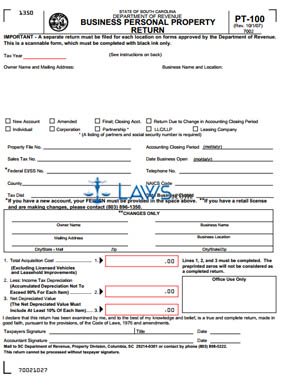

Form PT-100 Business Personal Property Return

INSTRUCTIONS: SOUTH CAROLINA BUSINESS PERSONAL PROPERTY RETURN (Form PT-100)

All South Carolina businesses must file a form PT-100 annually detailing all personal property involved in their operations. The form can be found on the website of the South Carolina Department of Revenue. A separate form must be filed for every business location.

South Carolina Business Personal Property Return PT-100 Step 1: Enter the tax year for which you are filing where indicated in the top left corner.

South Carolina Business Personal Property Return PT-100 Step 2: Give the name and address of the owner, and the name and location of the business in question.

South Carolina Business Personal Property Return PT-100 Step 3: Nine statements are listed below this section. Check the box next to the appropriate statement concerning the entity filing this application, such as "individual," "partnership" or "corporation."

South Carolina Business Personal Property Return PT-100 Step 4: The next section requests the property file number, accounting closing period of the business, the full date the business opened and its sales tax number, the Social Security or Federal Employer Identification Number of you or your employer, the business' NAICS code category and its telephone number, county and tax district.

South Carolina Business Personal Property Return PT-100 Step 5: If there are any changes in the address or ownership, enter these in the box labeled "Changes Only."

South Carolina Business Personal Property Return PT-100 Step 6: On line one, enter the total acquisition cost of the property in question. Do not include licensed vehicles or leasehold improvements.

South Carolina Business Personal Property Return PT-100 Step 7: On line two, enter the accumulated depreciation of the property. This should follow income tax guidelines and may not exceed 90% of the property purchase cost.

South Carolina Business Personal Property Return PT-100 Step 8: Subtract line two from line one. Enter the result on line three to determine the property's net depreciated value.

South Carolina Business Personal Property Return PT-100 Step 9: The taxpayer must sign and date their form and provide their job title. Any accountant should also sign and date the form.

South Carolina Business Personal Property Return PT-100 Step 10: On the second page, give the number of business locations in South Carolina, the address where records are maintained, note if you lease equipment to other businesses, and if you lease equipment from others. If so, state from whom.