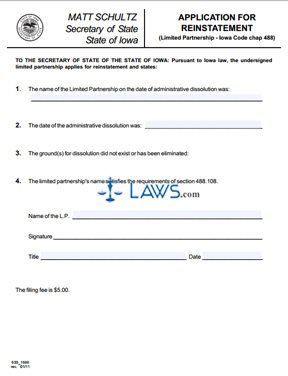

Form 635_1666 Application for Reinstatement

INSTRUCTIONS: APPLICATION FOR REINSTATEMENT 635_1666

A formerly dissolved limited partnership can use this form to reestablish the partnership in the state of Iowa. Follow these instructions carefully.

“Application for Reinstatement 635_1666 Step 1”

State the name of the limited partnership on the date the dissolution occurred in line 1. DO NOT provide a new name for the partnership on this line.

“Application for Reinstatement 635_1666 Step 2”

On line 2, indicate the date when the administrative dissolution occurred. Provide the day, month, and year.

“Application for Reinstatement 635_1666 Step 3”

State why the grounds for dissolution did not exist in the first place or the grounds have been eliminated in line 3. According to §488.809 of the Iowa Code, the Secretary of State can dissolve a partnership if:

1. It does not pay a fee, tax, or penalty due to the State within 60 days after the due date.

2. It does not send its biennial report to the Secretary of State within 60 days after the due date.

“Application for Reinstatement 635_1666 Step 4”

Make sure the name of the limited partnership satisfies requirements under §488.108. The name of the limited partnership may contain the name of any partner and needs to contain the term “limited partnership,” L.P.,” or “LP.”

Make sure to regard subsection 4 of §488.810 as well. The limited partnership cannot voluntarily give up its right to retain a name if the reinstatement occurs within five years of the dissolution.

“Application for Reinstatement 635_1666 Step 5”

A general partner needs to sign the bottom of this form. Indicate the name of the limited partnership above the signature, and make sure the signatory provides their title and dates the form as well.

“Application for Reinstatement 635_1666 Step 6”

The filing fee for this form is $5.00. Make the check payable to Secretary of State. Make a copy of the document and send both the original and copy to the following address:

Secretary of State

Business Services Division

Lucas Building, 1st Floor

Des Moines, IA 50319