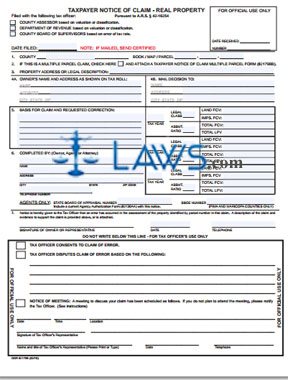

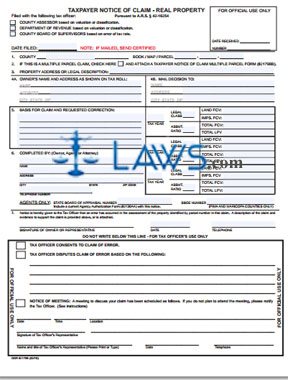

Form 82179B Taxpayer Notice of Claim – Real Property

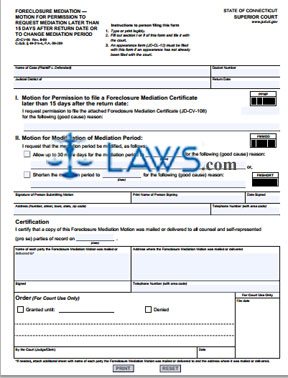

INSTRUCTIONS: CONNECTICUT FORECLOSURE MEDIATION — MOTION FOR PERMISSION TO REQUEST MEDIATION LATER THAN 15 DAYS AFTER RETURN DATE OR TO CHANGE MEDIATION PERIOD (Form JD-CD-96)

To request permission to file a foreclosure mediation certificate more than 15 days after the return date in a Connecticut foreclosure case or to request a modification of your mediation period, use a form JD-CD-96. This document can be obtained from the website of the Connecticut Judicial Branch.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 1: In the first blank box, enter the name of the case.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 2: In the second blank box, enter the district number.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 3: In the third blank box, enter the name of the judicial district.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 4: In the fourth blank box, enter the return date.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 5: Section I should be completed if seeking permission to file a foreclosure mediation certificate (form JD-CV-108) more than 15 days after your return date. Write the reason for your request.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 6: Section II should be completed if seeking to extend or shorten your mediation period. Check the first box if requesting another 30 days. Enter your new proposed end date and the reason for your request.

Connecticut Foreclosure Mediation — Motion For Permission To Request Mediation Later Than 15 Days After Return Date Or To Change Mediation Period JD-CD-96 Step 7: Check the second box if you are requesting that the mediation period be shortened. Give your proposed end date and the reason for your request. Sign and date the form where indicated.

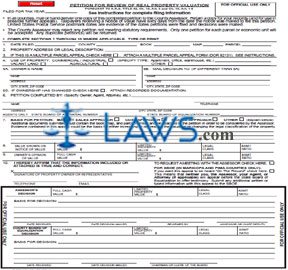

INSTRUCTIONS: ARIZONA PETITION FOR REVIEW OF REAL PROPERTY VALUATION (Form 82130)

To request a review of an Arizona real property valuation, file a form 82130 within 60 days of the date the notice was filed. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Petition For Review Of Real Property Valuation 82130 Step 1: On line 1, enter the date the notice was filed, the county of the property, and the book, map and parcel number of the property.

Arizona Petition For Review Of Real Property Valuation 82130 Step 2: On line 2, enter the property address or its legal description.

Arizona Petition For Review Of Real Property Valuation 82130 Step 3: If this appeal concerns multiple parcels, check the box on line 3 and attach form 82131, which concerns multiple parcel appeals.

Arizona Petition For Review Of Real Property Valuation 82130 Step 4: On line 4, indicate with a check mark whether the property is being used for commercial or industrial purposes, as vacant land, in an agricultural capacity, or other. If industrial or commercial, specify. If other, explain.

Arizona Petition For Review Of Real Property Valuation 82130 Step 5: On line 5a, enter the owner's name and address.

