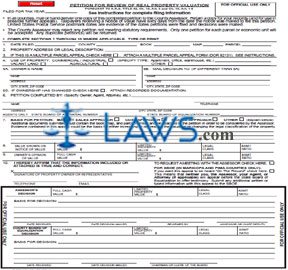

Form 82130 Petition for Review of Real Property Valuation

INSTRUCTIONS: ARIZONA PETITION FOR REVIEW OF REAL PROPERTY VALUATION (Form 82130)

To request a review of an Arizona real property valuation, file a form 82130 within 60 days of the date the notice was filed. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Petition For Review Of Real Property Valuation 82130 Step 1: On line 1, enter the date the notice was filed, the county of the property, and the book, map and parcel number of the property.

Arizona Petition For Review Of Real Property Valuation 82130 Step 2: On line 2, enter the property address or its legal description.

Arizona Petition For Review Of Real Property Valuation 82130 Step 3: If this appeal concerns multiple parcels, check the box on line 3 and attach form 82131, which concerns multiple parcel appeals.

Arizona Petition For Review Of Real Property Valuation 82130 Step 4: On line 4, indicate with a check mark whether the property is being used for commercial or industrial purposes, as vacant land, in an agricultural capacity, or other. If industrial or commercial, specify. If other, explain.

Arizona Petition For Review Of Real Property Valuation 82130 Step 5: On line 5a, enter the owner's name and address.

Arizona Petition For Review Of Real Property Valuation 82130 Step 6: If you wish for the decision to be mailed to an address other than the one entered on line 5a, enter this address on line 5b.

Arizona Petition For Review Of Real Property Valuation 82130 Step 7: On line 6, give the name, telephone number and address of the person completing the petition. If you are an agent, you should also enter your State Board of Appraisal number and your State Board of Equalization number.

Arizona Petition For Review Of Real Property Valuation 82130 Step 8: On line 7, indicate the basis for your petition with a check mark.

Arizona Petition For Review Of Real Property Valuation 82130 Step 9: On line 8, provide all values shown on the notice of value.

Arizona Petition For Review Of Real Property Valuation 82130 Step 10: On line 9, provide the owner's opinion of all values.

Arizona Petition For Review Of Real Property Valuation 82130 Step 11: On line 10, the property owner or their representative should enter their signature, their telephone number and their email address.