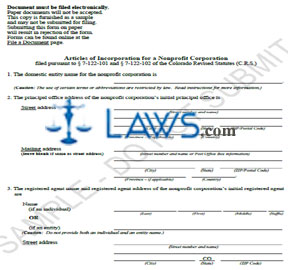

Form Organization of California Nonprofit, Nonstock Corporations

INSTRUCTIONS: ORGANIZATION OF CALIFORNIA NONPROFIT, NONSTOCK CORPORATIONS

This form is used to form a nonprofit, nonstock corporation in California for religious, charitable, social, education, recreational, or purpose of the like. You’re encouraged to consult with an attorney while completing this form.

“Organization of California Nonprofit, Nonstock Corporations Step 1”

Provide the name of the corporation in Article I. Make sure the name meets the California standards. Visit the following link for more information https://www.sos.ca.gov/business/be/name-availability.htm.

“Organization of California Nonprofit, Nonstock Corporations Step 2”

The statement within Article IIA is required by law for a mutual benefit corporation, public benefit corporation, or religious corporation. Do not alter this statement in any way.

“Organization of California Nonprofit, Nonstock Corporations Step 3”

Provide the specific purpose of the corporation in Article IIB. Indicate if the corporation plans to apply for the state franchise tax exemption.

“Organization of California Nonprofit, Nonstock Corporations Step 4”

Article III requires information about the corporation’s initial agent. Of the agent is an individual person, include the agent’s name and their business or residential street address. Do not provide a PO Box address or a C/O.

If the initial agent is a corporation, do not write down an address. In order to have a corporation as an initial agent, the corporation must be filed under the Secretary of State.

“Organization of California Nonprofit, Nonstock Corporations Step 5”

Article IV and Article V are required by law and should not be altered in any way. An attorney may suggest different phrasing in some cases.

“Organization of California Nonprofit, Nonstock Corporations Step 6”

Each incorporator needs to sign the bottom of the form. Type the name below the signature as well.

“Organization of California Nonprofit, Nonstock Corporations Step 7”

The filing fees for the Articles of Incorporation for a nonprofit, nonstock corporation are $30.00. If the forms are dropped off to the Sacramento Office of the Los Angeles Regional Office, an additional $15 is required.

“Organization of California Nonprofit, Nonstock Corporations Step 8”

Attach the filing fees and any other required documents and mail or deliver by hand. If you’re mailing this form, use the following address and provided a self-addressed, stamped envelope:

Secretary of State

Document Filing Support Unit

P.O. Box 944260

Sacramento, CA 94244-2600

If you’re delivering the forms in person, use either address:

Sacramento Office

1500 11th Street, 3rd Floor

Sacramento, CA

Los Angeles Regional Office

300 South Spring Street, Room 12513

Los Angeles, CA

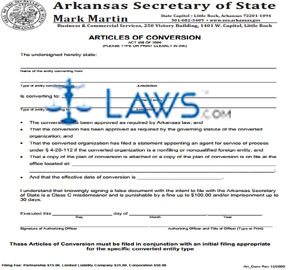

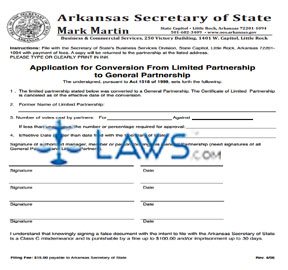

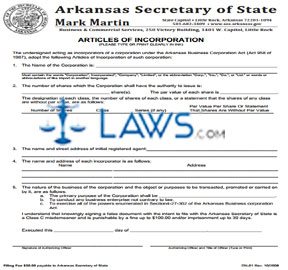

Form DN-01 Articles of Incorporation (Corporation)

INSTRUCTIONS: ARTICLES OF INCORPORATION (Corporation) DN-01

This form is used to form a corporation within the state of Arkansas. If you need additional help with this form, you’re encouraged to use the assistance of an attorney.

“Articles of Incorporation (Corporation) DN-01 Step 1”

Provide the name of the corporation on the first lines of the form. If you’ve reserved the name of the corporation, attach a copy of the form. A corporation’s name must contain the word “Corporation,” “Company,” “Limited,” “Incorporated,” or an appropriate abbreviation.

