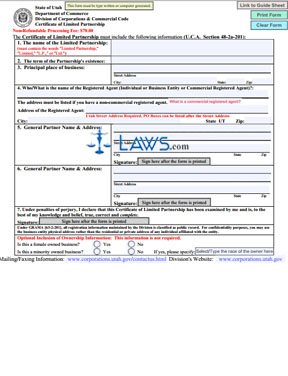

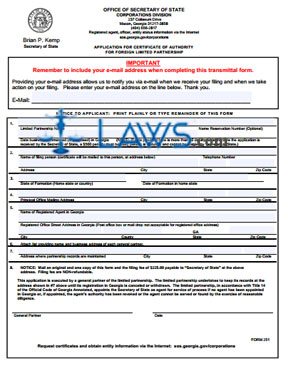

Form GA 251 Application for Certificate of Authority for a Limited Partnership

INSTRUCTIONS: APPLICATION FOR CERTIFICATE OF AUTHORITY FOR A LIMITED PARTNERSHIP GA 251

This form allows an out-of-state or foreign limited partnership to extend the partnership to the state of Georgia. The filer should provide their email address at the top of this form so the Secretary of State can send notification of receiving the application.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 1”

Place the name of the limited partnership on the first line in part 1. If the limited partnership reserved a name in the state of Georgia, provide the name reservation number as well. On the last line in part 1, provide the date on which business commenced in Georgia or the date business was proposed.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 2”

List the name of the filing person on the first line in part 2. Provide the telephone and address of the filing person as well.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 3”

Part 3 asks for the home state or country or formation and the date when the limited partnership started in the state or country.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 4”

List the address for the principal office in part 4. Make sure you list the city, state, and zip code as well.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 5”

Provide the name and address for the registered agent in Georgia within part 5. Then, in part 6, provide a list of the names and address for each general partner. Attach this list separately.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 6”

In part 7, state where the records for the partnership are stored. A general partner needs to sign and date the bottom of this form.

“Application for Certificate of Authority for a Limited Partnership GA 251 Step 7”

The original form and a copy need sent to the Secretary of State with a filing fee of $225.00. Use the following address while mailing this form:

Office of Secretary of State

Corporations Division

237 Coliseum Drive

Macon, Georgia 31217-3858

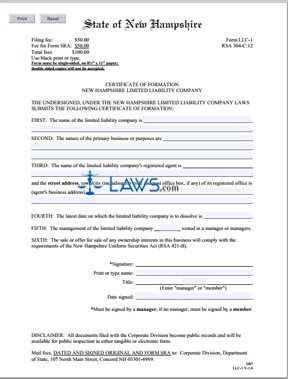

Form NH Certificate of Formation (LLC)

INSTRUCTIONS: NH CERTIFICATE OF FORMATION (LLC)

Use this form to form a limited liability company in the state of New Hampshire. You’re encouraged to consult with an attorney before completing this form.

“NH Certificate of Formation (LLC) Step 1”

In Article I, make sure the name of the company has one of the following designations: Limited Liability Company, L.L.C., L. L. C., or LLC.

“NH Certificate of Formation (LLC) Step 2”

List the primary nature of the business in Article II. Descriptive words need used in the description. Then, list the name and street address of the LLC’s agent in Article III. If the mailing address is different, provide the address after the physical address.

“NH Certificate of Formation (LLC) Step 3”

If there is an estimated date of dissolution, state the full date in Article IV. Write “perpetual” or “ongoing” otherwise.

“NH Certificate of Formation (LLC) Step 4”

State if the limited liability’s management is or is not vested in the manager or managers in Article V.

“NH Certificate of Formation (LLC) Step 5”

A manager or member of the business entity needs to sign and print their name at the bottom of the Articles. Provide the date of signature as well.

“NH Certificate of Formation (LLC) Step 6”

You then need to fill out the Addendum to Business Organization and Registration Forms. After providing the complete name, street address, and contact information in Part I, check ONLY ONE of the items in Part II.

Check the first section if the limited liability company meets criteria under (A), (B) and (C). If you check section two, the LLC will receive federal exemption, and an exemption or notice filing number is required. If you check section 3, the LLC knows they have to register and sell its securities in New Hampshire. If you check section 4, the LLC will not offer or sell securities in New Hampshire.

“NH Certificate of Formation (LLC) Step 7”

Check the appropriate section in Part III, and provide the necessary signatures at the bottom of the page. See the last page of the packet for instructions on the signatures.

“NH Certificate of Formation (LLC) Step 8”

The filing fee for this form is $100.00. Send the date and signed original, SRA form, and filing fee to the following address:

Corporate Division

Department of State

107 North Main Street

Concord, NH 03301-4989

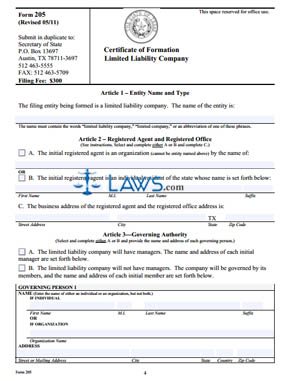

Form TX Certificate of Formation for a Limited Liability Company

INSTRUCTIONS: TEXAS CERTIFICATE OF FORMATION LIMITED LIABILITY COMPANY (Form 205)

Texans who wish to form a limited liability company (LLC) will need to file the proper application. The certificate of formation which should be submitted to the office of the Texas secretary of state is available on their website.

