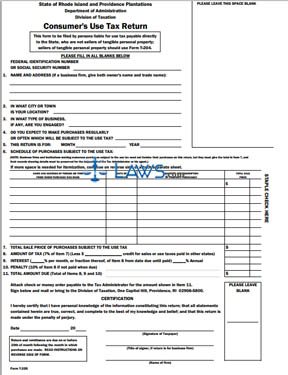

Form T205 Consumer Use Tax Return

INSTRUCTIONS: RHODE ISLAND CONSUMER'S USE TAX RETURN (Form T-205)

Rhode Island residents and businesses must file a form T-205 following most types of purchases from an out-of-state retailer of goods used, consumed or stored in the state on which no state tax was paid. Exceptions are detailed on the instructions included with this form, found on the website of Rhode Island's Division of Taxation. The form, along with payment, must be filed by the 20th of the month following the transaction in question.

Rhode Island Consumer's Use Tax Return T-205 Step 1: At the top of the page, enter your Social Security or Federal Identification number where indicated.

Rhode Island Consumer's Use Tax Return T-205 Step 2: On line one, enter your name and address. If a business, give the name of the owner and the trade name of the business.

Rhode Island Consumer's Use Tax Return T-205 Step 3: On line two, give your city or town.

Rhode Island Consumer's Use Tax Return T-205 Step 4: If engaged in any type of business, enter its nature on line three.

Rhode Island Consumer's Use Tax Return T-205 Step 5: On line four, indicate whether you expect to regularly or often make purchases subject to use tax.

Rhode Island Consumer's Use Tax Return T-205 Step 6: On line five, give the month and year during which this transaction took place.

Rhode Island Consumer's Use Tax Return T-205 Step 7: On line six, enter the name and address of the person or business from which the purchase was made, the date of the transaction, the quantity and a description of the property, and the total sale price. Enter the total of all purchase prices on line seven.

Rhode Island Consumer's Use Tax Return T-205 Step 8: On line eight, multiply this total by 7% to determine the tax owed. Subtract any sales or use tax already paid in other states.

Rhode Island Consumer's Use Tax Return T-205 Step 9: If submitting payment late, calculate the interest due on line nine and the penalty due on line 10.

Rhode Island Consumer's Use Tax Return T-205 Step 10: Total lines eight, nine and 10. Enter the sum on line 11 to determine your total due.

Rhode Island Consumer's Use Tax Return T-205 Step 11: Sign and date the form. If filing on behalf of a business, give its name and your title.