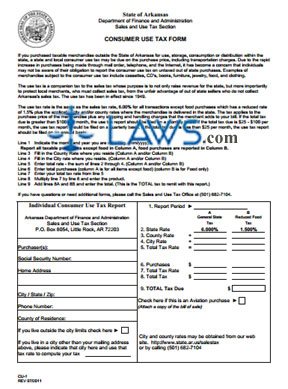

Consumer Use Tax Form CU-1

INSTRUCTIONS: ARKANSAS INDIVIDUAL CONSUMER USE TAX REPORT (Form CU-1)

Arkansas consumers are required to pay use tax on taxable merchandise bought outside the state for use, storage of consumption within the state on which no state sales tax was paid. If you owe more than $100 in use tax a month, form CU-1 should be filed monthly. If you owe between $25 and $100 a month, it should be filed on a quarterly basis. If you owe less than $25 a month use tax, you may file this form on an annual basis. This document can be obtained from the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Consumer Use Tax Report CU-1 Step 1: On the left, enter the name of the purchaser or purchasers on the first blank line.

Arkansas Individual Consumer Use Tax Report CU-1 Step 2: Enter your Social Security number on the second blank line.

Arkansas Individual Consumer Use Tax Report CU-1 Step 3: Enter your street home address on the third and fourth blank lines.

Arkansas Individual Consumer Use Tax Report CU-1 Step 4: Enter your city, state and zip code on the fifth blank line.

Arkansas Individual Consumer Use Tax Report CU-1 Step 5: Enter your phone number on the sixth blank line.

Arkansas Individual Consumer Use Tax Report CU-1 Step 6: Enter your county of residence on the seventh blank line.

Arkansas Individual Consumer Use Tax Report CU-1 Step 7: If you live outside city limits, check the box where indicated. If you live in a city different from that listed above, enter it where indicated.

Arkansas Individual Consumer Use Tax Report CU-1 Step 8: On line 1, enter the month and year you are filing in.

Arkansas Individual Consumer Use Tax Report CU-1 Step 9: Enter the state rate on line 2, your county's tax rate on line 3, your city's rate on line 4. Enter the sum of lines 2 through 4 on line 5 and on line 7.

Arkansas Individual Consumer Use Tax Report CU-1 Step 10: Enter your total purchases subject to use tax on line 6.

Arkansas Individual Consumer Use Tax Report CU-1 Step 11: Multiply line 6 by line 7. Enter the resulting product on line 8. This is your total tax payment due.