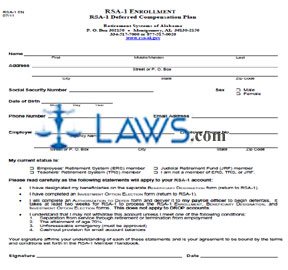

RSA-1 Enrollment

INSTRUCTIONS: ALABAMA APPLICATION TO OBTAIN SERVICE CREDIT FOR MATERNITY LEAVE WITHOUT PAY

Members of the Alabama Employees' Retirement System can use the form discussed in this article to obtain service credit for maternity leave without pay. In order to be eligible to file this form, they must be an active member and contributing to the Employees' Retirement System at the time of purchase and must not have already received credit for this time with the program or any retirement plan other than Social Security. This document can be obtained from the website of the Employees' Retirement System of Alabama.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 1: On the first blank line, enter your first name, middle or maiden name, and last name.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 2: On the second blank line, enter your date of birth.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 3: On the third blank line, enter your Social Security number.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 4: On the fourth blank line, enter your street address or post office box number.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 5: On the fifth blank line, enter your city, state and zip code.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 6: On the sixth blank line, enter the name of your current employer.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 7: The bottom half of the form is to be completed by your employer. On the first and second blank lines of this section, they should enter the beginning and ending dates of your maternity leave without pay.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 8: On the third blank line, they should enter your employee job classification.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 9: On the fourth blank line, they should enter the name of the employing institution.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 10: The certifying official should sign and date the form, as well as providing their official title.

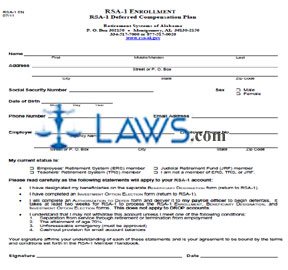

INSTRUCTIONS: ALABAMA STATEMENT OF MILITARY SERVICE ACT 66 (Form ERS SMS)

Alabama public employees enrolled in a state-administered retirement plan can obtain credit for active military service by filing the form discussed in this article. This document can be obtained from the website of the Retirement Systems of Alabama.

Alabama Statement Of Military Service Act 66 ERS SMS Step 1: Enter your first, middle and last name on the first blank line.

Alabama Statement Of Military Service Act 66 ERS SMS Step 2: Enter your address on the second blank line.

Alabama Statement Of Military Service Act 66 ERS SMS Step 3: Enter your Social Security number on the third blank line.

Alabama Statement Of Military Service Act 66 ERS SMS Step 4: Check the first box if you are currently receiving no retirement benefits.

Alabama Statement Of Military Service Act 66 ERS SMS Step 5: Check the second box if you are currently receiving service retirement benefits from a branch of the Armed Forces.

Alabama Statement Of Military Service Act 66 ERS SMS Step 6: Check the third box if you are currently receiving service retirement benefits based partially on military service from a source other than a branch of the Armed Forces. Specify the source on the blank line provided.

Alabama Statement Of Military Service Act 66 ERS SMS Step 7: Check the fourth box if you are currently receiving disability retirement benefits from a branch of the Armed Forces.

Alabama Statement Of Military Service Act 66 ERS SMS Step 8: Check the fifth box if you are currently receiving disability retirement benefits based partially on military service from a source other than a branch of the Armed Forces. Specify the source on the blank line provided.

Alabama Statement Of Military Service Act 66 ERS SMS Step 9: Enter your signature on the next blank line.

Alabama Statement Of Military Service Act 66 ERS SMS Step 10: Enter the date on the next blank line.

Alabama Statement Of Military Service Act 66 ERS SMS Step 11: The firm should be certified by a notary public.

Alabama Statement Of Military Service Act 66 ERS SMS Step 12: Mail the completed form to the address given at the top of the page. Further assistance in completion can be obtained by calling the numbers given here.

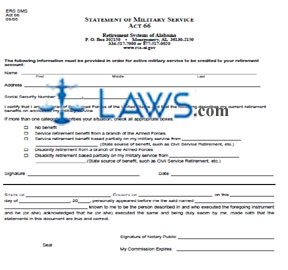

INSTRUCTIONS: ALABAMA INELIGIBLE MEMBER REFUND REQUEST (Form ERS 7IR)

When an Alabama public agency discovers that it has withheld retirement deductions from an employee who is not eligible for enrollment in the Employees' Retirement System of Alabama, they may request a refund using the document discussed in this article. This form should only be filed after you have ceased withholding retirement deductions from the employee's compensation and you have remitted the final contribution to the Employees' Retirement System of Alabama. This document can be found on the website of the Retirement Systems of Alabama.

