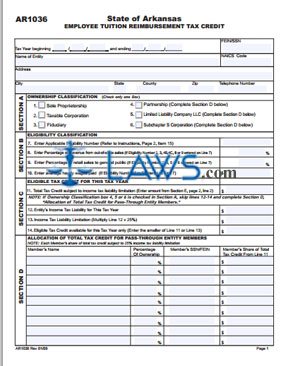

AR1036 Employee Tuition Reimbursement Tax Credit

INSTRUCTIONS: ARKANSAS EMPLOYEE TUITION REIMBURSEMENT TAX CREDIT (Form AR1036)

Arkansas employers who pay for tuition for employees may claim a reimbursement tax credit by filing a form AR1036. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 1: Enter the beginning and ending dates of your tax year in the first blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 2: Enter your federal employer identification number or Social Security number in the second blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 3: Enter the name of your entity in the third blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 4: Enter your NAICS code in the fourth blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 5: Enter your street address in the fifth blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 6: Enter your city, state, county, zip code and telephone number in the sixth blank box.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 7: In Section A, indicate your ownership classification with a check mark next to the appropriate description on lines 1 through 6.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 8: On line 7 for Section B, enter your applicable eligibility number. To determine this number, you will need to consult page 2 of the separate instruction booklet.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 9: On line 8, enter the percentage of your revenue from out-of-state sales.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 10: On line 9, enter the percentage of your retail sales to the public.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 11: On line 10, enter your average hourly wages paid.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 12: Section C concerns your eligible tax credit for this tax year. Complete lines 11 through 14 as instructed.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 13: Section D concerns documentation of total tax credits for pass-through entity members.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step 14: Enter the beginning and ending dates of your tax year, your name and ID number at the top of the second page.

Arkansas Employee Tuition Reimbursement Tax Credit AR1036 Step15: Section E concerns documentation of tuition paid or reimbursed by the employer.