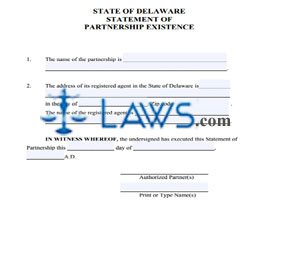

Form DE Statement of Partnership Existence

INSTRUCTIONS: DE STATEMENT OF PARTNERSHIP EXISTENCE

The completion of this form is the first step in forming a partnership in the state of Delaware.

“DE Statement of Partnership Existence Step 1”

Provide the name of the partnership in the first section of this form. If you want to reserve the partnership’s name, you can reserve a name before filing this form. The fee is $75.00.

“DE Statement of Partnership Existence Step 2”

Provide the address and name of the registered agent in the state of Delaware. The partnership can recruit an individual or business entity as a registered agent. The individual must have residency in Delaware, and the business entity needs authorization under the Secretary of State.

“DE Statement of Partnership Existence Step 3”

All authorized partners need to sign and date this form. Partners are asked to print their name below their signatures.

“DE Statement of Partnership Existence Step 4”

The filing fee for this form is $200.00, and expedited services will cost more. Make checks payable to the Delaware Secretary of State. You also need to provide a cover letter while submitting this form.

“DE Statement of Partnership Existence Step 5”

Send the form to the following address:

Division of Corporations

John G. Townsend Building

401 Federal Street

Suite 4

Dover, DE 19901

“DE Statement of Partnership Existence Step 6”

After filing this form, the partnership needs to obtain a Federal Identification Number. Complete Form SS-4 in order to obtain the number.

“DE Statement of Partnership Existence Step 7”

If the partnership will have employees, they need to register with the Delaware Department of Labor with Form UC-1. After registering with the Department of Labor, the partnership also needs to register with the Division of Revenue under the Department of Finance. The partnership can register online or complete the CRA form.

“DE Statement of Partnership Existence Step 8”

After registering with the Division of Revenue, the partnership must get a business license and meet local license and zoning requirements. The partnership will then have to contact a large number of state agencies. For more information on the process after filing the Statement of Partnership Existence, click on the following link: https://revenue.delaware.gov/services/Business_Tax/Step2_old.shtml

Form NV Sole Proprietor Application

INSTRUCTIONS: NV SOLE PROPRIETOR APPLICATION

Use this form if you want to file for a sole proprietor business license in the state of Nevada by mail. You can use the Application Packet to apply online. Make sure to check if you have to complete a Nevada Business Registration form with the Nevada Department of Taxation and Department of Employment, Training and Rehabilitation.

“NV Sole Proprietor Application Step 1”

Do not use this form if you meet exemptions under NRS 76.020. If the sole proprietorship is exempt, submit a State Business License Exemption form instead.

“NV Sole Proprietor Application Step 2”

The sole proprietor needs to provide their name, signature, and date of signature in part 1 of this form. If the spouse’s name will appear on the business license, he or she needs to provide the name, signature, and date of signature as well.

“NV Sole Proprietor Application Step 3”

If another business entity will operate under the sole proprietorship, list its name in part 2. The state allows four other businesses to operate with the sole proprietor.

“NV Sole Proprietor Application Step 4”

List the physical street address of the sole proprietorship in part 3. If the mailing address is different from the street address, list the mailing address in part 4.

“NV Sole Proprietor Application Step 5”

The sole proprietor should list a phone number for the place of business, along with an email address to receive electronic notifications.

“NV Sole Proprietor Application Step 6”

The sole proprietor needs to provide their taxpayer identification number in part 7. Don’t provide a social security number.

“NV Sole Proprietor Application Step 7”

The filing fee for this form is $200.00., and expedited service will cost more. If you’re filing this form online, you should use the Application Packet for Nevada. You’ll find the ePayment Checklist in the packet. If you’re filing by mail, make a check payable to Secretary of State. Send the completed form and filing fee to the following address:

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

If the form is incomplete or inaccurate, the state will return the form and keep the filing fee.

