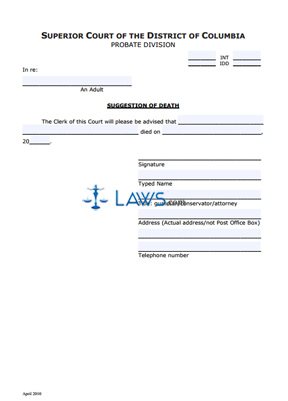

Suggestion of Death

INSTRUCTIONS: WASHINGTON D.C. SUGGESTION OF DEATH

The form discussed in this article is used to notify a Washington D.C. clerk of court of the death of the subject of a conservatorship or guardianship. This document can be obtained from the website maintained by the District of Columbia Courts system.

Washington D.C. Suggestion Of Death Step 1: On the first blank line, enter the name of the adult whose death is being given notice of.

Washington D.C. Suggestion Of Death Step 2: On the next blank line, enter the name of the decedent.

Washington D.C. Suggestion Of Death Step 3: On the next blank line, enter the month and date of death.

Washington D.C. Suggestion Of Death Step 4: On the next blank line, enter the last two digits of the year of death.

Washington D.C. Suggestion Of Death Step 5: On the next blank line, provide your signature.

Washington D.C. Suggestion Of Death Step 6: On the next blank line, type your name.

Washington D.C. Suggestion Of Death Step 7: On the next blank line, enter your title.

Washington D.C. Suggestion Of Death Step 8: On the next blank line, enter your street address. A P.O. box is not acceptable.

Washington D.C. Suggestion Of Death Step 9: On the next blank line, enter your city, state and zip code.

Washington D.C. Suggestion Of Death Step 10: On the next blank line, enter your telephone number, including the area code.

Washington D.C. Suggestion Of Death Step 11: The next page is a certificate of service document that is to be completed by the person serving notice through first class mail, postage prepaid, to the parties granted permission to participate who requested this notice. On the first blank line of this section, enter the date on which service was made.

Washington D.C. Suggestion Of Death Step 12: On the next blank line, enter the month in which service was made.

Washington D.C. Suggestion Of Death Step 13: On the next blank line, enter the last two digits of the year in which service was made.

Washington D.C. Suggestion Of Death Step 14: On the next blank line, enter the type of notice that was served.

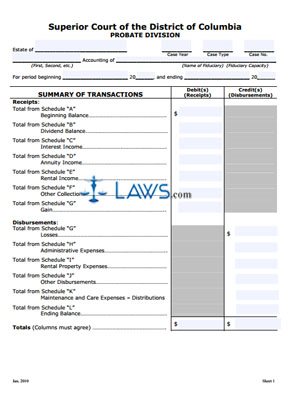

Statement of Account (and all attached sheets) and Order

INSTRUCTIONS: WASHINGTON D.C. STATEMENT OF ACCOUNT (AND ALL ATTACHED SHEETS) AND ORDER

The form discussed in this article is used to file an account related to a Washington D.C. probate case. This document can be obtained from the website maintained by the Washington D.C. judicial system.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 1: On the first blank line, enter the name of the person whose estate is concern.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 2: On the next blank line, enter the case year.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 3: On the next blank line, enter the case type.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 4: On the next blank line, enter the case number.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 5: On the next blank line, enter the number of this account.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 6: On the next blank line, enter the name of the fiduciary and their fiduciary capacity.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 7: On the next blank line, enter the beginning date of the period you are filing for.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 8: On the next blank line, enter the last two digits of the year of the beginning of the period you are filing for.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 9: On the next blank line, enter the ending date of the period you are filing for.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 10: On the next blank line, enter the last two digits of the year of the end of the period you are filing for.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 11: Skip to the second page. Schedule A concerns documentation of the beginning balance.

Washington D.C. Statement Of Account (And All Attached Sheets) And Order Step 12: Complete the rest of the form as instructed.

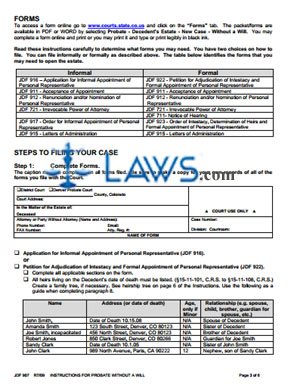

Instructions for Probate without a Will

INSTRUCTIONS: COLORADO INSTRUCTIONS FOR PROBATE WITHOUT A WILL (Form JDF 907)

The form discussed in this article is an information document used to outline the process of conducting probate in Colorado without a will. This document can be obtained from the website maintained by the Colorado Judicial Branch.

Colorado Instructions For Probate Without A Will JDF 907 Step 1: The first section of this form contains two questions to help you determine whether you need to file probate documents with the court.

Colorado Instructions For Probate Without A Will JDF 907 Step 2: The next section briefly outlines the two ways in which a probate case may be commenced, either formally or informally.

Colorado Instructions For Probate Without A Will JDF 907 Step 3: The next section contains a glossary of some common terms it is necessary to understand in order to complete the process of probate without a will.

