Form WY Articles of Organization (LLC)

INSTRUCTIONS: WYOMING LIMITED LIABILITY COMPANY ARTICLES OF ORGANIZATION

If you wish to establish a limited liability company (LLC) in Wyoming, you must first file a form known as articles of organization. This document is processed by the secretary of state and can be found on their website.

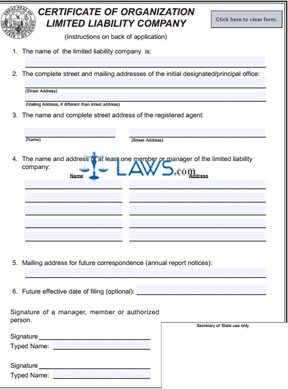

Wyoming Limited Liability Company Articles Of Organization Step 1: Section one requires that you enter the name of your limited liability company. This name must include the abbreviations "L.L.C.," "LLC," "L.C.," "LC," "Ltd. Liability Company," "Ltd. Liability Co.," "Limited Liability Co." or the words "Limited Liability Company."

Wyoming Limited Liability Company Articles Of Organization Step 2: Section two requires that you provide the name and physical address of your registered agent. If a suite number is part of this address, it must be included. A PO box does not constitute a sufficient address. The agent in question must either be a resident of the state of Wyoming or an entity (either domestic or foreign) which has been authorized to conduct business in the state.

Wyoming Limited Liability Company Articles Of Organization Step 3: Section three requires that you provide the mailing address of your LLC.

Wyoming Limited Liability Company Articles Of Organization Step 4: Section 4 requires you to enter the principal office address of your business.

Wyoming Limited Liability Company Articles Of Organization Step 5: One organizer of the form should sign and date the form.

Wyoming Limited Liability Company Articles Of Organization Step 6: Print the name, phone number and email address of the person to be contacted in case of problems.

Wyoming Limited Liability Company Articles Of Organization Step 7: The last form, the consent to appointment registered agent, should be filled out by that person.

Wyoming Limited Liability Company Articles Of Organization Step 8: Submit one photocopy of the form along with the original to the office of the Wyoming Secretary of State. You must include a check or money order with a filing fee of $100. This check or money order should be made payable to the Wyoming Secretary of State. Applications that do not have all sections completed or which do not contain a check or money order will not be approved.

Wyoming Limited Liability Company Articles Of Organization Step 9: Note that every year, on the anniversary month of the LLC's formation, you must submit an annual report.