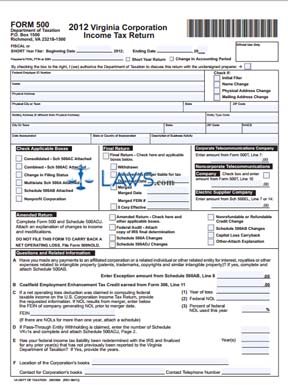

Form 500 Corporation Income Tax Return

INSTRUCTIONS: VIRGINIA CORPORATION INCOME TAX RETURN (Form 500)

Corporations operating in Virginia can file their state income taxes using a form 500. This document can be obtained from the website of the Virginia Department of Taxation.

Virginia Corporation Income Tax Return 500 Step 1: If you are a fiscal or short year filer, enter your beginning and ending dates for the period being documented. Indicate with a check mark if filing a short year return or one documenting a change in your accounting period. Enter the identification number of any paid preparer.

Virginia Corporation Income Tax Return 500 Step 2: Enter your federal employer identification number, name, physical address, entity type code, NAICS code, date and state or country of incorporation, and a description of your business activities.

Virginia Corporation Income Tax Return 500 Step 3: Check all boxes where indicated if filing a consolidated, combined or multistate return, one documenting a change in filing status, or one with a Schedule 500AB attached.

Virginia Corporation Income Tax Return 500 Step 4: If this is a final return, provide all information about your dissolution, merger, or election of S corporation status.

Virginia Corporation Income Tax Return 500 Step 5: Answer all remaining questions on the first page as applicable.

Virginia Corporation Income Tax Return 500 Step 6: Enter your federal employer identification number at the top of the second page.

Virginia Corporation Income Tax Return 500 Step 7: Document your income as instructed on lines 1 through 7.

Virginia Corporation Income Tax Return 500 Step 8: Compute your taxes owed as instructed on lines 8 and 9.

Virginia Corporation Income Tax Return 500 Step 9: Document payments already made and applicable credits on lines 11 through 16.

Virginia Corporation Income Tax Return 500 Step 10: Calculate your tax liability owed or refund due as directed on lines 17 through 24.

Virginia Corporation Income Tax Return 500 Step 11: An officer of the corporation should sign and date the form, as well as providing their title.

Virginia Corporation Income Tax Return 500 Step 12: Any paid preparer should sign and print their name (or that of their firm if applicable), their phone number, the date and their address.

Virginia Corporation Income Tax Return 500 Step 13: When filing this state return, attach a copy of your federal tax return.