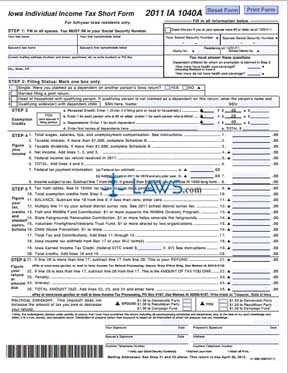

Form IA 1040A Individual Income Tax Short Form

INSTRUCTIONS: IOWA INDIVIDUAL INCOME TAX SHORT FORM (Form 2011 IA 1040A)

Iowa residents may complete an income tax short form if their income subject to tax is less than $100,000 a year and they are a full-year resident. This form 2011 IA 1040A is available on the website of the Iowa government.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 1: The first section requires your name, address and Social Security number. Include your spouse's name and Social Security number if applicable. On the box on the top right, check the box where indicated if your spouse is age 65 or older. Note your county and school district number and note how many of any dependent children have health insurance.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 2: In the second section, check the box indicating whether you are filing singly, jointly, as the head of household with a qualifying person or a qualifying widower with dependent children.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 3: In the third section, enter all information requested about dependents, household members who are blind or 65 or older to determine your tax credits.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 4: The fourth section is where you calculate your total taxable income. Note that if more than $1,500 of this came from either interest or dividends, you must complete Schedule B on the second page of this document.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 5: On line 9 of the fifth section, use the tax tables maintained on the website of the government of Iowa to determine your tax.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 6: Complete the rest of the fifth section to determine your total credits, including charitable contributions.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 7: Perform all calculations as instructed in the sixth section to determine your tax refund or the amount you must pay.

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 8: In the political checkoff section, you or your spouse may choose to set aside $1.50 for the Republican or Democratic party or to a campaign fund

Iowa Individual Income Tax Short Form 2011 IA 1040A Step 9: Sign and date the bottom of the form.