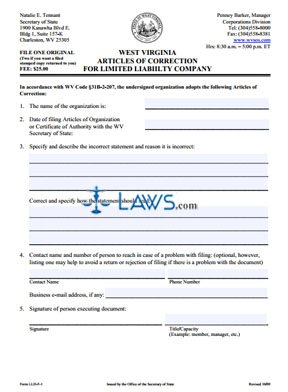

Form 2 Articles of Incorporation (Corporation)

INSTRUCTIONS: WISCONSIN ARTICLES OF INCORPORATION – STOCK FOR-PROFIT CORPORATION (Form 2)

To form a for-profit corporation in Wisconsin, you must complete the correct form. This article discusses the document to filed in such cases. The form is available on the website of the Wisconsin Department of Financial Institutions. This form contains further instructions on how to complete this form. If you have any further questions which cannot be answered, a phone number hotline is included in the instructions.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 1: Article one asks for the name of the corporation. This must include the word "corporation," "incorporated," "company" or "limited," or the abbreviation "corp.," "inc.," "co." or "ltd.," or equivalent words or abbreviations in another language.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 2: Article three asks how many shares will be issued in your corporation. Some share must have been authorized to be issued in order for this document to be completed.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 3: Article four asks for the name of your registered agent. This agent must have a registered office the state of Wisconsin.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 4: Article five asks for the street address of your registered agent. A PO box alone is not considered sufficient.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 5: Note any other provisions under article six.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 6: Provide the name and complete address of every incorporator.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 7: At least one incorporator must sign and date the form. All may sign if they so wish.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 8: The person who prepared the form should give their name where indicated.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 9: An optional section allows you to list your choice for a second name if your first choice is not available.

Wisconsin Articles Of Incorporation – Stock For-Profit Corporation 2 Step 10: Mail one original copy and one exact copy to the Wisconsin Department of Financial Institutions at the address listed in the instructions. Include the $100 filing fee.

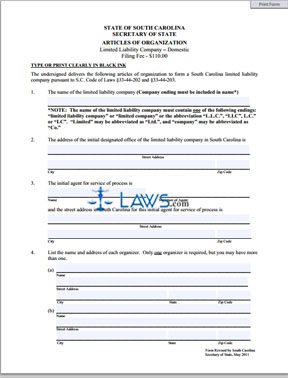

Form SC Articles of Organization (LLC)

INSTRUCTIONS: SC ARTICLES OF ORGANIZATION (LLC)

This form is required to register a limited liability company in the state of South Carolina. You should consult with attorney while completing this form. Type the entries of this form or use black ink.

“SC Articles of Organization (LLC) Step 1”

Provide the name of the limited liability company in Article 1. Make sure the name ends with one of the following terms: limited liability company, limited company, L.L.C., LLC, L.C., or LC.

“SC Articles of Organization (LLC) Step 2”

Provide the street address for the initial designated office for the limited liability company in Article 2. Make sure you include the city and zip code.

“SC Articles of Organization (LLC) Step 3”

Provide the name and address for the agent and any future service of process in Article 3. Make sure the registered agent provides their signature beside their printed name.

“SC Articles of Organization (LLC) Step 4”

List the name and address of each organizer in Article 4. If additional space is needed, attach a separate sheet.

“SC Articles of Organization (LLC) Step 5”

Provide the name of the limited liability company in the heading of the second page.

“SC Articles of Organization (LLC) Step 6”

Check the appropriate boxes in Articles 5 and 6. Check the box in Article 5 if the LLC is a term company. If so, provide the term on the line. If you check the box in Article 6, indicating the LLC is managed by a manager or managers and not the members, provide the name and street address of the managers in the lines provided.

“SC Articles of Organization (LLC) Step 7”

Check the box in Article 7 if one or more members are liable for debts or other obligations. If you check the box, make a list of specific members and their responsibilities.

“SC Articles of Organization (LLC) Step 8”

If the organizers want to delay the date of formation, provide a date in Article 8. Otherwise, leave the Article blank.

“SC Articles of Organization (LLC) Step 9”

All of the organizers need to sign the bottom of this form.

