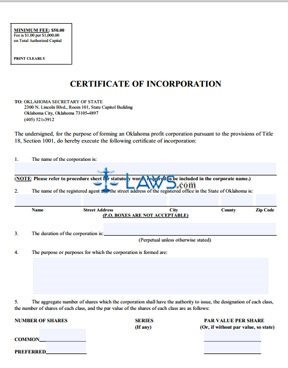

Form SOS FORM 0001-10/9 Certificate of Incorporation

INSTRUCTIONS: CERTIFICATE OF INCORPORATION SOS FORM 0001-10/9

Before filling out this form, check the availability of the proposed corporate name by calling the Secretary of State’s Office at (405) 521-3912. You can reserve the name up to 60 days for $10 by submitting a name reservation application.

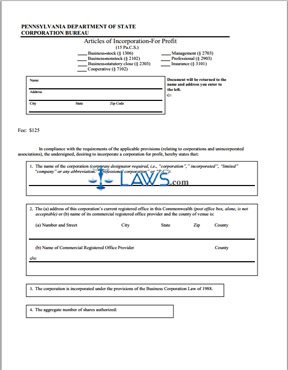

“Certificate of Incorporation SOS Form 0001-10/9 Step 1”

Provide the name of the corporation in section 1. Make sure the name contains one of the following designations: association, company, corporation, club, foundation, fund, incorporated, institute, society, syndicate, limited, or an appropriate abbreviation. Make sure all abbreviations are written in Roman characters or letters.

“Certificate of Incorporation SOS Form 0001-10/9 Step 2”

List the name and street address for the registered agent and registered office in Oklahoma in section 2. The registered agent needs to maintain a business during the same business hours of the corporation in order to receive any process of service in the future.

“Certificate of Incorporation SOS Form 0001-10/9 Step 3”

Provide a date in section 3 if the duration of the corporation is any less than perpetual. Otherwise, leave the line blank.

“Certificate of Incorporation SOS Form 0001-10/9 Step 4”

Provide purposes why the corporation is being formed in section 4.

“Certificate of Incorporation SOS Form 0001-10/9 Step 5”

Provide the number of common stock and preferred stock in section 5 along with the par value of each stock.

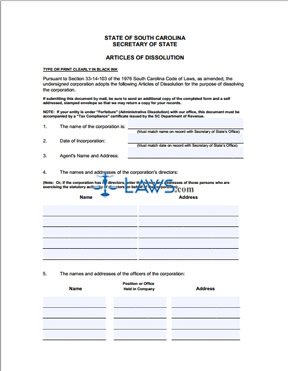

“Certificate of Incorporation SOS Form 0001-10/9 Step 6”

List the names and mailing addresses of the directors in section 6 if the powers of the incorporators are terminated after filing the Certificate.

“Certificate of Incorporation SOS Form 0001-10/9 Step 7”

In section 7, list the name and mailing address of all the incorporators. If additional space is needed, attach a separate sheet. All of the incorporators need to sign the bottom of this form.

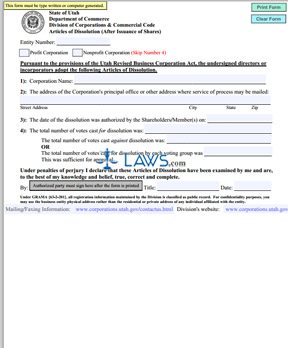

“Certificate of Incorporation SOS Form 0001-10/9 Step 8”

The minimum filing fee is $50.00 plus $1.00 per every $1,000 on total authorized capital. Make the check or money order payable to Oklahoma Secretary of State. Then, mail the documents and filing fee to the following address:

Secretary of State

2300 N Lincoln Blvd., Room 101

Oklahoma City, Oklahoma 73105-4897

You can also deliver the documents in person at the Secretary of State’s office between 8:00 a.m. and 4:00 p.m. during the workweek.