Notice and Information to Heirs and Divisees

INSTRUCTIONS: MONTANA NOTICE AND INFORMATION TO HEIRS AND DEVISEES

The form discussed in this article is used by the personal representative of a Montana estate to give notice of its administration to all persons who have or may have interest in the estate. This document can be obtained from the website maintained by the Montana Courts system.

Montana Notice And Information To Heirs And Devisees Step 1: On the first blank line, enter your name.

Montana Notice And Information To Heirs And Devisees Step 2: On the next blank line, enter your street address.

Montana Notice And Information To Heirs And Devisees Step 3: On the next blank line, enter your city, state and zip code.

Montana Notice And Information To Heirs And Devisees Step 4: On the next blank line, enter your telephone number, including the area code.

Montana Notice And Information To Heirs And Devisees Step 5: On the next blank line, enter the number of the district in which your county is located.

Montana Notice And Information To Heirs And Devisees Step 6: On the next blank line, enter the name of your county.

Montana Notice And Information To Heirs And Devisees Step 7: On the next blank line, enter the name of the deceased.

Montana Notice And Information To Heirs And Devisees Step 8: On the first blank line of line 1, enter the name of the decent.

Montana Notice And Information To Heirs And Devisees Step 9: On the next two blank lines, enter the date of death and the last two digits of the year in which death occurred.

Montana Notice And Information To Heirs And Devisees Step 10: On the first two blank lines of line 3, enter the name and address of the personal representative.

Montana Notice And Information To Heirs And Devisees Step 11: On the next three blank lines, enter the date, month and last two digits of the year in which the personal representative was appointed.

Montana Notice And Information To Heirs And Devisees Step 12: On line 4, enter the number of the district court, as well as its county and city.

Montana Notice And Information To Heirs And Devisees Step 13: On line 5, provide the date, month and last two digits of the year, then sign the form where indicated.

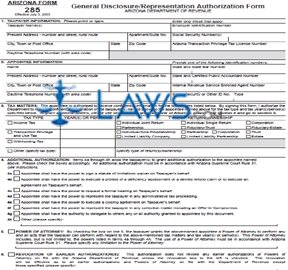

Form 285 General Disclosure/Representation Authorization Form (replaces 72-0105)

INSTRUCTIONS: ARIZONA GENERAL DISCLOSURE/REPRESENTATION AUTHORIZATION FORM (Form 285)

To authorize an appointee to discuss and receive confidential information pertaining to Arizona tax matters, a form 285 should be used. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona General Disclosure/Representation Authorization Form 285 Step 1: The first section concerns the taxpayer. Enter their name in the first box.

Arizona General Disclosure/Representation Authorization Form 285 Step 2: Enter the taxpayer's spouse's name, if applicable, in the second box.

Arizona General Disclosure/Representation Authorization Form 285 Step 3: Enter the taxpayer's present name and address, as well as their daytime phone number. Provide all applicable identifying numbers on the right.

Arizona General Disclosure/Representation Authorization Form 285 Step 4: The second section concerns the appointee. Enter their name, present address, daytime phone number, and the applicable identifying numbers.

Arizona General Disclosure/Representation Authorization Form 285 Step 5: The third section concerns the type of tax matters you are authorizing your appointee to receive confidential materials pertaining to.

Arizona General Disclosure/Representation Authorization Form 285 Step 6: Additional authorizations are documented in the fourth section.

Arizona General Disclosure/Representation Authorization Form 285 Step 7: Check the box in the fifth section if you wish to authorize your appointee with power of attorney.

Arizona General Disclosure/Representation Authorization Form 285 Step 8: If you wish to revoke an earlier authorization, check the box on the sixth section.

Arizona General Disclosure/Representation Authorization Form 285 Step 9: The seventh section should only be completed if you are a corporation with a controlled subsidiary.

Arizona General Disclosure/Representation Authorization Form 285 Step 10: The eighth section requires the taxpayer's signature, which should be entered on the first blank line.

Arizona General Disclosure/Representation Authorization Form 285 Step 11: Print the taxpayer's name on the second blank line.

Arizona General Disclosure/Representation Authorization Form 285 Step 12: Enter the taxpayer's title on the third blank line.

Arizona General Disclosure/Representation Authorization Form 285 Step 14: If authorization was granted in the fourth and fifth sections, the appointee is required to enter their signature in the table provided at the bottom of the page, as well as entering the date, the jurisdiction, and indicating their designation with a check mark.

