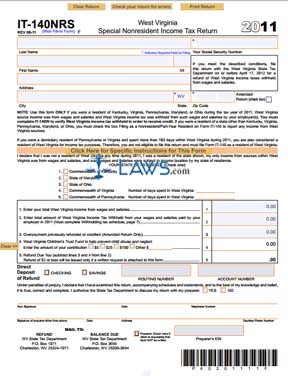

Form IT-140NRS Special Nonresident Income Tax Return

INSTRUCTIONS: WEST VIRGINIA SPECIAL NONRESIDENT INCOME TAX RETURN (Form IT-140NRS)

West Virginia income tax form IT-140NRS is only to be completed by residents of Kentucky, Virginia, Maryland, Pennsylvania and Ohio who had West Virginia income tax withheld from their wages by employers. This document is completed to claim credit on these taxes paid. The document can be found on the website of the government of West Virginia.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 1: On the form's first line, give your last name and Social Security number.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 2: On the second line, give your first name and middle initial.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 3: On the third line, give your street address.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 4: On the fourth line, give your city, state and zip code. Check the box where indicated if filing an amended return.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 5: On lines one through five, indicate with a check mark which of the five states listed above is your state of residence. Residents of Virginia and Pennsylvania must also enter the number of dates they were in West Virginia.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 6: Enter your total West Virginia income on line one of the next section.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 7: To complete line 2, you must first skip to the second page to complete form 140-W, documenting your taxes withheld. In box A, give the name of the employer, the name of the employee in box B, and the tax withheld in box C. Total the tax withheld in column C and transfer this to line two on the first page.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 8: If filing an amended return, complete line three. Otherwise, leave this blank.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 9: If you wish to contribute to the state's Children's Trust Fund, enter the amount on line four.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 10: Subtract the sum of lines three and four from line two. Enter the refund due on line five. If you wish to receive a direct deposit refund, give your routing and account number.