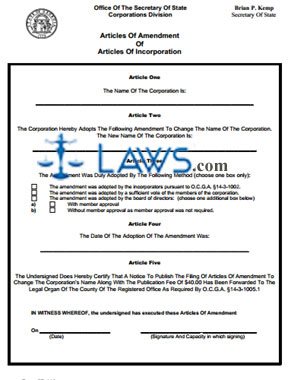

Form Articles of Amendment (Profit Corporation) (Sample)

INSTRUCTIONS: ARTICLES OF AMENDMENT (PROFIT CORPORATION) (Sample)

This form is a sample and cannot be filed electronically. This form needs filed electronically, and all paper forms will be rejected. Corporations submitting this document are strongly encouraged to use the assistance of an attorney. This form is used to make changes to the original Articles of Organization.

“Articles of Amendment (Profit Corporation) (Sample) Step 1”

Provide the ID number from the Secretary of State on the first line of this form.

“Articles of Amendment (Profit Corporation) (Sample) Step 2”

If you’re changing the name of the corporation, provide the name of the corporation before the change of name in part 1. Enter the new name for the organization on the next line. Leave part 2 blank if name of the corporation is staying the same.

“Articles of Amendment (Profit Corporation) (Sample) Step 3”

If you’re changing the name of the corporation and the name uses any of the restricted words, check the appropriate box in part 3.

“Articles of Amendment (Profit Corporation) (Sample) Step 4”

If there are any other amendments, part 4 asks for the applicant to attach separate pages describing the amendments to the first Articles of Organization.

“Articles of Amendment (Profit Corporation) (Sample) Step 5”

If the amendment applies to the exchange, reclassification or cancellation of issued shares, part 5 requires the applicant to explain the changes and provisions for implementing the changes on a separate sheet.

“Articles of Amendment (Profit Corporation) (Sample) Step 6”

In part 6, provide a date on the provided line if the amendments to the Articles of Organization are less than permanent. If the amendments is perpetual, check the appropriate box and leave the first line blank in part 6.

“Articles of Amendment (Profit Corporation) (Sample) Step 7”

If the corporation wants to delay the implementation of the amendments, provide a date on the line provided in part 7.

“Articles of Amendment (Profit Corporation) (Sample) Step 8”

Provide the name and address of the person or entity responsible for filing this amendment in part 8. The incorporators must provide their signatures at the bottom of this form as well. Speak within an attorney for more information.

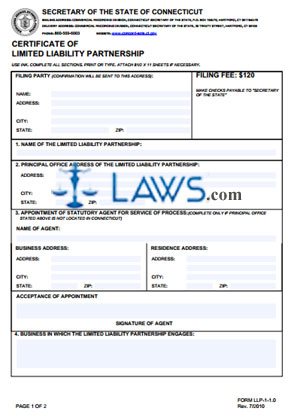

Form LP-1-1.0 Certificate of Limited Liability Partnership

INSTRUCTIONS: CERTIFICATE OF LIMITED LIABILITY PARTNERSHIP LP-1-1.0

This form is required in forming a limited liability partnership in the state of Connecticut. If you’re forming a general partnership, a different form is required. The Office for the Secretary of the State cannot help you fill out this form. If you need help, you need to consult with an attorney.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 1”

Provide the name and address for the filing party at the top of this form. The confirmation from the Secretary of the State is sent to this address.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 2”

Provide the name of the limited liability partnership in part 1. Make sure the name of the LLP has a designation as required by Connecticut law.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 3”

Provide the limited liability partnership’s principal office address in part 2. Provide the street address, city, state, and zip code. Do not abbreviate the city.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 4”

Part 3 is required if the LLP’s principal office location is not in the state of Connecticut. If part 3 is required, provide the name of the statutory agent along with their business address and residential address. Provide the street address, city, state and zip code for each address.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 5”

If you completed part 3, the statutory agent needs to provide their signature in the box below part 3. Make sure they print their name as well.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 6”

Provide the type of business conducted by the limited liability partnership in part 4. If there are any other necessary provisions, include these in part 5.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 7”

The signatory needs to print their name, provide their title, and sign their name at the bottom of this form. The date of execution is also required above the signature. Provide the day, month, and year.

“Certificate of Limited Liability Partnership LP-1-1.0 Step 1”

Provide a filing fee of $120 to this form. Make the check payable to the Secretary of the State. You can find the mailing address or delivery address of the Secretary of the State at the top of this form.

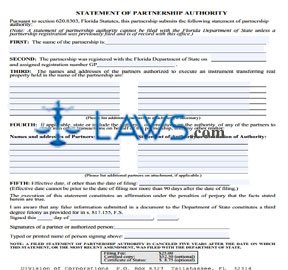

Form Statement of Authority (Partnership)

INSTRUCTIONS: STATEMENT OF AUTHORITY (PARTNERSHIP)

This form allows the partnership to state specific powers of authority and limitations for each partner. The partnership cannot file this form without filing the Partnership Registration form with the Florida Department of State.

“Statement of Authority (Partnership) Step 1”

Provide the name of the partnership as it appears under the Florida Department of State in first section of the form.

“Statement of Authority (Partnership) Step 2”

In the second section of this form, list the date on which the Florida Department of State registered the partnership. List the registration number on the second line of the second section.

“Statement of Authority (Partnership) Step 3”

List the names and addresses for each partner who is authorized to transfer real property held by the name of the partnership in the third section of this form. If additional space is needed, attach a separate sheet for this section.

“Statement of Authority (Partnership) Step 4”

In section four, provide the name and addresses of each partner along with a statement of authority or limitation of authority for each partner. If additional space is needed, attach a separate sheet.

“Statement of Authority (Partnership) Step 5”

If the partnership wants to extend the effective date for this form, provide a specific date in the fifth section of this form. The effective date cannot extend past 90 days after the filing date.

“Statement of Authority (Partnership) Step 6”

A signature, date of signature, and printed name is required at the bottom of this form. This form is effective for 5 years.

“Statement of Authority (Partnership) Step 7”

The person filing this form needs to provide a cover letter as well. Provide the name of the partnership and the document number at the top of the cover letter. Then, list the name, address, and telephone number for correspondence.

“Statement of Authority (Partnership) Step 8”

Include a filing fee of at least $25.00 within this form. Provide $52.50 for a certified copy and $8.75 for a certificate of status if necessary. Make the check payable to the Florida Department of State. Mail this form to the following address:

Registration Section

Division of Corporations

P.O. Box 6327

Tallahassee, Florida 32314