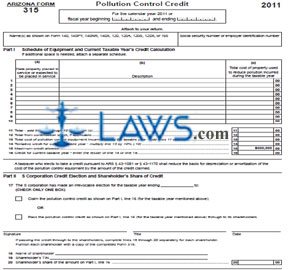

Form 315 Pollution Control Credit

INSTRUCTIONS: ARIZONA POLLUTION CONTROL CREDIT (Form 315)

In Arizona, form 315 is filed to obtain credit for use of pollution control equipment. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Pollution Control Credit 315 Step 1: If not filing for the calendar year pre-printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Pollution Control Credit 315 Step 2: In the first blank box, enter your name as it appears on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165.

Arizona Pollution Control Credit 315 Step 3: In the third blank box, enter your Social Security number or employer identification number.

Arizona Pollution Control Credit 315 Step 4: Part I concerns your equipment and calculation of the current taxable year's credit. This property should be documented on lines 1 through 10 of the table provided. In column a, enter the date each piece of property was placed into service or was expected to be placed in service.

Arizona Pollution Control Credit 315 Step 5: In column b, enter a description of each piece of property.

Arizona Pollution Control Credit 315 Step 6: In column c, enter the cost of each property used to reduce pollution incurred during the taxable year.

Arizona Pollution Control Credit 315 Step 7: Total the costs in column c on line 11. If you require additional space for documentation, use continuation sheets. Enter the total from these sheets on line 12. Enter the sum of lines 11 and 12 on line 13.

Arizona Pollution Control Credit 315 Step 8: Multiply line 13 by 10% and enter the resulting sum on line 14.

Arizona Pollution Control Credit 315 Step 9: Enter the lesser of the value calculated on line 14 or the value pre-printed on line 15 on line 16.

Arizona Pollution Control Credit 315 Step 10: Part II should only be completed by S corporations. If applicable, complete lines 17 through 20 as instructed.

Arizona Pollution Control Credit 315 Step 11: Part III concerns each partner's share of the credit. Complete lines 21 through 23 as instructed separately for each partner.

Arizona Pollution Control Credit 315 Step 12: Part IV concerns the available credit carryover. Complete lines 24 through 29 as instructed. Calculate your total available credit as instructed on lines 30 through 32 of Part V.