Form DL 51-09 Kansas Limited Liability Company Articles of Organization

INSTRUCTIONS: KANSAS LIMITED LIABILITY COMPANY ARTICLES OF ORGANIZATION DL 51-09

Use this form if you’re trying to form a non-professional limited liability company in the state of Kansas. An LLC holds many advantages to alternative business structures, but there are disadvantages as well. Talk with an attorney to find out what business structure is best for your circumstances.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 1”

Enter the name of the limited liability company in section 1 of this form. One of the following terms needs to be included in the LLC’s name according to state law: Limited Company, Limited Liability Company, L.C., L.L.C., LC, or LLC.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 2”

Provide the name and street address for the individual or business entity acting as the resident agent for the limited liability company in section 2. Do not provide a P.O. Box for the address.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 3”

Include a mailing address in section 3 for the limited liability company where the Secretary of State can send all paperwork.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 4”

Provide the tax closing month for the limited liability company in section 4 of this form.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 5”

Enter the effective date for these Articles in section 5. Check the first box if you want the Articles to become effective immediately. A requested date cannot extend past 90 days after the forms are filed.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 6”

An authorized person within the limited liability company needs to sign and date the bottom of this form.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 7”

This form requires a filing fee of $165. Pay for the fee by check or money order made payable to Secretary of State. Expedited service will cost more.

“Kansas Limited Liability Company Articles of Organization DL 51-09 Step 8”

Make a copy of this form, include the filing check or money, and send all the documents to the following address:

Kansas Office of the Secretary of State

Memorial Hall, 1st Floor

120 S.W. 10th Avenue

Topeka, KS 66612-1594

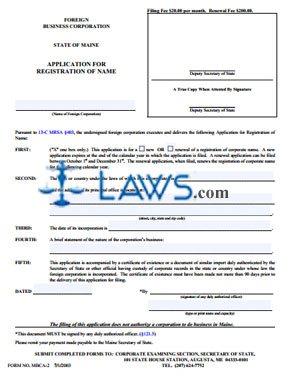

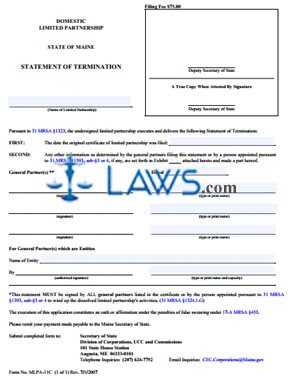

Form Certificate Of Limited Liability Partnership Form And Instructions

INSTRUCTIONS: CERTIFICATE OF LIMITED LIABILITY PARTNERSHIP

Interested parties can use this form to create a limited liability partnership in the state of Maryland. There are numerous advantages included in creating a partnership, and although this form is easy to complete, you should still consult with an attorney, accountant, or similar professional.

“Certificate of Limited Liability Partnership Step 1”

Indicate the proposed name of the limited liability partnership on line 1. Use one of the following terms in the name: limited liability partnership, L.L.P, or LLP. Make sure the proposed name is not confusingly similar to another company in the state.

“Certificate of Limited Liability Partnership Step 2”

State the purpose of the limited liability partnership on line 2 in one or two sentences.

“Certificate of Limited Liability Partnership Step 3”

Provide the address for the limited liability partnership on line 3. Do not include a PO Box; include a street address.

“Certificate of Limited Liability Partnership Step 4”

Enter the name of the resident agent for the limited liability partnership. The LLP can elect an individual, adult resident of the state or a corporation in the state. Also, indicate the resident agent’s street address. Do not provide a P.O. Box.

“Certificate of Limited Liability Partnership Step 5”

List any additional provisions on line 5. If additional space is need, write “See Attached” and attach a one-side, separate sheet.

“Certificate of Limited Liability Partnership Step 6”

The individual forming the limited liability partnership needs to sign line 6, and the resident agent must sign line 7. Make sure the filing party includes their mailing address on the last lines.

“Certificate of Limited Liability Partnership Step 7”

The minimum filing fee is $100.00, and the fee increases with a Certified Copy and/or Certificate of Status. Click on the blue box at the bottom of the Certificate to calculate the filing fee. If you’re faxing the form, provide your Visa or MasterCard card number. If you mail the form, provide a check payable to State Department of Assessments and Taxation.

“Certificate of Limited Liability Partnership Step 8”

Fax the form to 410-333-7097 or mail the form to the following address:

State Department of Assessment and Taxation

Charter Division, 301 W. Preston Street; 8th Floor

Baltimore, MD 21201-2395

The form takes about 8 weeks to process regularly. Expedited service takes about 7 business days. Expedited service is $50.00.