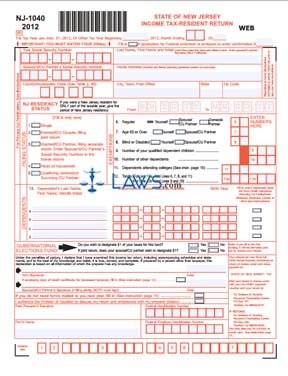

Form NJ-1040 Income Tax Resident Return

INSTRUCTIONS: NEW JERSEY INCOME TAX RESIDENT RETURN (Form NJ-1040)

New Jersey residents file their state income tax using a form NJ-1040. This document is found on the website of the state of New Jersey.

New Jersey Income Tax Resident Return NJ-1040 Step 1: Enter your Social Security number and name, and that of your spouse if filing jointly.

New Jersey Income Tax Resident Return NJ-1040 Step 2: Enter your home address, city, state, zip code, and county or municipality code.

New Jersey Income Tax Resident Return NJ-1040 Step 3: If you were only a part-year resident, give the dates of your residency where indicated.

New Jersey Income Tax Resident Return NJ-1040 Step 4: Indicate your filing status by filling in the box next to the applicable statement on lines 1 through 5.

New Jersey Income Tax Resident Return NJ-1040 Step 5: Note and total all applicable exemptions on lines 6 through 12.

New Jersey Income Tax Resident Return NJ-1040 Step 6: List all dependents on line 13, including their names, Social Security numbers and birth years.

New Jersey Income Tax Resident Return NJ-1040 Step 7: Sign and date the bottom of the first page, along with your spouse if applicable. Any paid preparer must sign the form, give the identification number for both themselves and their employer and their firm's name.

New Jersey Income Tax Resident Return NJ-1040 Step 8: Enter your name and Social Security number at the top of the second page.

New Jersey Income Tax Resident Return NJ-1040 Step 9: Lines 14 through 38 on the second page provide instructions for detailing your income and computing your tax owed.

New Jersey Income Tax Resident Return NJ-1040 Step 10: Enter your name and Social Security number at the top of the third page.

New Jersey Income Tax Resident Return NJ-1040 Step 11: Complete lines 39 through 46 as instructed to determine your total tax owed, along with any penalty for late payment.

New Jersey Income Tax Resident Return NJ-1040 Step 12: Lines 47 through 57 adjust your tax owed on the basis of taxes withheld or already paid.

New Jersey Income Tax Resident Return NJ-1040 Step 13: Lines 58 through 63 allow for you to make voluntary contributions to various state and government funds.

New Jersey Income Tax Resident Return NJ-1040 Step 14: If you have overpaid, lines 64 and 65 compute your refund owed.