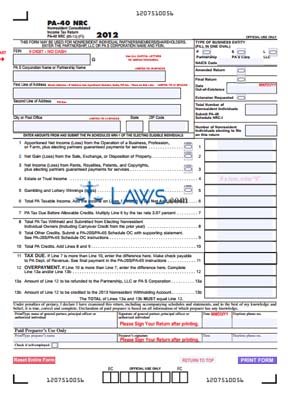

Form PA-40 NRC Nonresident Consolidated Income Tax Return

INSTRUCTIONS: PENNSYLVANIA NONRESIDENT CONSOLIDATED INCOME TAX RETURN (PA-40 NRC)

Pennsylvania businesses may file a PA-40 NRC on behalf of partners, members and shareholders who are not residents of the state. This consolidated income tax return is available on the website of the state's commonwealth enterprise portal.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 1: Enter all information requested about your business at the top of the page, including the address and Federal Tax Identification Number (FEIN) that has been assigned.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 2: Line one requires you to enter the net income or loss from operation of a business. As in all applicable questions, fill in the oval next to "loss" if there was a loss. Line two requires you to enter the net gain or loss from sale, exchange or disposition of property. Line three concerns rents, royalties, patents and copyrights or losses regarding these sources.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 3: Line four concerns estate or trust income. If this was a loss, write "0" in the box.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 4: Line five requires you to list the total gain or loss from gambling and lottery winnings. Add lines one through five to determine your total taxable income in the state in line six.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 5: Multiply line six by 3.07 percent in line seven.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 6: In line eight, enter the total state tax withheld and paid.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 7: Total all other credits in line nine. Attach a PA-20S/PA-65 schedule OC. Total lines eight and nine. The result in line ten is your total Pennsylvania credits.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 8: Should line seven be greater than line ten, enter the difference in line eleven. If line ten is greater than line seven, you have overpaid. Enter the result in line twelve and complete line thirteen.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 9: Line thirteen is only for those who have overpaid.

Pennsylvania Nonresident Consolidated Income Tax Return PA-40 NRC Step 10: Sign and date the form. Any paid preparer should include all information requested.