Texas Certificate Of Formation Limited Liability Company 205 Step 1: In section one, give the name of your LLC.

Texas Certificate Of Formation Limited Liability Company 205 Step 2: In section two, give the name of your registered agent or office, as well as their address. If your registered agent changes at any time, you must file a statement with the secretary of statement in order to note the change on your certificate of formation. Failure to do so may result in the termination of your certificate.

Texas Certificate Of Formation Limited Liability Company 205 Step 3: In section three, note whether there will be managers or whether the LLC will be solely managed by its members. Give the names and addresses of all governing managers or members.

Texas Certificate Of Formation Limited Liability Company 205 Step 4: Note any supplemental provisions or information in the box reserved for this purposes.

Texas Certificate Of Formation Limited Liability Company 205 Step 5: The person completing the form should give their name and address under "Organizer."

Texas Certificate Of Formation Limited Liability Company 205 Step 6: Under "Effectiveness of Filing," select from the three options given about when this certificate will take effect.

Texas Certificate Of Formation Limited Liability Company 205 Step 7: Print and sign your name and enter the date at the bottom of the second page.

Texas Certificate Of Formation Limited Liability Company 205 Step 8: Two copies of this document should be mailed or filed in person at the address listed on the form instructions. The document may also be faxed to the telephone number listed. If so, you must include credit card information for the filing fee.

Texas Certificate Of Formation Limited Liability Company 205 Step 9: A $300 filing fee will be collected from all applicants. This must be paid at the time the application is submitted by credit or debit card, check or money order. All checks and money orders should be made payable to the Secretary of State.

Form Credit Application

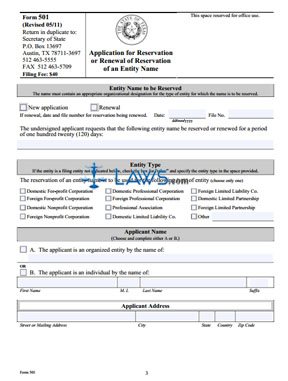

Form 501 Name Reservation

INSTRUCTIONS: TEXAS APPLICATION FOR RESERVATION OR RENEWAL OF RESERVATION OF AN ENTITY NAME (Form 501)

Any business which wishes to reserve a name for its sole use in Texas must file the appropriate application with the office of the secretary of state. This article discusses form 501, which should be filed in such cases. The document is available on the website of the Texas Secretary of State. The instructions include a chart detailing the organizational designations which must be included for every type of business. Make sure to include the words which apply to your company to ensure approval of your application. Any abbreviations are not required to include punctuation.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 1: Indicate with a check mark whether you are filing a new application or a request for a renewal of a reservation. If the latter, give the date and file number of the reservation.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 2: Under "entity type," indicate the operating category your business falls into with a check mark.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 3: Under "applicant name," give either the name of the organized entity or of the individual filing.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 4: Give the address of the applicant where indicated.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 5: You, your attorney or your agent should sign date the last page.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 6: Mail or deliver the form in duplicate to the office indicated in the instructions. A $40 filing fee will be assessed. This may be paid with a personal check, bank draft, credit or debit card, or a money order. All checks and money orders should be made payable to the Secretary of State.

Texas Application For Reservation Or Renewal Of Reservation Of An Entity Name 501 Step 7: If you wish to withdraw your reservation before the expiration period, you may file a notice of cancellation. No fee will be assessed for the processing of this document.

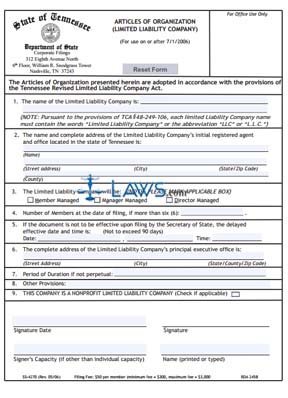

Form SS-4270 Articles of Organization

INSTRUCTIONS: TENNESSEE ARTICLES OF ORGANIZATION (LIMITED LIABILITY COMPANY) (Form SS-4270)

In order to establish a limited liability company (LLC) in Tennessee, you must file several documents with the Department of State. This article discusses form SS-4270, which consists of the articles of organization for your business. This document must be submitted to the Department of State to operate your company legally.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 1: Question one asks for the name of your company. Note that it must include the words "Limited Liability Company" or the abbreviations "LLC" or "L.L.C."

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 2: Give the name, street address, city, state, zip code and county of your LLC's registered agent in response to question two.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 3: In response to question three, indicate with a check mark whether your company will be member managed, manager managed or director managed.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 4: Question four only need to be answered if there are more than six members of your LLC at the time of filing. If so, write how many members are involved in your LLC.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 5: You do not have to answer question five if you wish for this document to take effect as soon as it is filed by the Department of State. Otherwise, give the date on which you wish for it to take effect. This date must be no more than 90 days past this filing date.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 6: Give the complete address of your principal executive office in response to question six.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 7: Question seven only needs to be answered if you do not intend to operate the company on a perpetual basis. If so, write how long it will be in effect.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 8: Question eight is also optional. This space is reserved for you to note any other provisions.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 9: Check the box in response to question nine if your LLC is a nonprofit.

Tennessee Articles Of Organization (Limited Liability Company) SS-4270 Step 10: Sign and date the form.