Arizona Petition For Review Of Real Property Valuation 82130 Step 6: If you wish for the decision to be mailed to an address other than the one entered on line 5a, enter this address on line 5b.

Arizona Petition For Review Of Real Property Valuation 82130 Step 7: On line 6, give the name, telephone number and address of the person completing the petition. If you are an agent, you should also enter your State Board of Appraisal number and your State Board of Equalization number.

Arizona Petition For Review Of Real Property Valuation 82130 Step 8: On line 7, indicate the basis for your petition with a check mark.

Arizona Petition For Review Of Real Property Valuation 82130 Step 9: On line 8, provide all values shown on the notice of value.

Arizona Petition For Review Of Real Property Valuation 82130 Step 10: On line 9, provide the owner's opinion of all values.

Arizona Petition For Review Of Real Property Valuation 82130 Step 11: On line 10, the property owner or their representative should enter their signature, their telephone number and their email address.

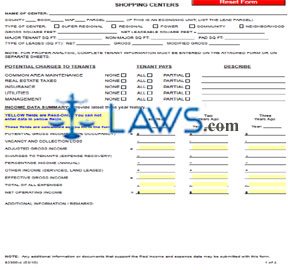

INSTRUCTIONS: ARIZONA INCOME AND EXPENSE – OFFICE BUILDING/RETAIL STORE SUPPLEMENT (Form 82300-2)

When disputing an Arizona property tax valuation made on the income basis, a form 82300 income and expense form is filed. Form 82300-2 is filed supplementally if the property in question is an office building or retail store. Both documents can be obtained from the website of the Arizona Department of Revenue.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 1: Enter the business or building name.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 2: Enter the property county, book, map and parcel numbers.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 3: Enter the property gross square feet and net leasable square feet.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 4: Indicate the type of lease with a check mark.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 5: Indicate whether the property owner occupies part of this property with a check mark. If so, enter the number of square feet they occupy.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 6: In the next section, document all potential charges to tenants as instructed.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 7: The next section is an income data summary concerning the last three years. Provide all information as directed.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 8: Enter any additional information or remarks at the bottom of the first page.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 9: In the first section of the second page, document disallowed expenses for the last three years.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 10: In the next section, document actual expenses for the last three years.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 11: Skip to the third page and document major replacement and repair expenses for the last three years. Transfer these values to the second page where indicated.

Arizona Income And Expense – Office Building/Retail Store Supplement 82300-2 Step 12: Provide a complete tenant list on the fourth page as directed.

INSTRUCTIONS: CONNECTICUT FORECLOSURE RETURN OF SALE — NO PROCEEDS (Form JD-CV-97)

After a sale of property involved in a Connecticut foreclosure case in which property was sold for less than the judgment debt, interests and costs, a form JD-CV-97 should be filed. This document can be obtained from the website of the Connecticut Judicial Department.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 1: In the first three blank boxes, enter the name of the case, the judicial district and the docket number.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 2: In the next two blank boxes, enter the name of the seller or committee and their juris number.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 3: In the next two blank boxes, enter the address of the seller or committee and their telephone number.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 4: In the next three blank boxes, enter the name, telephone number and address of the buyer.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 5: In the next four blank boxes, enter the name of the buyer's attorney, their juris number, their address and their telephone number.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 6: In the next blank box, enter the address or location of the property.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 7: On line 1, enter the date on which the court approved sale of the property for a dollar amount. Enter the amount.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 8: On line 2, enter the date on which the court approved the Committee deed for the sale of property.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 9: On line 3, enter the date on which the closing for the property was held and the amount paid the Committee by the buyer's attorney.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 10: On line 4, enter the date on which the committee paid court-approved committee fees, the court-approved appraiser's fee and court-approved committee expenses.

Connecticut Foreclosure Return Of Sale — No Proceeds JD-CV-97 Step 11: Sign and date the form where indicated. Also complete the bottom part of the form, which certifies copies were sent to all self-represented parties and attorneys involved.