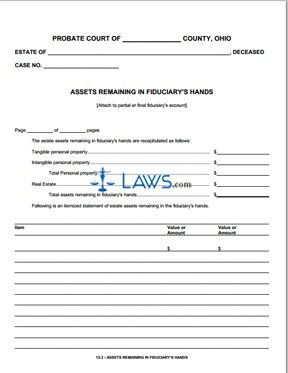

Assets Remaining in Fiduciary’s Hands

INSTRUCTIONS: OHIO ASSETS REMAINING IN FIDUCIARY'S HANDS (Form 13.2)

The document discussed in this article is used to document assets remaining in an Ohio fiduciary's hands after distributing estate assets to heirs, legatees and beneficiaries. This document can be obtained from the website maintained by the Ohio Supreme Court.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 1: Enter the name of the county in which the probate court is located on the first blank line.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 2: Enter the name of the estate on the second blank line.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 3: Enter the case number assigned to probation of the estate on the third blank line.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 4: On the next two blank lines, enter the page number of the page being filed and the total number of pages being filed.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 5: On the next blank line, enter the monetary value of tangible personal property remaining in the fiduciary's hands.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 6: On the next blank line, enter the monetary value of intangible personal property remaining in the fiduciary's hands.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 7: On the next blank line, enter the monetary value of the total personal property remaining in the fiduciary's hands.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 8: On the next blank line, enter the monetary value of the real estate remaining in the fiduciary's hands.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 9: On the next blank line, enter the monetary value of the total assets remaining in the fiduciary's hands.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 10: In the table provided below, an itemized statement of estate assets remaining in the fiduciary's hands must be provided. In the first column, enter the item.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 11: In the second column, enter the value or amount of the item.

Ohio Assets Remaining In Fiduciary's Hands 13.2 Step 12: File the document with the probate court which is overseeing administration of the estate.

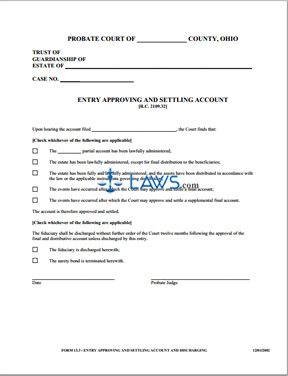

Entry Approving and Settling Account

INSTRUCTIONS: OHIO ENTRY APPROVING AND SETTLING ACCOUNT (Form 13.3)

The document discussed in this article is completed by an Ohio probate judge to approve and settle an estate account. This document can be obtained from the website maintained by the Supreme Court of Ohio.

Ohio Entry Approving And Settling Account 13.3 Step 1: The name of the county in which the court is located will be entered on the first blank line.

Ohio Entry Approving And Settling Account 13.3 Step 2: The name of the estate will be entered on the second blank line.

Ohio Entry Approving And Settling Account 13.3 Step 3: The case number will be entered on the third blank line.

Ohio Entry Approving And Settling Account 13.3 Step 4: The date on which the account was filed will be entered on the fourth blank line.

Ohio Entry Approving And Settling Account 13.3 Step 5: The probate judge will check the first statement if the partial account has been lawfully administered.

Ohio Entry Approving And Settling Account 13.3 Step 6: The probate judge will check the second statement if the estate has been lawfully administered except for final distribution to the beneficiaries.

Ohio Entry Approving And Settling Account 13.3 Step 7: The probate judge will check the third statement if the estate has been fully and lawfully administered and assets have been distributed in accordance with the law of the applicable instruments governing distribution.

Ohio Entry Approving And Settling Account 13.3 Step 8: The probate judge will check the fourth statement if events have occurred after which the court may approve and settle a final account.

Ohio Entry Approving And Settling Account 13.3 Step 9: The probate judge will check the fifth statement if events have occurred after which the court may approve and settle a supplemental final account.

Ohio Entry Approving And Settling Account 13.3 Step 10: The probate judge will check the sixth statement if the fiduciary is discharged.

Ohio Entry Approving And Settling Account 13.3 Step 11: The probate judge will check the seventh statement if the surety bond is terminated.

Ohio Entry Approving And Settling Account 13.3 Step 12: On the last two blank lines, the probate judge will enter the date and their signature.