Colorado Instructions For Probate Without A Will JDF 907 Step 4: The next section contains information about filing fees that may apply during the process of probate without a will.

Colorado Instructions For Probate Without A Will JDF 907 Step 5: The next section contains information about the forms it may be necessary to file as part of the process of probate without a will.

Colorado Instructions For Probate Without A Will JDF 907 Step 6: The remainder of the form contains a step-by-step outline of the process of probate without a will. Step 1 concerns the completion of forms, including a checklist of all documents which may be applicable.

Colorado Instructions For Probate Without A Will JDF 907 Step 7: Step 2 concerns filing the completed forms with the court.

Colorado Instructions For Probate Without A Will JDF 907 Step 8: Step 3 outlines the responsibilities of the personal representative once they have been appointed by the court, including the completion of an Information of Appointment form (JDF 940) and service of this form to all heirs within 30 days of the appointment.

Colorado Instructions For Probate Without A Will JDF 907 Step 9: Step 4 concerns the process of closing the estate.

Colorado Instructions For Probate Without A Will JDF 907 Step 10: The last page contains information about determining the heirs of the estate. Heirs must survive the decedent by a minimum of 120 hours.

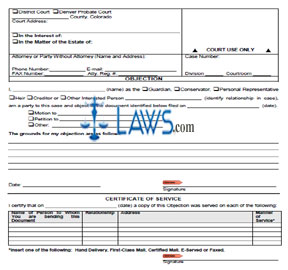

Objection

INSTRUCTIONS: COLORADO OBJECTION (Form JDF 723)

The form discussed in this article is filed to object to an aspect of a Colorado probate case. This document can be obtained from the website maintained by the Colorado Judicial Branch.

Colorado Objection JDF 723 Step 1: Check the first box if filing in district court.

Colorado Objection JDF 723 Step 2: Check the second box if filing in Denver Probate Court.

Colorado Objection JDF 723 Step 3: On the first blank line, enter the county in which the court is located.

Colorado Objection JDF 723 Step 4: Where indicated, enter the address of the court.

Colorado Objection JDF 723 Step 5: Check the next box if filing an objection in a case "in the interest of" and enter the applicable party's name.

Colorado Objection JDF 723 Step 6: Check the next box if filing an objection in a case "in the matter of the estate of" and enter the applicable party's name.

Colorado Objection JDF 723 Step 7: In the third box, enter the name and address of your attorney, as well as their phone number, email address, fax number and attorney registration number. Those not represented by a lawyer should instead enter their own name, address, phone number, email address and fax number.

Colorado Objection JDF 723 Step 8: In the fourth box, enter the case number.

Colorado Objection JDF 723 Step 9: Enter the division on the next blank line.

Colorado Objection JDF 723 Step 10: Enter the courtroom on the next blank line.

Colorado Objection JDF 723 Step 11: Enter your name on the next blank line.

Colorado Objection JDF 723 Step 12: Indicate with a check mark whether you are a guardian, conservator, personal representative, heir, creditor or other interested person. If the latter, identify your relationship in the case.

Colorado Objection JDF 723 Step 13: On the next blank line, enter the date on which the document you are objecting to was filed.

Colorado Objection JDF 723 Step 14: Indicate whether you are objecting to a motion, petition or other document with a check mark and specify what type of motion, petition or other document.

Colorado Objection JDF 723 Step 15: On the next set of blank lines, state the grounds for your objection.

Colorado Objection JDF 723 Step 16: Sign and date the next two blank lines.

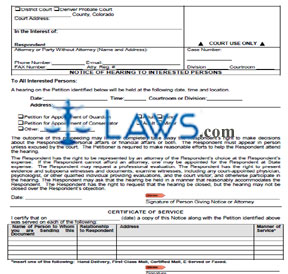

Notice of Hearing to Interested Persons

INSTRUCTIONS: COLORADO NOTICE OF HEARING TO INTERESTED PERSONS (Form JDF 806)

The form discussed in this article is completed to give notice to interested persons of a hearing regarding a Colorado petition for the appointment of a guardian or conservator for a minor or adult. This document can be obtained from the website maintained by the Colorado Judicial Branch.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 1: In the first box, indicate with a check mark whether the hearing will be held in district court or Denver Probate Court. Additionally, enter the county in which the court is located and its address.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 2: In the second box, enter the name of the respondent.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 3: In the third box, enter the name of your attorney, as well as providing their address, fax number, phone number, email address and attorney registration number. If not represented by an attorney, instead enter your own name, address, phone number, fax number and email address.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 4: In the fourth box, enter the case number, division and courtroom.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 5: On the next blank line, enter the date of the hearing.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 6: On the next blank line, enter the time at which the hearing will begin.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 7: On the next blank line, enter the courtroom or division of the hearing.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 8: On the next blank line, enter the address where the hearing will be conducted.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 9: Indicate with check marks the type of petition the hearing concerns and whether it concerns an adult or minor.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 10: On the next blank line, enter the date.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 11: On the next blank line, enter your signature.

Colorado Notice Of Hearing To Interested Persons JDF 806 Step 12: Once notice has been served to all interested persons, complete the bottom of the form as instructed.