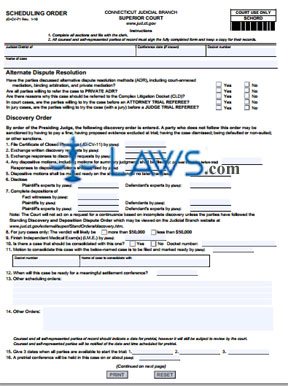

Form JD-CV-71 Scheduling Order

INSTRUCTIONS: CONNECTICUT SCHEDULING ORDER (Form JD-CV-71)

During a Connecticut foreclosure trial, you will be told by the court when you are required to complete a scheduling order. This form JD-CV-71 can be found on the website of the Connecticut Judicial Branch.

Connecticut Scheduling Order JD-CV-71 Step 1: Enter the name of the judicial district in the first blank box.

Connecticut Scheduling Order JD-CV-71 Step 2: Enter the conference date, if known, in the second blank box.

Connecticut Scheduling Order JD-CV-71 Step 3: Enter the docket number in the third blank box.

Connecticut Scheduling Order JD-CV-71 Step 4: Enter the name of the case in the fourth blank box.

Connecticut Scheduling Order JD-CV-71 Step 5: The next five questions concern alternate dispute resolution (ADR). The first question asks whether the parties involved have discussed ADR methods including court-annexed mediation, binding arbitration and private mediation. Check "yes" or "no" as appropriate.

Connecticut Scheduling Order JD-CV-71 Step 6: The next question asks whether all parties are willing to refer the case to private ADR. Check "yes" or "no" as appropriate.

Connecticut Scheduling Order JD-CV-71 Step 7: The next question asks whether there is any reason the case should be referred to the complex litigation docket. Check "yes" or "no" as appropriate.

Connecticut Scheduling Order JD-CV-71 Step 8: The next question asks whether the parties in a court case are willing to try the case before an attorney trial referee. Check "yes" or "no" as appropriate.

Connecticut Scheduling Order JD-CV-71 Step 9: The next question asks whether the parties in a jury case are willing to try the case before a judge trial referee. Check "yes" or "no" as appropriate.

Connecticut Scheduling Order JD-CV-71 Step 10: The next section concerns the discovery order which is entered by order of the presiding judge and will be completed under their supervision. Failure to follow the conditions of this order may result in a fine, having proposed evidence being excluded at trial, having the case dismissed, being dismissed, or other sanctions. Complete this section as directed.

Connecticut Scheduling Order JD-CV-71 Step 11: On the second page, all involved attorneys or self-represented parties in this scheduling order must enter their names. One must sign the document.

Connecticut Scheduling Order JD-CV-71 Step 12: The last section concerns certification that copies of this form have been mailed to all involved attorneys and self-represented parties.