“Articles of Incorporation (Corporation) DN-01 Step 2”

In part 2, provide the number of shares under the corporation and the par value of each share. In the section below, provide the number of shares, their class, their series (if any) and the shares par value.

“Articles of Incorporation (Corporation) DN-01 Step 3”

Provide the name and street address of the initial registered agent in part 3. Provide their physical address instead of a PO Box number.

“Articles of Incorporation (Corporation) DN-01 Step 4”

Provide the name and address of each incorporator in part 4. If additional space is needed, attach an separate sheet to this form.

“Articles of Incorporation (Corporation) DN-01 Step 5”

In part 5a, provide the main purpose of the corporation. The area of business must be lawful.

“Articles of Incorporation (Corporation) DN-01 Step 6”

The authorizing officer needs to sign and print their name at the bottom of this form.

“Articles of Incorporation (Corporation) DN-01 Step 7”

Authorized officer needs to complete second page of this form as well in order to receive the annual corporate franchise tax reporting form. Provide the corporation’s name on the first line and the name of the contact person on the second line. List the street address of PO Box number for the contact person along with their telephone number and email address.

“Articles of Incorporation (Corporation) DN-01 Step 8”

The Articles of Incorporation can be filed online or by mail. If the Articles are submitted online, the filing fee is $45.00. If filed by mail, the fee is $50.00. Send the forms to the following address:

Arkansas Secretary of State

Business and Commercial Services

State Capital

Little Rock, AR

72201-1094

If you to access other forms to attach to the Articles of Incorporation, visit the following link: https://www.sos.arkansas.gov/BCS/Pages/Domestic.aspx.

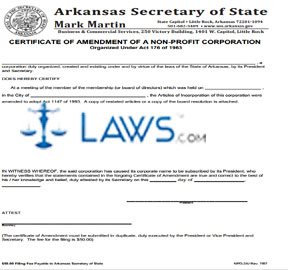

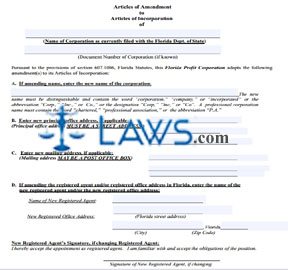

Form Profit Articles of Amendments (Profit Corporation)

INSTRUCTIONS: PROFIT ARTICLES OF AMENDMENTS (PROFIT CORPORATION)

This form allows a for-profit corporation to make amendments to the original Articles of Incorporation. If a corporation is not amending a category within this form, leave it blank.

“Profit Articles of Amendments (Profit Corporation) Step 1”

Provide the current name of the corporation on the first line of the form. If the corporation has a document number under the Florida Department of State, provide this number on the line below.

“Profit Articles of Amendments (Profit Corporation) Step 2”

If the corporation is amending its name, provide the requested name in the section A. It’s the corporation’s responsibility to search for other corporations and companies with similar names.

“Profit Articles of Amendments (Profit Corporation) Step 3”

If the corporation is changing its principal office location, provide the new street address in section B. If the mailing address remains the same, leave section C blank. If the mailing address has changed as well, provide the new P.O. Box in section C.

“Profit Articles of Amendments (Profit Corporation) Step 4”

If the corporation is changing its registered agent, the name of the new registered agent and their office address is required in section D. The new registered agent must provide their signature in section D in order to indicate they understand the responsibilities of such a position.

“Profit Articles of Amendments (Profit Corporation) Step 5”

If the officers and/or directors are being amended, fill out the first section on page 2. Provide the title, name, and address of the new or removed officer or director and check the appropriate box. You can attach a separate sheet for more room if necessary.

“Profit Articles of Amendments (Profit Corporation) Step 6”

Complete section E if additional articles are being added or amended. Fill out section F if amendments address the exchange, reclassification, or cancellation of issued shares. Place “N/A” in this section if it does not apply.

“Profit Articles of Amendments (Profit Corporation) Step 7”

Check the appropriate box on page 3 and provide the signature of the director, president, or other authorized officer.

“Profit Articles of Amendments (Profit Corporation) Step 8”

Make sure to complete the cover sheet and check the appropriate box for the filing fees. Make the check payable to the Florida Department of State. Mail the form to the following address:

Amendment Section

Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314