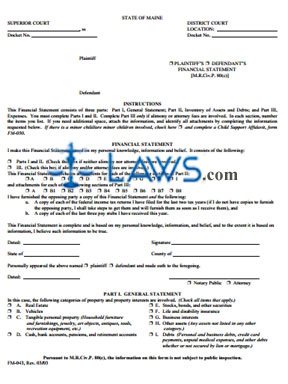

Form FM-043 Financial Statement

INSTRUCTIONS: MAINE FINANCIAL STATEMENT (Form FM-043)

In divorce cases in Maine, it may be necessary to file an affidavit detailing your financial circumstances. This article discusses the Maine Financial Statement which can be filed by either spouse in a divorce where no children are involved. This document can be obtained from the website of the Maine Court System.

Maine Financial Statement FM-043 Step 1: Write the location of the court where your case is being heard and the docket number your case has been assigned.

Maine Financial Statement FM-043 Step 2: There are three parts to this form, the third of which should only be completed if alimony payments or disputes over attorney's fees exist. Indicate whether you are only completing the first two parts or all three.

Maine Financial Statement FM-043 Step 3: Under "Financial Statement," indicate with check marks all attachment forms you have included and sign and date the top part of this form in front of a notary public or attorney.

Maine Financial Statement FM-043 Step 4: Part I, "General Statement," you should put check marks to the types of property listed which are involved in your divorce. These include real estates, motor vehicles, personal property, cash, bank accounts, pension and retirement funds, securities such as stocks and bonds, insurance, businesses you have a stake in and assets. You may also indicate that the payment of debts is at issue.

Maine Financial Statement FM-043 Step 5: Part II, "Assets and Debts," requires that you list all such possessions in detail. Include the date of your purchase, the current market value, and the debt owed for each asset in question, as well as any additional information requested. When listing debts, note the name of every creditor.

Maine Financial Statement FM-043 Step 6: Part III, "Income and Expenses," requires those who must complete it to detail all sources of income, deductions from their wages, housing and household costs, transportation costs, medical expenses, credit card payments and miscellaneous expenses.