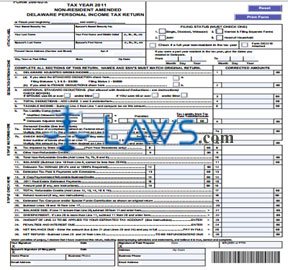

Form 200-02-X Non-Resident Amended Delaware Personal Income Tax Return

INSTRUCTIONS: NON-RESIDENT AMENDED DELAWARE PERSONAL INCOME TAX RETURN (Form 200-02-X)

Non-residents who paid income tax in Delaware and who must amend their initial return do so with a form 200-02-X. This document is found on the website of the Delaware Division of Revenue.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 1: Give the fiscal beginning and end dates for which you are filing if you do not file your taxes on a calendar year basis.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 2: Enter your Social Security number and name, as well as that of your spouse if filing jointly.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 3: Enter your present home address.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 4: Indicate your filing status with a check mark. Check the applicable boxes if you were a full year non-resident in the given tax year and if you have attached a form DE2210. If you were a part-year resident, give the dates of your residency.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 5: Skip to the second page and complete sections A through C to calculate your state adjusted gross income. Enter the result on line 1 of the front page.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 6: If you are claiming a standard deduction, enter the applicable amount on line 2 and claim additional standard deductions on line 3. If you are claiming an itemized deduction, you must complete section D on the second page and transfer the result to line 2 and skip line 3.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 7: Add lines 2 and 3 and enter the total on line 4. Subtract line 4 from line 1 and enter the difference on line 5.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 8: Complete lines 6 through 26 to compute your tax liability due or the refund owed you by the state.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 9: On the second page, answer all questions by checking "Yes" or "No" and provide a detailed explanation of all changes from your original return. Attach all supporting schedules and documentation.

Non-Resident Amended Delaware Personal Income Tax Return 200-02-X Step 10: Sign and date the bottom of the first page.