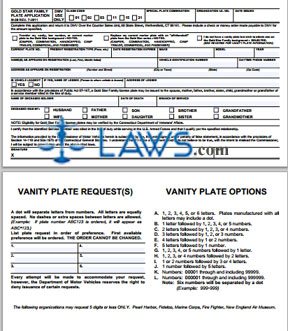

Form M-38 Special Order – Gold Star Family Plate

INSTRUCTIONS: CONNECTICUT GOLD STAR FAMILY PLATE APPLICATION (Form M-38)

To apply for a Connecticut gold star family plate, use a form M-38. This document can be obtained from the website of the government of Connecticut.

Connecticut Gold Star Family Plate Application M-38 Step 1: Check the first statement if you wish to transfer a vanity, low number or current marker plate to a Gold Star background.

Connecticut Gold Star Family Plate Application M-38 Step 2: Check the second statement if you wish to replace your current marker plate with an "off-the-shelf" plate from the Gold Star series.

Connecticut Gold Star Family Plate Application M-38 Step 3: Check the third statement if you do not have a vanity plate but wish to obtain one on the Gold Star family background.

Connecticut Gold Star Family Plate Application M-38 Step 4: Enter your current plate number in the first blank box.

Connecticut Gold Star Family Plate Application M-38 Step 5: Enter your present registration type in the second blank box.

Connecticut Gold Star Family Plate Application M-38 Step 6: Enter the date your registration expires in the third blank box.

Connecticut Gold Star Family Plate Application M-38 Step 7: Enter the vehicle make in the fourth blank box.

Connecticut Gold Star Family Plate Application M-38 Step 8: Enter the model in the fifth blank box and its year in the sixth blank box.

Connecticut Gold Star Family Plate Application M-38 Step 9: Enter your name as it appears on the registration in the seventh blank box.

Connecticut Gold Star Family Plate Application M-38 Step 10: Enter the vehicle registration number in the eighth blank box.

Connecticut Gold Star Family Plate Application M-38 Step 11: Enter your daytime phone number in the ninth blank box.

Connecticut Gold Star Family Plate Application M-38 Step 12: Enter your address as it appears on your registration in the tenth blank box.

Connecticut Gold Star Family Plate Application M-38 Step 13: Indicate whether the vehicle is leased by checking yes or no. If yes, give the name and address of the lessee.

Connecticut Gold Star Family Plate Application M-38 Step 14: Complete the next four blank boxes if applying for a license plate as the direct relative of a deceased soldier.

Connecticut Gold Star Family Plate Application M-38 Step 15: Sign and date the form.