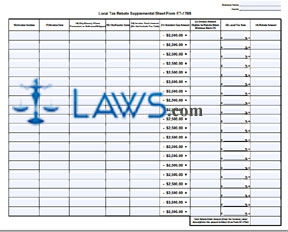

Local Tax Rebate Supplemental Form

INSTRUCTIONS: ARKANSAS LOCAL TAX REBATE SUPPLEMENTAL SHEET (Form ET-179B)

When filing a claim for a refund or rebate or Arkansas local tax on a qualifying business purchase of $2,500 or more on one receipt, a form ET-179A is filed. If enough space is not provided here to document all invoices, a supplemental form ET-179B is used to document additional invoices. Both forms can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 1: On the first blank line at the top right, enter your business name.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 2: On the second blank line at the top right, enter your permit number.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 3: In column 16, enter the invoice number.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 4: In column 17, enter the invoice date.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 5: In column 18, enter the city or county where the items were purchased or from which they were shipped or delivered.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 6: In column 19, enter your city or county code.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 7: In column 20, enter the invoice total amount. Do not include the tax amount.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 8: Column 21 contains a standard cap amount. Subtract this from column 20 and enter the resulting difference in column 22. This is the amount of the invoice which is eligible for a rebate.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 9: Enter your local tax rate in column 23.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 10: Multiply column 22 by column 23. Enter the resulting product in column 24. This is your rebate amount.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 11: Total all rebate amounts in the bottom right box of the table.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 12: Transfer the value from this box to box 26 on form ET-179A.

Arkansas Local Tax Rebate Supplemental Sheet ET-179B Step 13: Add boxes 25 and 26 on form ET-179A and enter the result on box 27. When filing, include both forms.