Alabama Ineligible Member Refund Request ERS 7IR Step 1: Enter the employee's first, middle and last name on the first blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 2: Enter the employee's Social Security number on the second blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 3: Enter the employee's register number on the third blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 4: State the reason for the employee's ineligibility on the fourth blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 5: Enter the total retirement deductions made from the employee's salary on the fifth blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 6: Enter the total matching employer contributions remitted on the sixth blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 7: Enter the total refund amount owed to the employee and employer on the seventh blank line. This amount should be calculated by the Employees' Retirement System of Alabama.

Alabama Ineligible Member Refund Request ERS 7IR Step 8: Enter the date the last deduction from the employee's salary was made on the eighth blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 9: Enter the name of the employing agency on the ninth blank line.

Alabama Ineligible Member Refund Request ERS 7IR Step 10: Enter the agency's mailing address on the next three blank lines.

Alabama Ineligible Member Refund Request ERS 7IR Step 11: On the next blank line, the employing official should enter their signature.

Alabama Ineligible Member Refund Request ERS 7IR Step 12: On the next blank line, enter the date.

Alabama Ineligible Member Refund Request ERS 7IR Step 13: On the last blank line, enter the title of the employing official.

INSTRUCTIONS: ALABAMA MONTHLY MEMBER CONTRIBUTION REMITTANCE PROBATE JUDGES ON SALARY (Form JRF MMCR – Salary)

Alabama probate judges who are members of the Judicial Retirement Fund and compensated by salary are required to contribute 6% of their annual compensation. These payments must be made in equal monthly installments and are documented using a form JRF MMCR – Salary. This form can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 1: On the first blank line, enter the end date of the month you are filing for.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 2: On the second blank line, enter your county.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 3: On the third blank line, enter the member name.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 4: On the fourth blank line, enter your Social Security number.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 5: On the first blank line of line 1, enter your annual salary.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 6: On the second blank line of line 1, enter the annual rate of 6%.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 7: Multiply your annual salary by the annual rate and enter the resulting product on the third blank line of line 1. This is your annual contribution.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 8: On the first blank line of line 2, enter your annual contribution.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 9: Divide your annual contribution by 12 and enter the resulting figure on the second blank line of line 2. This is your monthly contribution.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 10: The next section should only be completed if salary changes occurred during the monthly reporting period.

Alabama Monthly Member Contribution Remittance Probate Judges On Salary JRF MMCR – Salary Step 11: Have the form certified by a notary public.

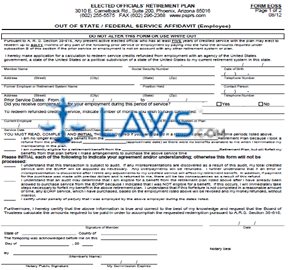

INSTRUCTIONS: ARIZONA OUT OF STATE/FEDERAL SERVICE AFFIDAVIT (Form EOSS)

Arizona elected officials with at least five years of credited service within the state Elected Officials' Retirement Plan may redeem up to five years of prior elected service out of state or in a federal capacity. This is done by filing a form EOSS. This document can be obtained from the website maintained by the Elected Officials' Retirement Plan of the State of Arizona.

Arizona Out Of State/Federal Service Affidavit EOSS Step 1: Enter your name on the first line, your Social Security number on the second line, and your date of birth on the third line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 2: Enter your complete street address on the fourth line and your telephone number on the fifth line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 3: Enter the name of your former employer or retirement system on the sixth line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 4: Enter your position formerly held on the seventh line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 5: Enter the name of a contact person on the eighth line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 6: Enter the address of your former employer or retirement system on the ninth line and its telephone number on the tenth line.

Arizona Out Of State/Federal Service Affidavit EOSS Step 7: Enter your prior service beginning and ending dates on the eleventh and twelfth lines.

Arizona Out Of State/Federal Service Affidavit EOSS Step 8: On the next line, indicate with a check mark whether you received compensation for your employment during this service period.

Arizona Out Of State/Federal Service Affidavit EOSS Step 9: Enter the number of months you wish to have calculated.

Arizona Out Of State/Federal Service Affidavit EOSS Step 10: On the next four lines, give all information requested about your current employment.

Arizona Out Of State/Federal Service Affidavit EOSS Step 11: Initial all applicable statements on the next five lines.

Arizona Out Of State/Federal Service Affidavit EOSS Step 12: Sign and date the bottom of the page.

Arizona Out Of State/Federal Service Affidavit EOSS Step 13: The form must be presented to a notary public for their seal.