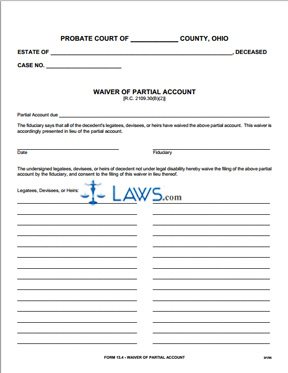

Waiver of Partial Account

INSTRUCTIONS: OHIO WAIVER OF PARTIAL ACCOUNT (Form 13.4)

The form discussed in this article should be used if Ohio legatees, devisees or heirs of a decedent have waived their right to receive a partial account. This document can be obtained from the website maintained by the Supreme Court of Ohio and the Ohio Judicial System. Note that this document should not be confused with form 113.01, which is utilized in wrongful death cases and can be filed annually in place of a fiduciary's account. If the legatees, devisees or heirs do not waive their right to the partial account, the fiduciary in charge of administration is require to file form 13.2, which documents the assets remaining in the fiduciary's control.

Ohio Waiver Of Partial Account 13.4 Step 1: Enter the name of the county in which the probate court is located on the first blank line.

Ohio Waiver Of Partial Account 13.4 Step 2: Enter the name of the decedent whose estate is being administered on the second blank line.

Ohio Waiver Of Partial Account 13.4 Step 3: Enter the assigned case number on the third blank line.

Ohio Waiver Of Partial Account 13.4 Step 4: Enter the due date for the partial account on the fourth blank line.

Ohio Waiver Of Partial Account 13.4 Step 5: Enter the date on the fifth blank line.

Ohio Waiver Of Partial Account 13.4 Step 6: Enter the name of the fiduciary on the sixth blank line.

Ohio Waiver Of Partial Account 13.4 Step 7: To complete the document, you must obtain the signatures of all legatees, devisees or heirs not under legal disability who are waiving their right to the filing of the partial account by the fiduciary. By signing their document, these parties are waiving their right and consenting to the filing of this waiver instead. Obtain their signatures.

Ohio Waiver Of Partial Account 13.4 Step 8: File the document with the supervising probate court. A copy of the form should be maintained for your records.

Ohio Waiver Of Partial Account 13.4 Step 9: If you are filing an application and entry to extend administration (form 13.81), you may file this waiver of partial account along with this application.

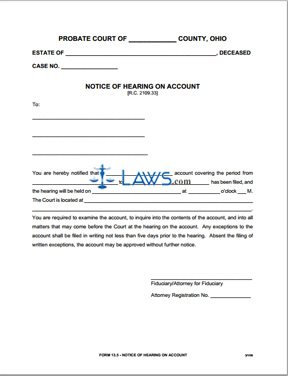

Notice of Hearing on Account

INSTRUCTIONS: OHIO NOTICE OF HEARING ON ACCOUNT

During Ohio probate cases, the form discussed in this article is used to notify involved parties that a hearing has been scheduled concerning an estate account. This document can be obtained from the website maintained by the Supreme Court of Ohio.

Ohio Notice Of Hearing On Account Step 1: Enter the name of the county on the first blank line.

Ohio Notice Of Hearing On Account Step 2: Enter the name of the estate on the second blank line.

Ohio Notice Of Hearing On Account Step 3: Enter the assigned case number on the third blank line.

Ohio Notice Of Hearing On Account Step 4: On the next three blank lines, enter the name or names of the person(s) being notified of the hearing with this document.

Ohio Notice Of Hearing On Account Step 5: On the next blank line, enter the type of account.

Ohio Notice Of Hearing On Account Step 6: On the next blank line, enter the beginning date of the period covered by this account.

Ohio Notice Of Hearing On Account Step 7: On the next blank line, enter the ending date of the period covered by this account.

Ohio Notice Of Hearing On Account Step 8: On the next blank line, enter the date for which the hearing is scheduled.

Ohio Notice Of Hearing On Account Step 9: On the next blank line, enter the time for which the hearing is scheduled.

Ohio Notice Of Hearing On Account Step 10: On the next blank line, enter "A" if the hearing is scheduled for an A.M. time or "P" if the hearing is scheduled for a P.M. time.

Ohio Notice Of Hearing On Account Step 11: On the next blank line, enter the location of the court.

Ohio Notice Of Hearing On Account Step 12: On the next blank line, enter the name of the fiduciary or their attorney.

Ohio Notice Of Hearing On Account Step 13: On the next blank line, if applicable, enter the attorney registration number.

Ohio Notice Of Hearing On Account Step 14: File the form with all parties who are concerned in the estate. However, you are not required to file the notice of hearing on account with any parties who have filed a form waiving their right to receive this notice.

