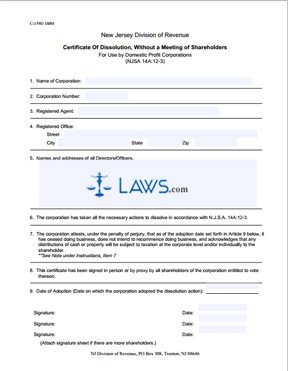

Form F0100 MS LLC Certificate of Formation

INSTRUCTIONS: MS LLC CERTIFICATE OF FORMATION F-0100

Use this form to form a limited liability company in the state of Mississippi. Consider meeting with an attorney before completing this form.

“MS LLC Certificate of Formation F-0100 Step 1”

List the name of the limited liability company in section 1. State law requires the name to contain one of the following terms: Limited Liability Company, LLC, or L.L.C.

“MS LLC Certificate of Formation F-0100 Step 2”

This document becomes effective on the date it’s filed under the Secretary of State. If the organizer wants to postpone the effective date, provide a date no more than 90 days after the filing date in section 2. Provide a business email address for correspondence about this form and other matters.

“MS LLC Certificate of Formation F-0100 Step 3”

Place the company’s federal tax ID in section 3. If there is no federal number, provide a social security number of an organizer in the same box.

“MS LLC Certificate of Formation F-0100 Step 4”

List the name and address of the registered agent for the limited liability company. An LLC can elect an individual, corporation, or other LLC to serve as the registered agent.

“MS LLC Certificate of Formation F-0100 Step 5”

If a projected date of dissolution exists, provide the date in section 5. Otherwise, leave this box blank.

“MS LLC Certificate of Formation F-0100 Step 6”

Check the appropriate box in section 6. Check “Yes” if the management is vested in a manager or managers.

“MS LLC Certificate of Formation F-0100 Step 7”

If the limited liability company wants to provide other information about the company, managers, or members, use section 7 and attach separate sheets if necessary.

“MS LLC Certificate of Formation F-0100 Step 8”

Provide the printed name, title, address, and signature for at least one member, manager, or organizer at the bottom of the form.

“MS LLC Certificate of Formation F-0100 Step 9”

The filing fee for this form is $50.00, and expedited service will cost more. Make a check or money order payable to Mississippi Secretary of State. Attach all separate sheets and mail the forms to the following address:

Office of the Mississippi Secretary of State

P.O. Box 1020

Jackson, MS 39215-1020

If you have any questions about this form of the filing process, call Business Services Division of the Secretary of State Office at (601) 359-1633.

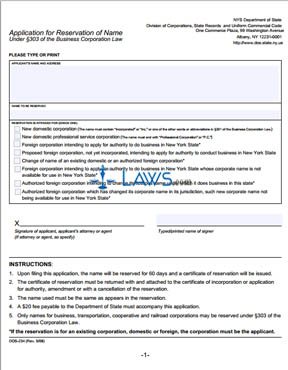

Form DOS-234 Application for Reservation of Name Form

INSTRUCTIONS: APPLICATION FOR RESERVATION OF NAME DOS-234

This form is used to reserve the name of a corporation in the state of New York. The form is easy to complete and can help a corporation reserve a name while completing other forms like the Certification Incorporation.

“Application for Reservation of Name DOS-234 Step 1”

The applicant needs to provide their name and mailing address in the top part of this form. If the name is approved, a Certificate of Reservation is sent to the address.

“Application for Reservation of Name DOS-234 Step 2”

Next, list the name for reservation in the second box. If the reservation is for a domestic reservation, make sure the name contains one of the following designations: incorporated, Inc., or other words or abbreviation in §301 of the Business Corporation Law. If reserving a name for a professional service corporation, use the words “Professional Corporation” or the abbreviation “P.C.”

“Application for Reservation of Name DOS-234 Step 3”

The applicant needs to check the appropriate box in the third section of this form. Check the following numbers depending on the type of corporation and use of the name reservation form:

1. New domestic corporation

2. New domestic professional corporation

3. Foreign corporation applying to conduct business in New York

4. Proposed foreign corporation looking to conduct business in New York

5. Change of name for existing domestic corporation or authorized foreign corporation

6. Foreign corporation applying to conduct business in New York but the corporate name cannot be used in New York

7. Authorized foreign corporation in New York trying to change its fictitious name currently used in the state

8. Authorized foreign corporation which changed the corporate name in its jurisdiction but cannot use the new name in New York

“Application for Reservation of Name DOS-234 Step 4”

The applicant, the applicant’s attorney, or the registered agent can sign the bottom of this form. If the application is approved, the name is reserved for 60 days.

“Application for Reservation of Name DOS-234 Step 5”

Before sending in the form to the address listed at the top of this form, check the name’s availability under the following link: https://www.dos.ny.gov/corps/bus_entity_search.html. Also, attach a $20 filing fee made payable to Department of State.

