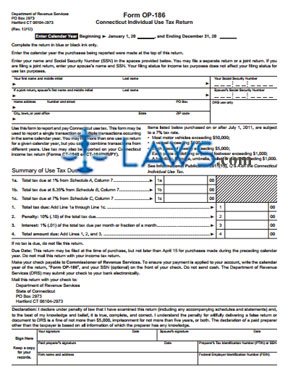

Form OP-186 Connecticut Individual Use Tax Return

INSTRUCTIONS: CONNECTICUT INDIVIDUAL USE TAX RETURN (Form OP-186)

Connecticut residents use a form OP-186 to pay use tax on items purchased for use, storage or consumption within the state on which no state sales tax was paid. Use tax can also be reported your state income tax return (forms CT-1040 or CT-1040NR/PY). All of these documents can be found on the website of the government of Connecticut.

Connecticut Individual Use Tax Return OP-186 Step 1: Enter the calendar year or fiscal year dates for which you are filing.

Connecticut Individual Use Tax Return OP-186 Step 2: Enter your name and Social Security number. If you file your taxes jointly, enter the name and Social Security number of your spouse as well.

Connecticut Individual Use Tax Return OP-186 Step 3: Enter your home address, city, state and zip code.

Connecticut Individual Use Tax Return OP-186 Step 4: You must complete Schedules A through D on the second page first. Schedule A is for the computation of the 1% tax rate due on computer and data processing services.

Connecticut Individual Use Tax Return OP-186 Step 5: To determine which tax rates apply to which goods and services, you will need to consult the separate information publication 2011(15), also available on the website of the Connecticut state government. Schedule B computes the total of the 6.35% tax due on applicable purchases made on or after July 1, 2011, Schedule C computes the total of the 7% tax due on applicable purchases made on or after the same date, and Schedule D computes the total of the 6% tax due on applicable purchases made on or before June 30, 2011.

Connecticut Individual Use Tax Return OP-186 Step 6: On the first page, enter the total from Schedule A, Column 7 on line 1a, the total from Schedule B, Column 7 on line 1b, the total from Schedule C, Column 7 on line 1c, and the total from Schedule C, Column 7 on line 1d.

Connecticut Individual Use Tax Return OP-186 Step 7: Add lines 1a through 1d and enter the resulting sum on line 1.

Connecticut Individual Use Tax Return OP-186 Step 8: If filing or paying late, calculate your penalty and interest due on lines 2 and 3. Add the sum of these to line 1 to calculate your total due on line 4.