Affidavit of Service

INSTRUCTIONS: MONTANA AFFIDAVIT OF SERVICE

The form discussed in this article is filed by a Montana estate representative mailed or personally serviced notice and information to an heir or devisee. This document can be obtained from the website maintained by the Montana Courts system.

Montana Affidavit Of Service Step 1: On the first blank line, enter your name.

Montana Affidavit Of Service Step 2: On the second blank line, enter your street address.

Montana Affidavit Of Service Step 3: On the third blank line, enter your city, state and zip code.

Montana Affidavit Of Service Step 4: On the fourth blank line, enter your telephone number, including the area code.

Montana Affidavit Of Service Step 5: On the fifth blank line, enter the number of the district in which your county is located.

Montana Affidavit Of Service Step 6: On the sixth blank line, enter the name of your county.

Montana Affidavit Of Service Step 7: On the seventh blank line, enter the name of the deceased.

Montana Affidavit Of Service Step 8: On the eighth blank line, print your name.

Montana Affidavit Of Service Step 9: On the ninth blank line, enter the name of the recipient.

Montana Affidavit Of Service Step 10: Check the first box if you mailed a true and correct copy of the notice. Enter the date, month and year on which you did this, as well as the address to which this copy was mailed.

Montana Affidavit Of Service Step 11: Check the second box if you hand-delivered a copy of the notice. Enter the date, month and year in which you did so, as well as entering the name of the opposing party to whom delivery was made and/or the name of their attorney, if they are represented by one.

Montana Affidavit Of Service Step 12: On the next blank line, enter the date.

Montana Affidavit Of Service Step 13: On the next blank line, enter the month.

Montana Affidavit Of Service Step 14: On the next blank line, enter the last two digits of the year.

Montana Affidavit Of Service Step 15: On the next blank line, enter your signature.

Montana Affidavit Of Service Step 16: The remainder of the form should be completed by a notary public, who will enter the state, county, their signature, their title or rank and all other information requested.

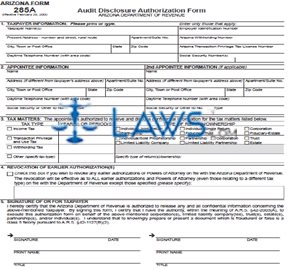

Form 285A Audit Disclosure Authorization Form

INSTRUCTIONS: ARIZONA AUDIT DISCLOSURE AUTHORIZATION FORM (Form 285A)

To authorize an appointee to discuss tax matters related to an Arizona audit, a form 285A. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Audit Disclosure Authorization Form 285A Step 1: The first section concerns information about the tax payer. In the first box, enter the taxpayer name.

Arizona Audit Disclosure Authorization Form 285A Step 2: In the second and third boxes, enter the taxpayer street address and, if applicable, apartment or suite number.

Arizona Audit Disclosure Authorization Form 285A Step 3: Enter the taxpayer city, town or post office in the fourth box, the state in the fifth box and the zip code in the sixth box.

Arizona Audit Disclosure Authorization Form 285A Step 4: Enter the taxpayer daytime phone number in the seventh box.

Arizona Audit Disclosure Authorization Form 285A Step 5: Enter the employer identification number, Arizona withholding number, Arizona transaction privilege tax license number or Social Security numbers. Enter only the applicable numbers.

Arizona Audit Disclosure Authorization Form 285A Step 6: The second section allows you to document up to two appointees. In the first box, enter their name.

Arizona Audit Disclosure Authorization Form 285A Step 7: Enter their address, if different from the one given above, including the city, state and zip code, in the next five boxes.

Arizona Audit Disclosure Authorization Form 285A Step 8: Enter the appointee's daytime phone number in the next box. Enter their Social Security number or other ID number in the last box of this section.

Arizona Audit Disclosure Authorization Form 285A Step 9: In the third section, indicate what type of tax matters the appointees are authorized to receive discuss confidential information regarding. Check "income tax," "transaction privilege and withholding tax," "withholding tax" or "other" as applicable. If the latter, specify.

Arizona Audit Disclosure Authorization Form 285A Step 10: Only complete the fourth section if you wish to revoke a previous authorization.

Arizona Audit Disclosure Authorization Form 285A Step 11: Enter your signature and date on the first blank line of the fifth section.

Arizona Audit Disclosure Authorization Form 285A Step 12: Print your name on the second blank line.

Arizona Audit Disclosure Authorization Form 285A Step 13: Enter your title on the third blank line.