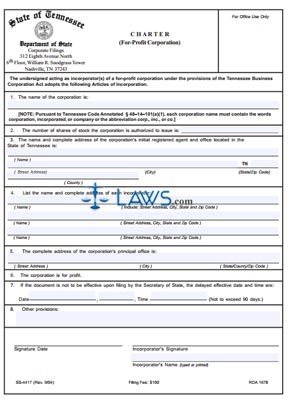

Form TN Corporation Charter

INSTRUCTIONS: TENNESSEE CHARTER (FOR-PROFIT CORPORATION) (Form SS-4417)

In order to incorporate a for-profit business in the state of Tennessee, you must submit a charter application form. This document, formally labeled form SS-4417, is processed by the Tennessee Secretary of State. The form is available on the website of the state of Tennessee.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 1: Disregard the top right section labeled "for office use only."

Tennessee Charter (For-Profit Corporation) SS-4417 Step 2: Section one requires you to enter the name of your business. Note that the name must include the words "corporation," "incorporated," "company" or the abbreviations "corp.," "inc." or "co."

Tennessee Charter (For-Profit Corporation) SS-4417 Step 3: Section two requires you to enter the number of shares of stock which the corporation in company has been authorized to issue.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 4: Section three requires you to enter the name of your registered agent. This person must be based in the state of Tennessee. In addition to providing their full name, give their street address, city, zip code, and county.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 5: In section four, you must give the full name and address of every incorporator. Include the street address, city, state and zip code of every incorporator. You do not need to include the county of residence in this section.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 6: In section five, you must give the complete address of the principal office of your corporation. Give the street address, city, state, county and zip code.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 7: Section six is a statement confirming that your company is a for-profit corporation. You do not need to enter anything into this section.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 8: Section seven concerns the date on which the charter will become active, incorporating your business. This will take place immediately upon the date on which the office of the Secretary of State files your form. If you do not wish for this to be the date, give the day, month and year on which you wish for this document to take effect. This must be within 90 days of the filing period.

Tennessee Charter (For-Profit Corporation) SS-4417 Step 9: At least one incorporator must print and sign their name, along with providing the date.

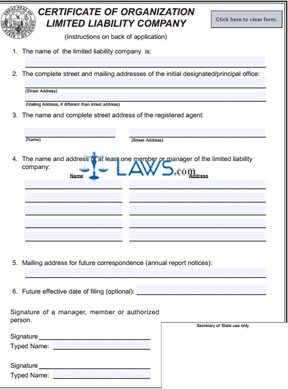

Form 251 Certificate of Organization LLC

INSTRUCTIONS: CERTIFICATE OF ORGANIZATION LLC 251

Professionals looking to form a limited liability company in the state of Idaho can use this form. The filing party should provide their phone number in the top part of the form’s instructions in case there are any mistakes with the form.

“Certificate of Organization LLC 251 Step 1”

Enter the requested name of the limited liability company on line 1. State law requires the name of the company to contain one of the following designations: Limited Liability Company, Limited Company, L.C., L.L.C., or LLC.

“Certificate of Organization LLC 251 Step 2”

Provide the full street address and mailing address of the initial principal office for the limited liability company on line 2.

“Certificate of Organization LLC 251 Step 3”

List the name and street address of the registered agent for the limited liability company on line 3. The LLC can recruit an individual registered agent or a business entity under the Secretary of State. An LLC cannot act as its own registered agent.

“Certificate of Organization LLC 251 Step 4”

Provide at least one name and address for a member or manager of the limited liability company. If additional space is needed, attach a separate form.

“Certificate of Organization LLC 251 Step 5”

Enter a mailing address for correspondence in the future on line 5. Annual report reminders are sent to this address.

“Certificate of Organization LLC 251 Step 6”

Line 6 is optional. If the date is not listed, the certificate becomes effective when filed with the Secretary of State. A delayed effective date cannot extend past 90 days after the filing date.

“Certificate of Organization LLC 251 Step 7”

A manager, member or other authorized person needs to sign the bottom of the form. Only one signature is required by the state, but more than one authorized individual can sign the form.

“Certificate of Organization LLC 251 Step 8”

The filing fee for this form is $100.00. If you request expedited service, the filing fee is $120.00. Make the check payable to Secretary of State. Make a copy of the original form and send or deliver both forms to the following address:

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise, ID 83720-0080