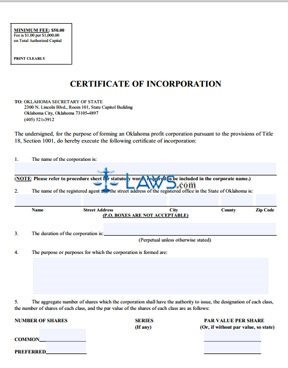

Form SOS FORM 0001-10/9 Certificate of Incorporation

INSTRUCTIONS: CERTIFICATE OF INCORPORATION SOS FORM 0001-10/9

Before filling out this form, check the availability of the proposed corporate name by calling the Secretary of State’s Office at (405) 521-3912. You can reserve the name up to 60 days for $10 by submitting a name reservation application.

“Certificate of Incorporation SOS Form 0001-10/9 Step 1”

Provide the name of the corporation in section 1. Make sure the name contains one of the following designations: association, company, corporation, club, foundation, fund, incorporated, institute, society, syndicate, limited, or an appropriate abbreviation. Make sure all abbreviations are written in Roman characters or letters.

“Certificate of Incorporation SOS Form 0001-10/9 Step 2”

List the name and street address for the registered agent and registered office in Oklahoma in section 2. The registered agent needs to maintain a business during the same business hours of the corporation in order to receive any process of service in the future.

“Certificate of Incorporation SOS Form 0001-10/9 Step 3”

Provide a date in section 3 if the duration of the corporation is any less than perpetual. Otherwise, leave the line blank.

“Certificate of Incorporation SOS Form 0001-10/9 Step 4”

Provide purposes why the corporation is being formed in section 4.

“Certificate of Incorporation SOS Form 0001-10/9 Step 5”

Provide the number of common stock and preferred stock in section 5 along with the par value of each stock.

“Certificate of Incorporation SOS Form 0001-10/9 Step 6”

List the names and mailing addresses of the directors in section 6 if the powers of the incorporators are terminated after filing the Certificate.

“Certificate of Incorporation SOS Form 0001-10/9 Step 7”

In section 7, list the name and mailing address of all the incorporators. If additional space is needed, attach a separate sheet. All of the incorporators need to sign the bottom of this form.

“Certificate of Incorporation SOS Form 0001-10/9 Step 8”

The minimum filing fee is $50.00 plus $1.00 per every $1,000 on total authorized capital. Make the check or money order payable to Oklahoma Secretary of State. Then, mail the documents and filing fee to the following address:

Secretary of State

2300 N Lincoln Blvd., Room 101

Oklahoma City, Oklahoma 73105-4897

You can also deliver the documents in person at the Secretary of State’s office between 8:00 a.m. and 4:00 p.m. during the workweek.

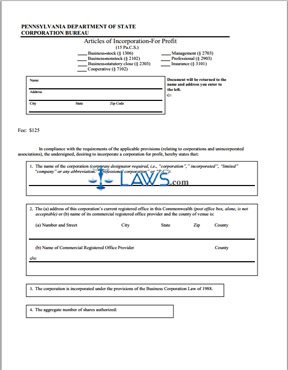

Articles of Incorporation (Profit Corporation)

INSTRUCTIONS: ARTICLES OF INCORPORATION (PROFIT CORPORATION)

Use these articles to establish a corporation in the state of Pennsylvania. You should type this form, but you can use black ink as well.

“Articles of Incorporation (Profit Corporation) Step 1”

Check the appropriate space at the top of the form. Then, provide a name and address for a return address.

“Articles of Incorporation (Profit Corporation) Step 2”

Provide the proposed name in Article I. Make sure the name has one of the following designations: corporation, incorporated, limited, company, or appropriate abbreviation. If forming a professional corporation, use the term “Professional Corporation” or “P.C.”

“Articles of Incorporation (Profit Corporation) Step 3”

List the street address for the corporation’s registered office in Article 2a. List the name of the commercial registered office provider and the county in Article 2b.

“Articles of Incorporation (Profit Corporation) Step 4”

Enter the total number of authorized shares in Article 4. In the next section, make a list of the names and street addresses of the incorporators. If more space is needed, attach a separate sheet.

“Articles of Incorporation (Profit Corporation) Step 5”

If the incorporators want to delay the effective date for opening business, provide a specific date in Article 6. If any other provisions are necessary, attach a separate sheet with the corresponding Articles.

“Articles of Incorporation (Profit Corporation) Step 6”

If you’re forming a cooperative corporation, complete Article 9. Strike out the term that doesn’t apply and provide the common bond of membership on the line provided.

“Articles of Incorporation (Profit Corporation) Step 7”

The incorporators need to sign the bottom of this form. You should then file the following forms with this document:

· necessary governmental approvals

· necessary copies of form DSCB:17.2.3 (Consent to Appropriation of Name)

· one copy of completed form DSCB:15-134A (Docketing Statement)

“Articles of Incorporation (Profit Corporation) Step 8”

The filing fee for this form is $125. Make the check payable to Department of State. Attach of the documents and send the completed forms to the following address:

Department of State

Corporation Bureau

P.O. Box 8722

Harrisburg, PA 787-1057