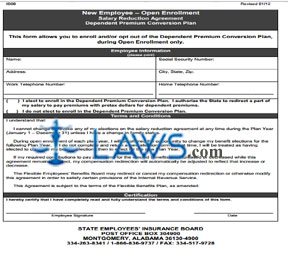

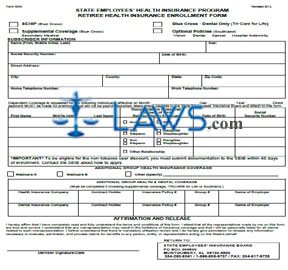

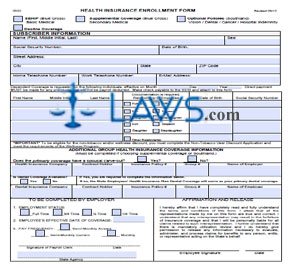

Health Insurance Enrollment IB02 – New employees only

INSTRUCTIONS: ALABAMA HEALTH INSURANCE ENROLLMENT FORM (Form IB02)

Alabama state employees file for health insurance for themselves and qualifying dependents using a form IB02. This document can be obtained from the website of the Alabama State Employees' Insurance Board.

Alabama Health Insurance Enrollment Form IB02 Step 1: Indicate with a check mark if you are filing for basic medical coverage, secondary supplemental coverage, optional policies for vision, dental and hospital indemnity, or if you are declining coverage.

Alabama Health Insurance Enrollment Form IB02 Step 2: Enter your full name and sex.

Alabama Health Insurance Enrollment Form IB02 Step 3: Enter your Social Security number and date of birth.

Alabama Health Insurance Enrollment Form IB02 Step 4: Enter your street address, city, state and zip code.

Alabama Health Insurance Enrollment Form IB02 Step 5: Enter your home and work telephone numbers, as well as your email address.

Alabama Health Insurance Enrollment Form IB02 Step 6: Enter the date on which you are requesting that coverage take effect for dependents.

Alabama Health Insurance Enrollment Form IB02 Step 7: The next section requires you to list all dependents you are seeking coverage for. Enter their name, indicate their relationship to you with a check mark, and provide their date of birth and Social Security number. Note that you cannot obtain coverage for a divorced or common-law spouse.

Alabama Health Insurance Enrollment Form IB02 Step 8: If you have additional group health insurance, indicate whether it has a spousal-carve out.

Alabama Health Insurance Enrollment Form IB02 Step 9: Enter the name of the company providing this insurance.

Alabama Health Insurance Enrollment Form IB02 Step 10: Enter the name of the contract holder and the policy number.

Alabama Health Insurance Enrollment Form IB02 Step 11: Enter the group number and the name of the employer providing this insurance.

Alabama Health Insurance Enrollment Form IB02 Step 12: Indicate with a check mark whether this plan includes dental coverage. If so, you must give the name of the dental insurance company, the policy and group number, and the name of the providing employer.

Alabama Health Insurance Enrollment Form IB02 Step 13: The section at the bottom left should be completed by your current employer.

Alabama Health Insurance Enrollment Form IB02 Step 14: Sign and date the form at the bottom right.