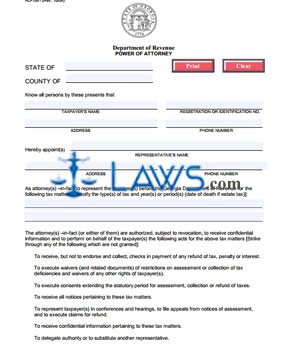

Form RD-1061 Power of Attorney

INSTRUCTIONS: GEORGIA POWER OF ATTORNEY (Form RD-1061)

Granting a person power of attorney gives them the right to act on your behalf in legally binding situations. The Georgia Power of Attorney form discussed here (RD-1061) only concerns tax matters handled by that state's Department of Revenue. It can be obtained from their division of the website of the government of Georgia.

Power of Attorney FD-1061 Step 1: Enter the state and county where indicated.

Power of Attorney FD-1061 Step 2: Enter your name, address, phone number and Social Security number or other identification number at the top of the form.

Power of Attorney FD-1061 Step 3: Where indicated, enter the name, address and phone number of the person you are appointing as your representative.

Power of Attorney FD-1061 Step 4: Indicate the types of taxes, such as sales or income, you are authorizing them to handle, and what years or time periods.

Power of Attorney FD-1061 Step 5: On the first page's bottom half, a list of statements details all powers you can grant a representative. These include the right to receive refund checks, to receive all tax-related notices, to receive confidential information and to represent you at hearings. Cross through any of these powers you do not wish for a representative to have.

Power of Attorney FD-1061 Step 6: If the listed powers are not enough, write any additional powers you wish for your representative to have where indicated at the top of the second page.

Power of Attorney FD-1061 Step 7: Once submitted, this form will automatically revoke any previous powers of attorney which you have submitted. If you wish for some or any of these to remain in effect, list the name and address of these representatives, as well as the date they were authorized, in the space provided. You must include copies of these previously submitted forms.

Power of Attorney FD-1061 Step 8: Enter the date.

Power of Attorney FD-1061 Step 9: If your chosen representative is a CPA, enrolled agent, registered public accountant or lawyer, they must provide their license number, the state where they were licensed and their profession in addition to their signature and the date.

Power of Attorney FD-1061 Step 10: If your chosen representative does not fall into the above categories, it must be executed before two witnesses or a notary public.