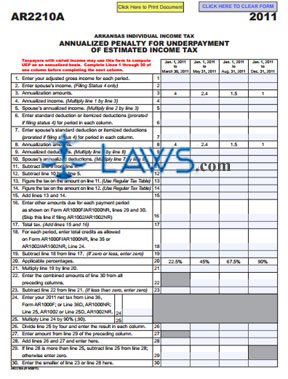

AR2210A Annualized Penalty for Underpayment of Estimated Tax

INSTRUCTIONS: ARKANSAS ANNUALIZED PENALTY FOR UNDERPAYMENT OF ESTIMATED INCOME TAX (Form AR2210A)

To calculate the annualized penalty owed on underpaid estimated Arkansas income tax, a form AR2210A is used. This document can be obtained from the website of the Arizona Department of Finance and Administration.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 1: Throughout the form, provide all information divided into the quarterly periods as stated at the top of all four columns. On the first line, enter your annualized gross income for each period.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 2: If your filing status is 4, enter the same information for your spouse on line 2.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 3: Multiply line 1 by the amounts entered on line 3. Enter the resulting products on line 4.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 4: If applicable, multiply line 2 by the amounts entered on line 3 and enter the resulting products on line 5.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 5: Enter your standardized or itemized deduction on line 6, and that of your spouse (if applicable) on line 7.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 6: Multiply line 6 by line 8. Enter the resulting products on line 9. If applicable for your spouse, also multiply line 7 by line 8 and enter the resulting products on line 10.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 7: Subtract line 9 from line 4. Enter the resulting difference on line 11. If applicable for your spouse, also subtract line 10 from line 5 and enter the resulting difference on line 12.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 8: Use the regular tax tables to determine your tax owed on lines 13 and 14.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 9: Add lines 13 and 14. Enter the resulting sums on line 15.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 10: Complete lines 16 through 30 as directed to complete the first page.

Arkansas Annualized Penalty For Underpayment Of Estimated Income Tax AR2210A Step 11: Complete lines 31 through 46 on the second page as instructed.