Form RI-1040S Simplified Resident Return Booklet

INSTRUCTIONS: RHODE ISLAND RESIDENT INDIVIDUAL INCOME TAX RETURN BOOKLET (Form RI-1040S)

Rhode Island residents filing a simplified RI-1040S state individual income tax return it can obtain as part of a larger booklet available on the website of the state's Division of Taxation. This article discusses the actual return, which begins on the third page of the booklet.

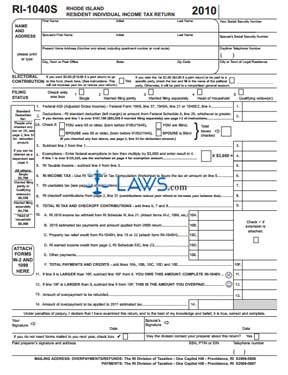

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 1: Give your name and Social Security number, along with your spouse's same information if filing jointly, as well as your home address and daytime telephone number in the first section.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 2: Indicate whether you wish to make an electoral contribution with a check mark.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 3: Indicate your filing status with a check mark.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 4: Enter your federal adjusted gross income on line 1.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 5: On line 2, enter the greater of your standard deduction as documented in the left margin or the amount from federal Schedule A, line 29.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 6: Document and apply deductions and exemptions on lines 2A through 6.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 7: Document and apply use and sales tax and checkoff contributions on lines 7 through 9.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 8: Document payments already made and applicable credits on lines 10A through 10E. Enter their sum on line 10F.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 9: Complete lines 11 through 14 as instructed to determine your tax liability owed or refund you are due. You may also choose to have any overpayment tax the form of a credit to be applied to your next year's tax.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 10: Sign and date the page. If filing jointly, your spouse should do the same.

Rhode Island Resident Individual Income Tax Return Booklet RI-1040S Step 11: If you do not need returns mailed to you next year, check the box where indicated. A paid preparer who has completed this form should give their name, address, identification and telephone numbers.