“SC Articles of Organization (LLC) Step 10”

The filing fee is $110.00. Make the check payable to South Carolina Secretary of State. Provide a self-address, stamped envelope with the original form and duplicate. Use the following address:

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

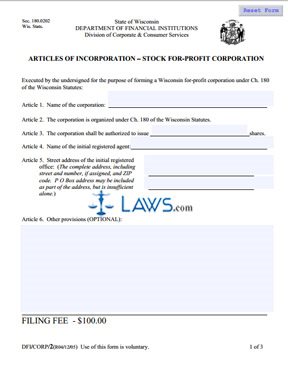

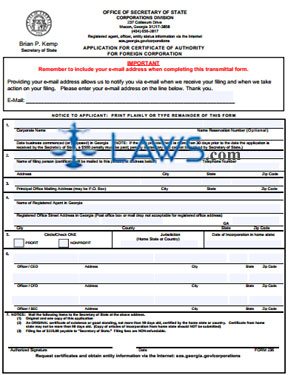

Form GA 236 Application for Certificate of Authority for a Corporation

INSTRUCTIONS: APPLICATION FOR CERTIFICATE OF AUTHORITY FOR A CORPORATION GA 236

A non-domestic corporation can use this form to establish business practices within the state of Georgia. A non-domestic corporation is encouraged to request the help of an attorney while completing this form.

“Application for Certificate of Authority for a Corporation GA 236 Step 1”

The filing party should provide their email address at the top of this form. The Secretary of State will notify the applicant by email when the application is received and processing has begun.

“Application for Certificate of Authority for a Corporation GA 236 Step 2”

Provide the corporate name and name reservation number (if applicable) in part 1. On the line below, provide the date when business commenced or was proposed in Georgia. If the date is more than 30 days before the date the application arrived at the Secretary of State, the corporation is subject to a $500 fine.

“Application for Certificate of Authority for a Corporation GA 236 Step 3”

State the name of the person filing this form in part 2. Provide their telephone and address including city, state and zip code as well. In part 3, provide the principal mailing address of the corporation.

“Application for Certificate of Authority for a Corporation GA 236 Step 4”

List the name of the corporation’s registered agent in Georgia in part 4. List the registered agent’s office address as well. Do not provide a P.O. Box or mail drop.

“Application for Certificate of Authority for a Corporation GA 236 Step 5”

In section 5, indicate the type of corporation (profit or nonprofit), the jurisdiction of the corporation, and the date of incorporation in the home state.

“Application for Certificate of Authority for a Corporation GA 236 Step 6”

List the name and address of the CEO, CFO, and SEC in part 6. An authorized signature is needed at the bottom of this form along with the date of signature.

“Application for Certificate of Authority for a Corporation GA 236 Step 7”

Make a copy of this form and attach it to the original. Also, attach a Certificate of Good Standing from the home state that is no more than 90 days old. Include a filing fee of $225.00 made payable to the Secretary of State and send the forms to the following address:

Office of Secretary of State

Corporations Division

237 Coliseum Drive

Macon, Georgia 31217-3858

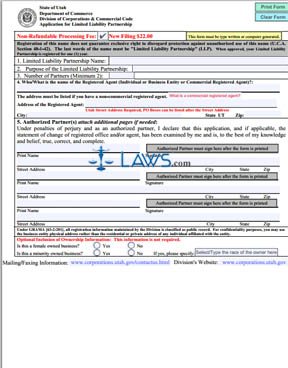

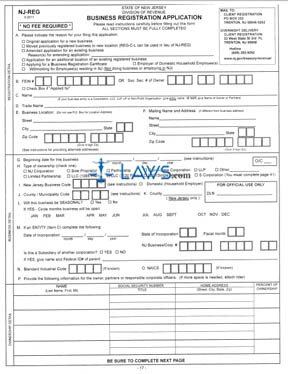

Form NJ Business Registration Application

INSTRUCTIONS: NJ BUSINESS REGISTRATION APPLICATION

You’re strongly encouraged to complete the Business Registration Application with the help of an attorney. All of the questions need answer thoroughly and completely.

