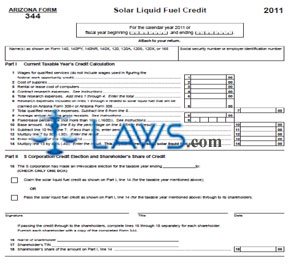

Form 344 Solar Liquid Fuel Credit

INSTRUCTIONS: ARIZONA SOLAR LIQUID FUEL CREDIT (Form 344)

Arizona individuals, S corporations, corporations or partnerships can claim credit for use of solar liquid fuel by completing a form 344. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Solar Liquid Fuel Credit 344 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year at the top of the first page.

Arizona Solar Liquid Fuel Credit 344 Step 2: Enter your name or names as it appears on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165.

Arizona Solar Liquid Fuel Credit 344 Step 3: Enter your Social Security number or employer identification number.

Arizona Solar Liquid Fuel Credit 344 Step 4: Part I concerns the current taxable year's credit computation. Enter wages for qualified services on line 1.

Arizona Solar Liquid Fuel Credit 344 Step 5: Enter the cost of supplies on line 2.

Arizona Solar Liquid Fuel Credit 344 Step 6: Enter the rental or lease cost of computers on line 3.

Arizona Solar Liquid Fuel Credit 344 Step 7: Enter contract research expenses on line 4.

Arizona Solar Liquid Fuel Credit 344 Step 8: Add lines 1 through 4. Enter the resulting sum on line 5.

Arizona Solar Liquid Fuel Credit 344 Step 9: Complete lines 6 through 14 as instructed to compute your current year's solar liquid fuel credit.

Arizona Solar Liquid Fuel Credit 344 Step 10: Part II should only be completed by S corporations. On line 15, indicate with a check mark whether claiming the credit or passing it through to shareholders. If the latter, complete lines 16 through 18 separately for each shareholder.

Arizona Solar Liquid Fuel Credit 344 Step 11: At the top of the second page, enter your name and tax identification number.

Arizona Solar Liquid Fuel Credit 344 Step 12: Part III concerns partnerships. Complete lines 19 through 21 separately for each partner.

Arizona Solar Liquid Fuel Credit 344 Step 13: Complete line 22 calculate your total current year's credit by transferring the value from the appropriate line as instructed. Corporations and S corporations should also enter this amount on line 20 of form 300, while individuals should also enter it on line 26 of form 301.a