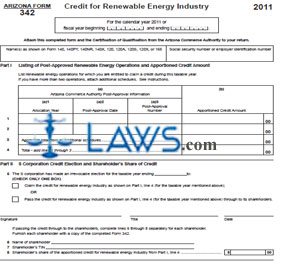

Form 342 Credit for Renewable Energy Industry

INSTRUCTIONS: ARIZONA CREDIT FOR RENEWABLE ENERGY INDUSTRY (Form 342)

Individuals, corporations, S corporations and partners in a partnership use a form 342 to claim a credit for renewable energy industry in Arizona. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Credit For Renewable Energy Industry 342 Step 1: If not filing for the calendar year preprinted on the form, enter the beginning and ending dates of your fiscal year.

Arizona Credit For Renewable Energy Industry 342 Step 2: Enter your name as it appears on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165.

Arizona Credit For Renewable Energy Industry 342 Step 3: Enter your Social Security number or employer identification number.

Arizona Credit For Renewable Energy Industry 342 Step 4: Part I concerns post-approved renewable energy operations and apportioned credit amounts. List these operations on lines 1 and 2. If you require additional space to list all such energy operations, attach additional schedules and enter the aggregate total from these schedules on line 3.

Arizona Credit For Renewable Energy Industry 342 Step 5: Add lines 1 through 3 and enter the resulting sum on line 4.

Arizona Credit For Renewable Energy Industry 342 Step 6: Part II should only be completed by S corporations. On line 5, indicate with a check mark whether you are claiming the credit or passing it to your shareholders. If the latter, complete lines 6 through 8 separately for each shareholder.

Arizona Credit For Renewable Energy Industry 342 Step 7: Enter your name and tax identification number at the top of the second page.

Arizona Credit For Renewable Energy Industry 342 Step 8: Part III should only be completed for partnerships. Complete lines 9 through 11 separately to document each partner's share of the credit.

Arizona Credit For Renewable Energy Industry 342 Step 9: Part IV concerns the total apportioned credit being claimed for this taxable year. Individuals, corporations and S corporations should enter the value from line 4, S corporation shareholders should enter the value from line 8, and partners from a partnership should enter the value from line 11. Corporations should also transfer this value to form 120, 120A or 120X as applicable, S corporations should transfer this value to form 120S, and individuals should transfer this value to form 140, 140NR, 140PY or 140X as applicable.