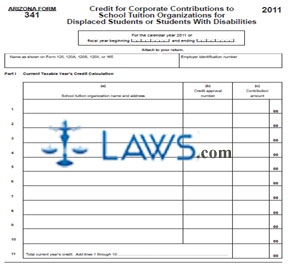

Form 341 Credit for Corporate Contributions to School Tuition Organizations for Displaced Students or Students With Disabilities

INSTRUCTIONS: ARIZONA CREDIT FOR CORPORATE CONTRIBUTIONS TO SCHOOL TUITION ORGANIZATIONS FOR DISPLACED STUDENTS OR STUDENTS WITH DISABILITIES (Form 341)

A form 341 is used to claim an Arizona credit for corporate contributions to school tuition organizations for displaced students or students with disabilities. This form can be obtained from the website of the Arizona Department of Revenue.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 1: If not filing for the calendar year preprinted on the form, enter the beginning and ending dates of your fiscal year.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 2: Enter your corporate name as it appears on form 120, 120A, 120S, 120X or 165.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 3: Enter your employer identification number.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 4: Part I concerns calculation of your current year's credit. Document your contributions on lines 1 through 10 and enter the total on line 11.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 5: Enter your name and employer identification number at the top of the second page.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 6: Part II concerns each corporate partner's share of the credit. This section must be completed for each partner separately. Enter their name on line 12, tax identification number on line 13, and share of the credit on line 14.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 7: Part III concerns documentation of your available credit carryover. Complete lines 15 through 20 as instructed.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 8: Part IV concerns computation of your total available credit. Enter the current year's credit on line 21 and your available credit carryover on line 22.

Arizona Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities 341 Step 9: Add lines 21 and 22. Enter the sum on line 23.