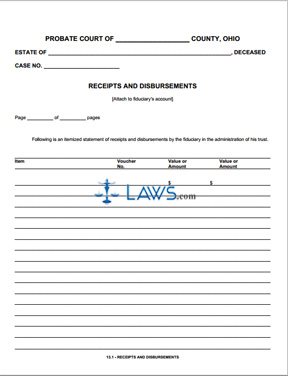

Receipts and Disbursements

INSTRUCTIONS: OHIO RECEIPTS AND DISBURSEMENTS (Form 13.1)

As part of the administration of an Ohio trust, the administering fiduciary should file the document discussed in this article to provide an itemized statement of receipts and disbursements by the fiduciary of the trust. This document can be obtained from the website maintained by the Supreme Court of Ohio.

Ohio Receipts And Disbursements 13.1 Step 1: On the first blank line, enter the county in which the probate court overseeing administration is located.

Ohio Receipts And Disbursements 13.1 Step 2: On the second blank line, enter the name of the decedent whose estate is being administered.

Ohio Receipts And Disbursements 13.1 Step 3: On the third blank line, enter the case number assigned to probation of this estate.

Ohio Receipts And Disbursements 13.1 Step 4: On the fourth blank line, enter the page number of the page being submitted.

Ohio Receipts And Disbursements 13.1 Step 5: On the fifth blank line, enter the total number of pages being submitted.

Ohio Receipts And Disbursements 13.1 Step 6: In the table provided below, you must document receipts and disbursements. In the first column, enter the item being documented.

Ohio Receipts And Disbursements 13.1 Step 7: In the second column, enter the voucher number of the item.

Ohio Receipts And Disbursements 13.1 Step 8: In the third or fourth column, enter the value or amount associated with this item.

Ohio Receipts And Disbursements 13.1 Step 9: At the top of the second page, enter the page number of this page on the first blank line.

Ohio Receipts And Disbursements 13.1 Step 10: Enter the total number of pages being submitted on the second blank line on the second page.

Ohio Receipts And Disbursements 13.1 Step 11: Continue documentation of receipts and disbursements in the table on the second page.

Ohio Receipts And Disbursements 13.1 Step 12: Enter your signature on the blank line at the bottom of the second page.

Ohio Receipts And Disbursements 13.1 Step 13: If you require additional pages to fully document receipts and disbursements, obtain additional copies of these pages. You may submit as many pages as necessary to document all receipts and disbursements. File this form along with your account.

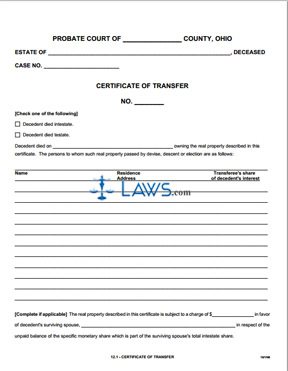

Certificate of Transfer

INSTRUCTIONS: OHIO CERTIFICATE OF TRANSFER (Form 12.1)

The form discussed in this article is used to certify transfers in the administration of an Ohio estate. This document can be obtained from the website maintained by the Ohio Supreme Court.

Ohio Certificate Of Transfer 12.1 Step 1: Enter the county in which the administering probate court is located on the first blank line.

Ohio Certificate Of Transfer 12.1 Step 2: Enter the name of the decedent whose estate is being administered on the second blank line.

Ohio Certificate Of Transfer 12.1 Step 3: Enter the case number on the third blank line.

Ohio Certificate Of Transfer 12.1 Step 4: Enter the number of the certificate on the fourth blank line.

Ohio Certificate Of Transfer 12.1 Step 5: Check the first box if the decedent died intestate.

Ohio Certificate Of Transfer 12.1 Step 6: Check the second box if the decedent died testate.

Ohio Certificate Of Transfer 12.1 Step 7: On the next blank line, enter the date of death.

Ohio Certificate Of Transfer 12.1 Step 8: The table provided below is for documentation of persons to whom real property passed by devise, descent or election. In the first column, enter the name of each person.

Ohio Certificate Of Transfer 12.1 Step 9: In the second column, enter the residential address of each person.

Ohio Certificate Of Transfer 12.1 Step 10: In the third column, enter each transferee's share of the decedent's interest.

Ohio Certificate Of Transfer 12.1 Step 11: If applicable, on the first blank line at the bottom of the page enter the charge to which the real property described in this certificate is subject to and the name of the decedent's surviving spouse on the second blank line.

Ohio Certificate Of Transfer 12.1 Step 12: In the blank space at the top of the second page, enter a legal description of the decedent's interest in the real property subject to this certificate.

Ohio Certificate Of Transfer 12.1 Step 13: Enter the prior instrument reference and parcel number where indicated.

Ohio Certificate Of Transfer 12.1 Step 14: The remainder of the form will be completed by the supervising probate judge, who will issue and certify the document.