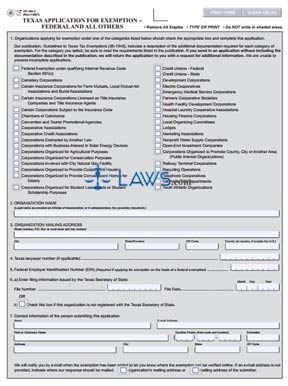

Form Application for Exemption Federal and All Others

INSTRUCTIONS: TEXAS APPLICATION FOR EXEMPTION — FEDERAL AND ALL OTHERS (Form AP-204-2)

Texas organizations or businesses may file a form AP-204-2 seeking an exemption from sales, franchise and hotel taxes if they are a qualified 501(c)(3) organization or any other organization which qualifies which is not religious, charitable or educational or a homeowners' association. Separate forms are provided for all such entities. This form is found on the website of the government of the state of Texas.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 1: Question 1 provides a complete list of all qualifying exempt entities. Check the box next to the statement which describes your organization.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 2: Question 2 requires you to write the name of your organization. If you are an incorporated business, give your legal name as listed in your articles of incorporation. If you are not incorporated, give the name as given on your governing document.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 3: Question 3 asks for the street address or PO box of your organization, as well as your city, state, zip code and county.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 4: Question 4 asks for your Texas taxpayer number if applicable. Question 5 asks for your Federal Employer Identification Number. This is required if seeking an exemption on the basis of an already granted federal exemption.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 5: If your organization is registered with the Texas Secretary of State, give your file number and date in response to question 6a. Check box 6b if you are not registered with the Texas Secretary of State.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 6: Question 7 requires contact information for the person completing and submitting this application. Give your name, email address, firm or company name, daytime phone number and extension (if applicable), and the business address.

Texas Application For Exemption — Federal And All Others AP-204-2 Step 7: If you do not have an email address, indicate with a check mark whether the Texas Comptroller's Office should send their response to the mailing address of the organization or the mailing address of the contact person.