“NJ Business Registration Application Step 1”

Check the appropriate box in Part A. If you amended the application for an existing business, provide why you made amendments.

“NJ Business Registration Application Step 2”

Provide the federal employer identification number (FEIN) of the company or the social security number of the owner in Part B. State the name of the corporation, LLC, LP, or the name of the owner in Part C, and the trade name in Part D.

“NJ Business Registration Application Step3”

Provide the address for the business location in part E. If the mailing address is different, fill in Part F. Next, state the beginning date of business in Part G including month, day and year.

“NJ Business Registration Application Step 4”

After checking the appropriate box in Part H, provide the New Jersey business code in Part I or check the box to indicate a domestic business. Provide the county/municipality code in Part J, and fill out Part K if the business is in a New Jersey county.

“NJ Business Registration Application Step 5”

Indicate if the business is seasonal or not in Part L. If you answer yes, circle the months the business will stay open.

“NJ Business Registration Application Step 6”

A corporation needs to complete Part M. Provide the date of incorporation, state of incorporation, fiscal date, and NJ business number. If the business is a subsidiary of another corporation, check the box and provide the federal identification number of the parent corporation. Provide the standard industrial code in Part N and the NAICS number in Part O.

“NJ Business Registration Application Step 7”

List the name, social security number, home address, and percent of ownership for the owner, partners, or officers. If additional space is needed, attach a separate sheet.

“NJ Business Registration Application Step 8”

You need to answer all of the questions on the second and third pages of this form. You should send the completed form to the following address:

Client Registration

PO Box 252

Trenton, NJ 08646-0252

If you want overnight delivery, use this address:

Client Registration

33 West State St 3rd FL

Trenton, NJ 08608

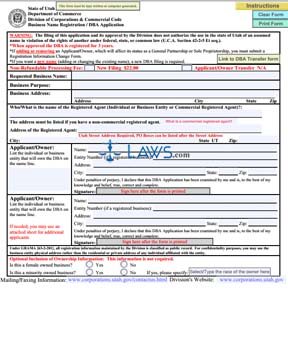

Form 701 LLP Application

INSTRUCTIONS: TEXAS REGISTRATION OF A LIMITED LIABILITY PARTNERSHIP (Form 701)

If you wish to form a limited liability partnership (LLP) in Texas, you will need to register your business. This article discusses form 701 which is filed in such cases. The form is available on the website of the Texas Secretary of State, which will be processing the application.

Texas Registration Of A Limited Liability Partnership 701 Step 1: Question one asks you to give the name of your LLP.

Texas Registration Of A Limited Liability Partnership 701 Step 2: Question two asks you to give the federal employment identification number of your business. If you have not yet been assigned one, indicate this with a check mark.

Texas Registration Of A Limited Liability Partnership 701 Step 3: Question three asks you to state how many partners are in this business.

Texas Registration Of A Limited Liability Partnership 701 Step 4: Question four asks you to provide the complete address of the principal office.

Texas Registration Of A Limited Liability Partnership 701 Step 5: Question five asks you to provide a brief description of the business the LLP is engaged in.

Texas Registration Of A Limited Liability Partnership 701 Step 6: The section headed "effectiveness of filing" asks you to indicate when you would like your LLP status to formally take effect.

Texas Registration Of A Limited Liability Partnership 701 Step 7: If the company filing is a general partnership, the majority-of-interest of partners must sign, or at least one or more partners authorized by the majority-of-interest of partners should sign. If the company filing is a limited partnership, any general partner may sign.

Texas Registration Of A Limited Liability Partnership 701 Step 8: The filing fee for this application is $200 for every general partner named in the registration form. The fee can be paid via check or money order made out to the Secretary of State, or a credit or debit card.

Texas Registration Of A Limited Liability Partnership 701 Step 9: The registration form can be mailed or delivered in person to the address listed in the instructions. You may also submit the form via fax.

Texas Registration Of A Limited Liability Partnership 701 Step 10: Submit two copies of the application. A file-stamped copy of one will be returned to you once your registration has been processed.