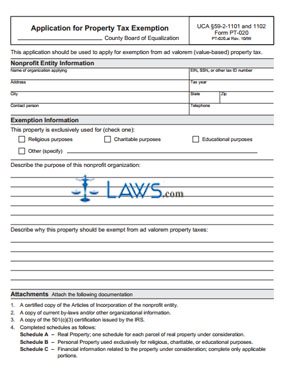

Form PT-020 Application for Property Tax Exemption

INSTRUCTIONS: UTAH APPLICATION FOR PROPERTY TAX EXEMPTION (Form PT-020)

Utah non-profit organizations may apply for an exemption for their property by filing a form PT-020. In order for their request to be valid, they must demonstrate that the real or personal property in question is used exclusively for religious, charitable or educational purposes. This document can be found on the website maintained by the Utah Property Taxes division of the Utah State Tax Commission.

Utah Application For Property Tax Exemption PT-020 Step 1: At the top of the page, enter the name of the county where you are filing.

Utah Application For Property Tax Exemption PT-020 Step 2: The first section asks for information about your nonprofit organization. On the first line, enter the name of the organization and its employer identification number or any other applicable tax ID number.

Utah Application For Property Tax Exemption PT-020 Step 3: The remainder of this section requests the full address of the business, the name and telephone number of a contact person, and the tax year in question.

Utah Application For Property Tax Exemption PT-020 Step 4: Under "Exemption Information," check the box next to "Religious Purposes," "Charitable Purposes," "Educational Purposes" or "Other" to describe the reason you are seeking an exemption. If the last reason, provide a written explanation.

Utah Application For Property Tax Exemption PT-020 Step 5: Provide a written explanation of your nonprofit organization's purpose and practices where indicated.

Utah Application For Property Tax Exemption PT-020 Step 6: Provide a written explanation of why the property in question should be exempt from taxation in the space where indicated.

Utah Application For Property Tax Exemption PT-020 Step 7: You must attach a copy of the articles of incorporation for your nonprofit, a copy of your current organizational by-laws and any other related information, and a copy of your nonprofit 501(c)(3) certification from the IRS.

Utah Application For Property Tax Exemption PT-020 Step 8: If filing for an exemption related to real property, you must attach a separate Schedule A form for each piece of property in question.

Utah Application For Property Tax Exemption PT-020 Step 9: If filing for an exemption concerning personal property, you must attach a separate Schedule B form.

Utah Application For Property Tax Exemption PT-020 Step 10: A Schedule C form must be attached detailing financial information about the property in question.