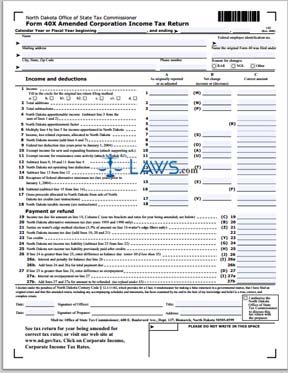

Form 40X Amended Corporation Income Tax Return

INSTRUCTIONS: NORTH DAKOTA AMENDED CORPORATION INCOME TAX RETURN (Form 40X)

North Dakota corporations must file a state amended income tax return when they file an amended federal return, have a change in their federal income or tax liability due to an audit, have a change in state income due to a state carryback, wish to correct an error, or receive a federal income tax refund deducted on a previously filed return. This form is found on the website of the government of North Dakota.

North Dakota Amended Corporation Income Tax Return 40X Step 1: Enter the beginning and ending dates of the fiscal year you are filing for if not filing on a calendar year basis.

North Dakota Amended Corporation Income Tax Return 40X Step 2: Enter your corporation name, address and telephone number.

North Dakota Amended Corporation Income Tax Return 40X Step 3: Enter the name under which the original return was filed.

North Dakota Amended Corporation Income Tax Return 40X Step 4: Throughout the form, three columns are provided. The first, column A, is for the amounts as originally reported or as last adjusted. The second, column B, requires you to enter the net change between your original and corrected amounts. The third, column C, requires you to enter the corrected amount.

North Dakota Amended Corporation Income Tax Return 40X Step 5: Lines 1 through 8 provide instructions for the calculation of your total North Dakota income.

North Dakota Amended Corporation Income Tax Return 40X Step 6: Lines 9 through 18 provide instructions for calculating your total state taxable income.

North Dakota Amended Corporation Income Tax Return 40X Step 7: Lines 19 through 27 provide instructions for calculating your total payment due or refund owed from the state.

North Dakota Amended Corporation Income Tax Return 40X Step 8: An officer of the form should sign the bottom of the page, give their title and enter the date. If the form was completed by a paid preparer, they must provide their signature, the date and their address.

North Dakota Amended Corporation Income Tax Return 40X Step 9: Consult the instructions on the second page to determine which supporting schedules must be included with your completed return.

North Dakota Amended Corporation Income Tax Return 40X Step 10: If the tax due is less than $5,000 you do not need to submit payment with your return. Otherwise, submit payment.