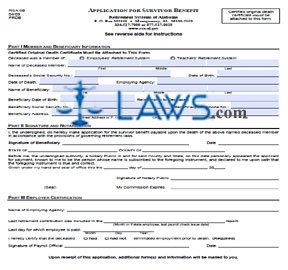

INSTRUCTIONS: ALABAMA APPLICATION FOR SURVIVOR BENEFIT

Survivors of deceased members of the Alabama Employees' Retirement System or Teachers' Retirement System can file the form discussed in this article to receive their benefits. The document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Application For Survivor Benefit Step 1: Indicate whether the deceased was a members of the Employees' Retirement System or Teachers' Retirement System by filling in the oval next to the applicable statement.

Alabama Application For Survivor Benefit Step 2: On the first blank line, enter the full name of the deceased.

Alabama Application For Survivor Benefit Step 3: On the second blank line, enter the Social Security number of the deceased.

Alabama Application For Survivor Benefit Step 4: On the third blank line, enter the date of birth of the deceased.

Alabama Application For Survivor Benefit Step 5: On the fourth blank line, enter the date of death of the deceased.

Alabama Application For Survivor Benefit Step 6: On the fifth blank line, enter the employing agency of the deceased.

Alabama Application For Survivor Benefit Step 7: On the sixth blank line, enter the full name of the surviving beneficiary.

Alabama Application For Survivor Benefit Step 8: On the seventh blank line, enter the date of birth of the beneficiary.

Alabama Application For Survivor Benefit Step 9: On the eighth blank line, enter the relationship to the deceased of the beneficiary.

Alabama Application For Survivor Benefit Step 10: On the ninth blank line, enter the Social Security number of the beneficiary.

Alabama Application For Survivor Benefit Step 11: On the tenth blank line, enter the telephone number of the beneficiary.

Alabama Application For Survivor Benefit Step 12: On the eleventh blank line, enter the complete address of the beneficiary.

Alabama Application For Survivor Benefit Step 13: In Part II, the beneficiary should sign and date the form.

Alabama Application For Survivor Benefit Step 14: The beneficiary should have the remainder of Part II completed by a notary public.

Alabama Application For Survivor Benefit Step 15: Part III should be completed by the payroll official of the employer of the deceased.

Alabama Application For Survivor Benefit Step 16: File this return by mailing it to the address at the top of the page. A certified original death certificate must be attached.

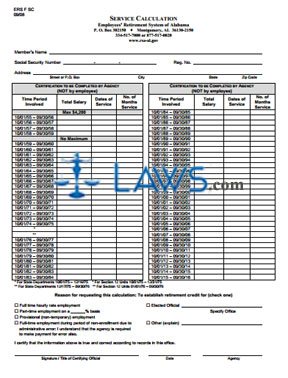

INSTRUCTIONS: ALABAMA SERVICE CALCULATION (Form ERS F SC)

Those enrolled in the Employees' Retirement System of Alabama can use a form ERS F SC to request the establishment of a retirement credit for several different types of employment. This document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Service Calculation ERS F SC Step 1: On the first blank line, enter your full name.

Alabama Service Calculation ERS F SC Step 2: On the second blank line, enter your Social Security number.

Alabama Service Calculation ERS F SC Step 3: On the third blank line, enter your registration number.

Alabama Service Calculation ERS F SC Step 4: On the fourth blank line, enter your street address or P.O. box number, city, state and zip code.

Alabama Service Calculation ERS F SC Step 5: Do not complete the two tables, which are for agency use anyway. Below these, check the box next to the first statement if you are seeking a retirement credit for full time hourly rate employment.

Alabama Service Calculation ERS F SC Step 6: Check the box next to the second statement if you are seeking a retirement credit for part-time employment on a percentage basis. Enter the percent.

Alabama Service Calculation ERS F SC Step 7: Check the box next to the third statement if you are seeking a retirement credit for provisional (non-temporary) employment.

Alabama Service Calculation ERS F SC Step 8: Check the box next to the fourth statement if you are seeking a retirement credit for full-time employment during a period of non-enrollment due to administrative error. By checking this statement, you acknowledge that the agency is also required to make a payment for their error.

Alabama Service Calculation ERS F SC Step 9: Check the box next to the fifth statement if you are seeking a retirement credit for your work as an elected official. Enter the name of the office you served in.

Alabama Service Calculation ERS F SC Step 10: Check the box next to the sixth statement if you are seeking a retirement credit for another reason. Provide a written explanation.

Alabama Service Calculation ERS F SC Step 11: Submit this form to the appropriate agency official, who will complete the tables, then sign and date the bottom of the page.