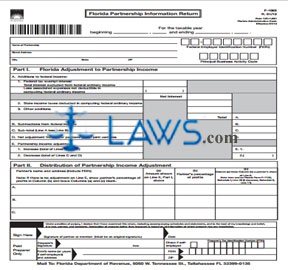

Form F-1065 Florida Partnership Information Return

INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065)

Florida partnerships with partners subject to the state corporate income tax form are required to file a form F-1065. This also applies to any limited liability company with a corporate partner classified as a partnership for federal tax purposes. This document is found on the website of the Florida Department of Revenue.

Florida Partnership Information Return F-1065 Step 1: Give the beginning and ending dates of your taxable year at the top of the form.

Florida Partnership Information Return F-1065 Step 2: Give the partnership's name, address, federal employer identification number and principal business activity code.

Florida Partnership Information Return F-1065 Step 3: Part I documents Florida adjustments to partnership income. Calculate your net interest on line 1, enter state income taxes deducted in computing federal ordinary income on line 2, enter other additions on line 3, and enter the total on line A.

Florida Partnership Information Return F-1065 Step 4: Give subtractions from federal income on line B. Subtract line B from line A and enter the difference on line C. Enter the net adjustment from other partnerships or joint ventures on line D. Give the total of lines C and D on line E.

Florida Partnership Information Return F-1065 Step 5: Part II documents distribution of partnership income adjustment. In the first column, give each partner's name and federal employment identification number.

Florida Partnership Information Return F-1065 Step 6: In column (a), give the amount from line E above. Note that if there are no adjustments on line E, only complete column (b) and leave the other two blank.

Florida Partnership Information Return F-1065 Step 7: In column (b), give the partner's percentage of profits.

Florida Partnership Information Return F-1065 Step 8: Multiply column (a) by column (b) and enter the resulting product in column (c).

Florida Partnership Information Return F-1065 Step 9: A partner or member should sign and date the bottom of the first page. If a paid preparer has completed the form, they should give their signature and the date. If employed by a firm, give its name, federal identification employment number and zip code.

Florida Partnership Information Return F-1065 Step 10: Parts III and IV should be completed if the partnership or any of its partners do business outside of Florida. These calculate the apportionment of each partner's income as taxable by the state.