Form 82525 Manufactured Housing, Mobile Home and Mobile Office Acquisition and Sales Report

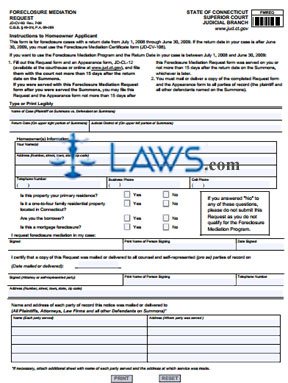

INSTRUCTIONS: CONNECTICUT FORECLOSURE MEDIATION REQUEST (Form JD-CV-93)

To request mediation in a Connecticut foreclosure case as a homeowner, a form JD-CV-93 should be filed. This document can be obtained from the website of the Connecticut Judicial Department.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 1: In the first blank box, enter the name of the case.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 2: In the second blank box, enter the return date.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 3: In the third blank box, enter the judicial district.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 4: In the fourth blank box, enter your name.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 5: In the next two blank boxes, enter your address.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 6: In the next blank box, enter your telephone number.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 7: In the next blank box, enter your business phone number.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 8: In the next blank box, enter your cell phone number.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 9: Indicate whether this property is your primary residence by checking "Yes" Or "No" as appropriate.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 10: Indicate whether this property is a one-to-four family residential property located in Connecticut by checking "Yes" or "No" as appropriate.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 11: Indicate whether you are the borrower by checking "Yes" or "No" as appropriate.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 12: Indicate whether this is a mortgage foreclosure by checking "Yes" or "No" as appropriate.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 13: Enter your signature in the next blank box.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 14: Print your name in the next blank box.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 15: Enter the date in the next blank box.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 16: The next section confirms copies which must be sent of this request to all counsel and self-represented parties involved in the case. Enter the date on which these copies were mailed or delivered.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 17: Detail the name and address of every party who received a copy of this form.

Connecticut Foreclosure Mediation Request JD-CV-93 Step 18: Sign and date the certification portion of the form where indicated.

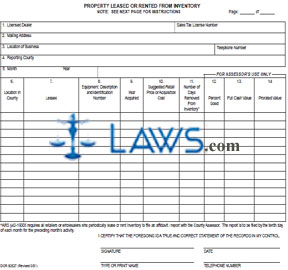

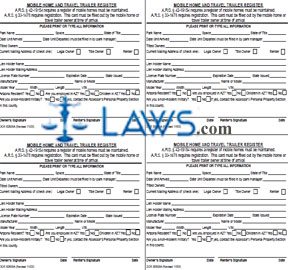

INSTRUCTIONS: ARIZONA MOBILE HOME AND TRAVEL TRAILER REGISTER (Form 82505A)

Arizona mobile home or travel trailer owners must submit a registration form when arriving at a mobile home or trailer court. This document can be obtained from the website of the Arizona Department of Revenue. Four copies of the form are on one page.

Arizona Mobile Home And Travel Trailer Register 82505A Step 1: On the first line, enter the park's name. On the second line, enter the assigned space. On the third line, enter the state in which the mobile home or travel trailer title is registered.

Arizona Mobile Home And Travel Trailer Register 82505A Step 2: On the fourth line, enter the date on which the unit arrived. On the fifth line, enter date on which it departed. The park manager must complete the latter line.

Arizona Mobile Home And Travel Trailer Register 82505A Step 3: On the sixth line, enter the titled owners of the mobile home or travel trailer.

Arizona Mobile Home And Travel Trailer Register 82505A Step 4: On the seventh line, enter the current address of the legal owner, title owner or the renter of the mobile home or travel trailer. Indicate which with a check mark.

Arizona Mobile Home And Travel Trailer Register 82505A Step 5: On the eight line, enter the lien holder number. On the ninth line, enter the lien holder's mailing address.

Arizona Mobile Home And Travel Trailer Register 82505A Step 6: On the tenth line, enter the license plate number. On the eleventh line, enter its expiration date. On the twelfth line, enter the state in which it was issued.

Arizona Mobile Home And Travel Trailer Register 82505A Step 7: On the thirteenth line, enter the manufacturer name. On the fourteenth line, enter the name or model of the mobile home or trailer park.

Arizona Mobile Home And Travel Trailer Register 82505A Step 8: Indicate whether you are an Arizona resident with a check mark. Answer questions about your employment in the state, whether you have children in the state or whether you are non-resident military in the same fashion. If the latter, contact the Assessor's Personal Property section in your county.

Arizona Mobile Home And Travel Trailer Register 82505A Step 9: The owner and/or renter should sign and date the form.