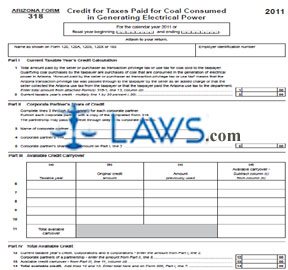

Form 318 Credit for Taxes Paid for Coal Consumed in Generating Electrical Power

INSTRUCTIONS: ARIZONA CREDIT FOR TAXES PAID FOR COAL CONSUMED IN GENERATING ELECTRICAL POWER (Form 318)

A form 318 is filed to obtain Arizona credit for taxes paid for coal consumed in generating electrical power. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 2: Enter your name as it appears on form 120, 120A, 120S, 120X or 165.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 3: Enter your employer identification number.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 4: Skip to the next page and complete form 318-1, which documents qualifying coal purchases. Complete the table provided as instructed and transfer the value from line 13d here to line 1 on the first page.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 5: Multiply line 1 by 30% and enter the resulting product on line 2.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 6: Part II concerns each corporate partner's share of the credit and must be completed separately for each one. Enter each partner's name on line 3, their tax identification number on line 4, and their share of the credit on line 3.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 7: Part III concerns documentation of your available credit carryover. Complete lines 6 through 10 on the table provided as instructed. Your total available carryover will be entered on line 11.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 8: Transfer the value on line 2 to line 12 unless a corporate partner, in which case transfer the value from line 5.

Arizona Credit For Taxes Paid For Coal Consumed In Generating Electrical Power 318 Step 9: Enter the value from line 11d on line 13. Add lines 12 and 13 and enter the resulting sum on line 14.