of Amendment for a Profit Corporation AMD Step 2”

List the specific articles for amendment in part 2 along with the exact text for the amended article. Use this section to change the corporation’s name, duration, number of shares, and more. You’ll likely need additional space, so attach a separate sheet if necessary.

“Articles of Amendment for a Profit Corporation AMD Step 3”

If the amendments make for an exchange, reclassification, or cancellation of shares and the changes are not listed in the amendments, provide the changes in part 3 of this form. If more room is needed, attach a separate sheet.

“Articles of Amendment for a Profit Corporation AMD Step 4”

Provide the date on which each amendment was adopted by the corporation in part 4.

“Articles of Amendment for a Profit Corporation AMD Step 5”

Check the first box in part 5 if the amendments were adopted by the incorporators before shares were issued. Check the second box if the amendments were adopted by the board of directors before the shares were issued. If the amendments were adopted by the incorporators or board with action from the shareholders because such action was not required, check box 3.

If the amendment were adopted by the shareholders, check the fourth box in part 5 including values for the outstanding shares and votes in subsections a-f.

“Articles of Amendment for a Profit Corporation AMD Step 6”

The officer or chairman of the board needs to sign the bottom of this form. They need to print their name and include their title and date of signature as well.

“Articles of Amendment for a Profit Corporation AMD Step 7”

The filing fee is $40.00. Add $10.00 to the filing fee if there are 1,000 shares or less. A complete copy of this form and all attachments is required while filing as well. If you’re mailing the form, use the following address:

Elaine N. Walker

Office of the Secretary of State

PO Box 718

Frankfort, KY 40602-0718

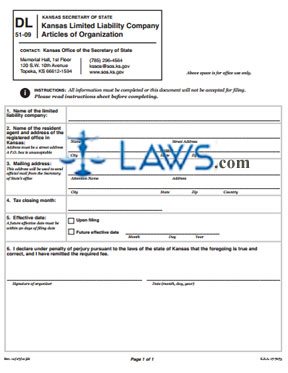

Form 19 Articles Of Organization

INSTRUCTIONS: ARTICLES OF ORGANIZATION 19

Use this article to register as a limited liability company or a professional limited liability company in the state of Montana. Consider consulting with an attorney and filling out a Name Reservation form before submitting this document.

“Articles of Organization 19 Step 1”

State the name of the limited liability company in part 1. A limited liability company’s name needs to contain any of these terms: limited liability company, limited company, or an appropriate abbreviation. A professional LLC needs to include the phrase “professional limited liability company” or an appropriate abbreviation.

“Articles of Organization 19 Step 2”

Provide the name and address of the registered agent for the LLC. Only provide the mailing address if it’s different than the street address. The registered agent needs to sign their name at the bottom of part 2.

“Articles of Organization 19 Step 3”

List the mailing address for the LLC’s principal place of business in part 3. Then, check only one box in part 4. If you check “Term,” list the date of estimated dissolution.

“Articles of Organization 19 Step 4”

Check the appropriate box in part 5. Next, list the names of the managers or members along within their business mailing address. If you need more space, attach a separate sheet.

“Articles of Organization 19 Step 5”

If any member of the limited liability company is liable for debts or obligations, provide their names on a separate sheet along with their signatures.

“Articles of Organization 19 Step 6”

If you’re registering a professional limited liability company, you need to describe the main services provided in part 8.

“Articles of Organization 19 Step 7”

At least one organizer needs to sign the bottom of this form along with their printed name, title, and date of signature. The filing fee is, at minimum, $70.00. 24 hour expedited service is $90.00, and 1 hour expedited service is $170.00. After you’ve completed the forms, make a check payable to Secretary of State. Send the forms and filing fee to the following address:

Linda McCulloch

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801

“Articles of Organization 19 Step 1”

The limited liability company is required to file annual reports with the Secretary of State by April 15 of every year.