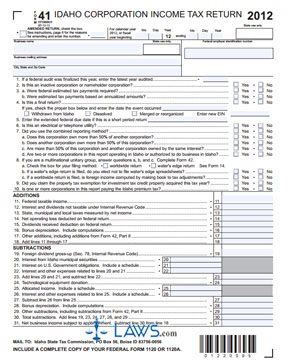

Form 41 Idaho Corporation Income Tax Return

INSTRUCTIONS: IDAHO CORPORATION INCOME TAX RETURN (Form 41)

Corporations operating in Idaho file their income taxes using a form 41. This document can also be used to file an amended return. The form can be obtained from the website of the Idaho State Tax Commission.

Idaho Corporation Income Tax Return 41 Step 1: At the top of the form, indicate with a check mark if you are filing an amended return.

Idaho Corporation Income Tax Return 41 Step 2: If you are filing on a fiscal year basis, enter the beginning and ending month, date and year in question.

Idaho Corporation Income Tax Return 41 Step 3: Enter your business name, mailing address, city, state, zip code and federal employer identification number.

Idaho Corporation Income Tax Return 41 Step 4: Lines 1 through 10 require you to give yes or no answers by checking "yes" or "no."

Idaho Corporation Income Tax Return 41 Step 5: Lines 11 through 18 require you to document additions to your income.

Idaho Corporation Income Tax Return 41 Step 6: Lines 19 through 31 require you to document subtractions to your income to calculate your net business income subject to apportionment.

Idaho Corporation Income Tax Return 41 Step 7: Lines 32 through 37 provide instructions to calculate your Idaho taxable income.

Idaho Corporation Income Tax Return 41 Step 8: Multiply line 37 by 7.6% to calculate your Idaho income tax. A corporation must pay a minimum of $20 in state income tax.

Idaho Corporation Income Tax Return 41 Step 9: Document and apply credits to your tax due on lines 39 through 43.

Idaho Corporation Income Tax Return 41 Step 10: Calculate and apply other taxes on lines 44 through 49.

Idaho Corporation Income Tax Return 41 Step 11: If you have underpaid, complete form 41ESR to calculate your interest owed and enter this on line 50. If you wish to make a donation to the Opportunity Scholarship Program, enter this on line 51. Total lines 50 and 51 and enter the sum on line 52.

Idaho Corporation Income Tax Return 41 Step 12: Document payments and credits on lines 53 through 56.

Idaho Corporation Income Tax Return 41 Step 13: Calculate your refund or payment due on lines 57 through 62.

Idaho Corporation Income Tax Return 41 Step 14: Lines 63 through 66 are only for those filing an amended return.